There is a wide variety of charting software available that can be used by traders. Some systems are made for professionals, others for traders who just want more insight into the market.

Many software programs have a variety of features and tools that can be customized. This can make software more useful for traders.

Futures, stocks and forex

These programs may have many technical indicators, patterns, or charts that can displayed in them. These can be very useful in identifying potential trading opportunities.

You can download many of these programs for free. They also have the option to be accessed through a website or an app designed specifically for mobile use. These programs are particularly helpful to anyone who wants to keep up with the market.

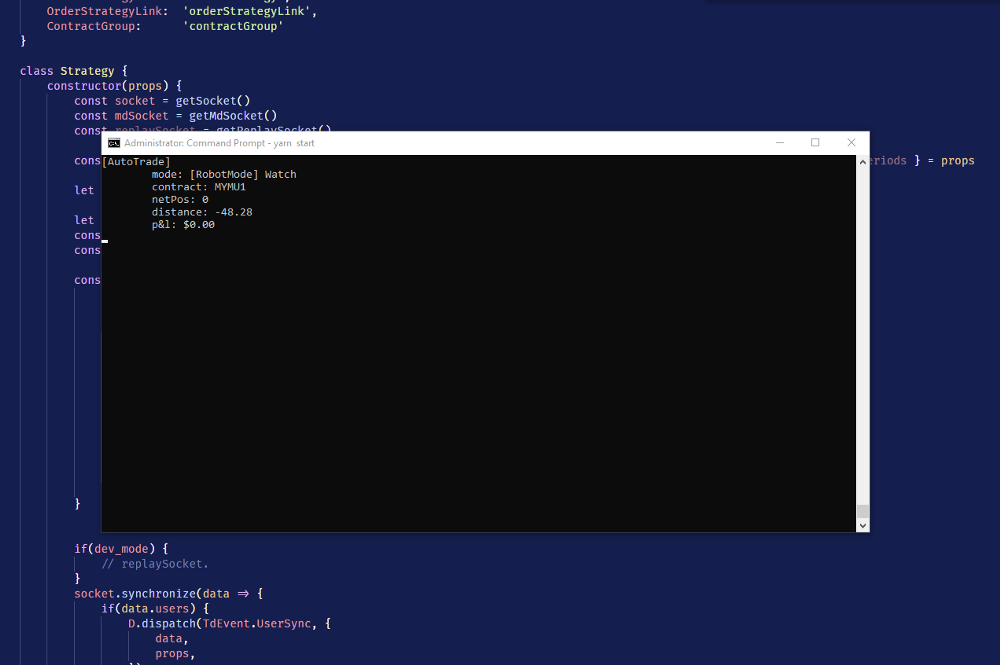

These programs can also be used to automate and back-test trades. This will allow traders to feel more confident about their strategy and reduce their reliance on trial and errors, as well as increasing their odds of making profits.

Investing can be difficult and complicated. It is therefore important to have reliable charting platforms. This will help you to understand how the market is moving, and what the likely outcome is.

Trading View offers an online charting service with many features and tools. It is also popular among traders who use multiple platforms.

Three accounts are available for Trading View: Basic, Premium, and Pro. The Basic account is most affordable and can be used in all areas. While the Premium account allows you to access more advanced features and has more data.

The Basic account only allows one chart per layout. It can only hold up to three indicators. But it is a great place to get started with the tool. It can also provide server-side alerts, global data, and other features.

Traders who want to expand their horizons can try out a program like MultiCharts. This platform has been around since over 20 years.

The software has many features that make it easy for beginners as well as experts. Trading questions can be answered by the company via video tutorials or live support.

Trend Trader Pro - A popular and highly effective trading program designed for people who want more profits in the Forex market. It features a number of features, and was created by an experienced trader. It has been tried by thousands of traders, and is a great tool to help you achieve consistent and profitable results in forex trading.

The course Learn How to Trade the Market covers all aspects and topics of trading. It shows traders how to identify the best setups, develop trading strategies, manage open trades, and what to do when they get there. It provides insight into the psychology of trading as well as how to improve it.

FAQ

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many options.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Do forex traders make money?

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts should be safe. It's essential to protect your data and assets from any unwanted intrusion.

First, ensure the platform you are using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Look at user reviews to get a feel for how the platform works. Finally, you should be aware of tax implications for investing online.

Follow these steps to ensure your online account is protected from potential threats.