Commodity Forex pairs are used to denote currency pairings that include countries that export raw resources. Not only does the US Dollar count, but so does the Canadian Dollar.

It is common for commodity currencies to be highly correlated with a country's trade and import activities. This is especially true in emerging economies, where a lot of the economy's revenue comes from local raw materials. There are many other factors that can affect currency values. It is also important to consider the economy's GDP. People might not be able to purchase the commodities they need if the economy is weak.

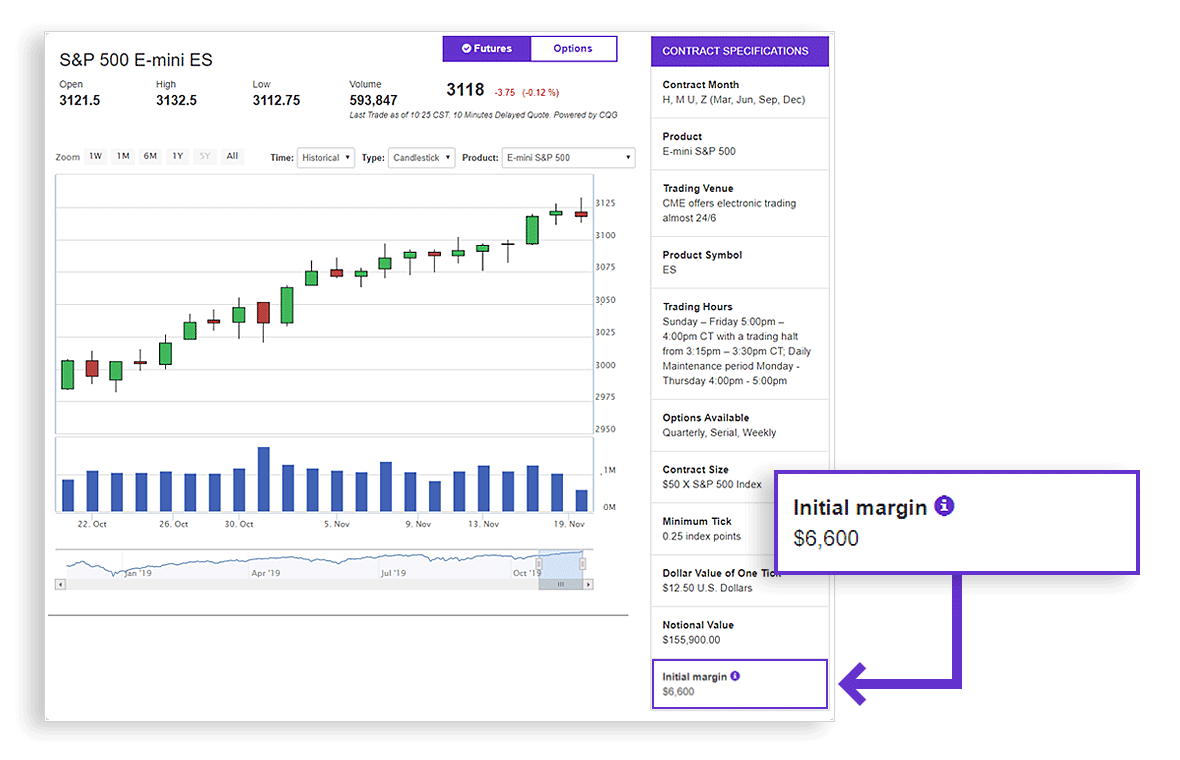

Futures contracts are one of most popular methods to trade commodities. A futures contract is an agreement between the seller and the buyer that the commodity will be purchased at a specified price in the future.

A forex commodity is a basic good, such as oil, which is traded for other goods or currencies. These commodities are most commonly used for routine purposes but they can also be traded in speculative trading. You can trade commodities with a variety strategies for forex traders. Some traders are more focused on the analysis of the supply and demand of major commodities. Others may use more direct approaches, such as buying stocks in corporations that have a connection to the commodities.

It is possible for commodities markets to become volatile and abrupt. You should be ready. Private research firms and government departments can provide information on the supply/demand of commodities. You could also search for index funds or mutual funds that are invested into companies that are involved within the commodity industry.

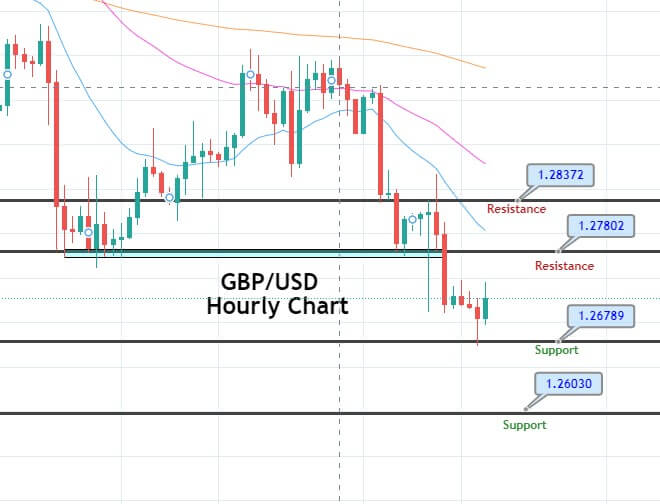

If traders want to maximize their profits in the commodity forex pair, they should devise a step-by–step trading strategy. They should also be disciplined and keep an eye on the market. They must also have an exit strategy.

Commodity currency pairs can be profitable, but you need to be disciplined and understand the different variables that can affect them. Inflation, deflations, tariffs and armed conflict can have an effect on commodity prices. Oil prices have dropped 30% over the last month, for example. Therefore, it is important that you understand the impact of oil on your currency.

Other variables that can affect the price of commodities include economic protectionionism and subsidized production. Certain industrial regulations can also have an impact on the cultivation of commodities. It is important also to assess the country’s economic performance and price of raw materials.

Even though commodity currencies tend to have low liquidity they can be manipulated by traders. Speculators have the ability to manipulate derivatives prices by purchasing an asset, hedging the asset and then selling the asset back at a later time. Traders should be aware of the pitfalls of hedging.

Traders should be aware of the differences between the major and minor commodity currencies. Although minor currencies may be related to a country's natural resource, they are not as sensitive to raw material pricing.

FAQ

Frequently Asked Fragen

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which trading platform is the best for beginners?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Are forex traders able to make a living?

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Conduct due diligence checks to make sure that you're receiving what you paid for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.