You should verify the security of any trading platform you choose to trade NFTs. This is especially important if you are looking to purchase collectibles. When you purchase from a reputable company you can expect a high-quality and safe NFT. However, even the best NFT trading sites are vulnerable to scammers.

It is important to store your NFTs in a private crypto wallet. It's also a smart idea to store your tokens in a hardware device such Ledger. This will give you the assurance that your tokens won't be exposed to the public.

Another option to purchase NFTs is to do so on a curated platform. These markets will screen the artists and projects involved. Many websites offer a place for traders and artists to meet. These websites allow you to not only purchase and sell NFTs; you can also collaborate on projects and support each other.

SuperRare or Rarible are some examples of NFT marketplaces that have been curated. Both have a large selection of digital collectibles. You can browse through thousands upon thousands of NFTs in order to find the one that suits you best. While they may be more well-known than some other curated stores, they don't charge much.

NFT market profiles with KYC information are required for some markets. Some users may find this a red flag. You might need to place a bid if you want to purchase an NFT from a celebrity. While most NFT sites allow buyers and sellers to accept offers, you can also list a collectible at a fixed price.

NFT is on the rise. NFT trading platforms are becoming more popular among the major companies in the centralized cryptocurrency trading industry. Binance is the largest company in this space, and there is a market for NFTs. Other companies include GameStop, which is looking to get into the NFT business.

You can also search for specific NFT traits, such as fashion or sports memorabilia. You can search for NFTs with specific styles or gold fur. NFT marketplaces also offer the option to purchase NFTs with Apple Pay or your credit card.

You should also consider the trading volume of your trading platform. A high trading volume means that there are a lot of people buying and selling on the website. Low trading volumes indicate that the site hasn't been as active. It is ideal to be able view the trading volume in graph format. It is also an indicator of a site's reputation that its daily trading volume.

You should also consider how easy it can be used. Customers are required to register KYC information and connect their crypto wallets on most NFT sites. In addition, most of these sites ask for customer service contact details. If you experience any difficulties with your account contact customer care.

FAQ

What are the benefits and drawbacks of investing online?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Forex traders can make money

Forex traders can make good money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is best forex trading or crypto trading?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is the best trading platform?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

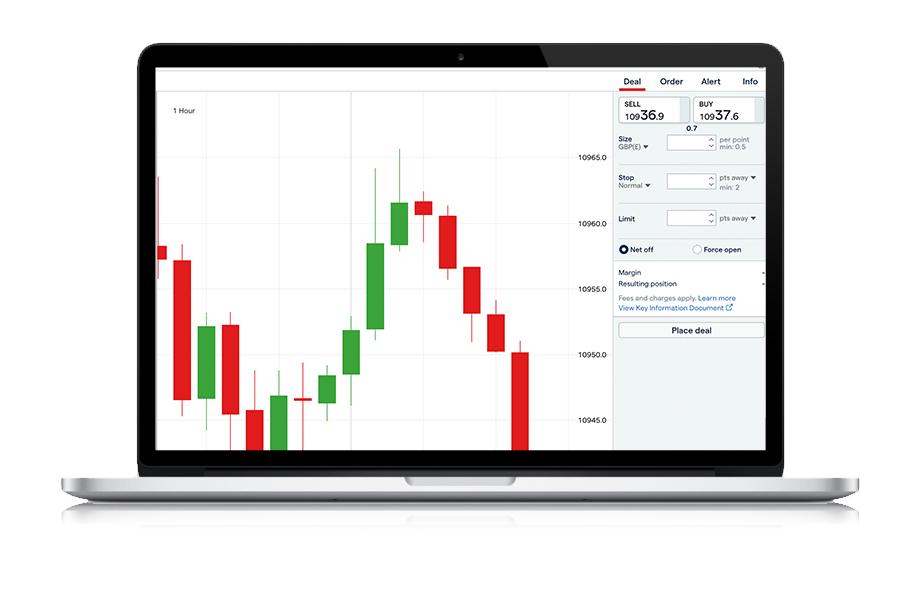

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?