Forex trading has become a very popular method of financial trading. You can make a lot of money by trading forex, but it is important to be familiar with the basics.

Trading forex requires that you understand forex terminology, identify your trading style, develop trading strategies that match your personality, and learn how psychology affects your trading decisions. These and many other aspects of forex trading will be taught by the best forex trading schools so you can start to make consistent profits from your trades.

The best forex course should also be customized to your specific needs. You will have access to up-to-date material, a support community, and a learning process which evolves as you complete the course. Some courses are available for lifetime access so that you can review and learn from the material whenever you like.

In a high-quality forex course, you will have access to a tutor who can answer your questions in an informal and supportive environment. These tutors are often industry experts, and they can be a vital resource for any newcomer to forex trading.

You will have to make your own decision on the best path for you. But the following guidelines will help you start your search.

First Steps To Consider Before Buying A Course

A good Forex trading course should include several modules that cover the core topics required to be successful as a trader. These may be delivered in an online format or face-to-face.

The best forex courses are designed to give you a balanced mix of theory, practice, and real-world examples. The course should also encourage interaction between the tutor and students. This allows you to ask questions and share experiences with other learners at the same stage as you.

Two Steps Before You Purchase a Course

The next step after you have chosen a forex course is to confirm that it has been approved by a respected professional in this field. These are commonly referred to as certified forex instructors or accredited forex traders and indicate that the course is genuine and will teach you the skills you require.

Third Steps to Consider Before Buying a Course

It is also important to ensure that the course you select offers interactive, live support via an online platform. This could be in the form of a dedicated chat area where you can share any issues or questions with fellow course members or in a personalized mentoring session with a tutor.

Good courses will also include a team experienced tutors that can answer all your questions and provide ongoing support once you have completed the course. You can ask the tutors for recommendations on other forex courses, as well as a list of brokers that might be suitable.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

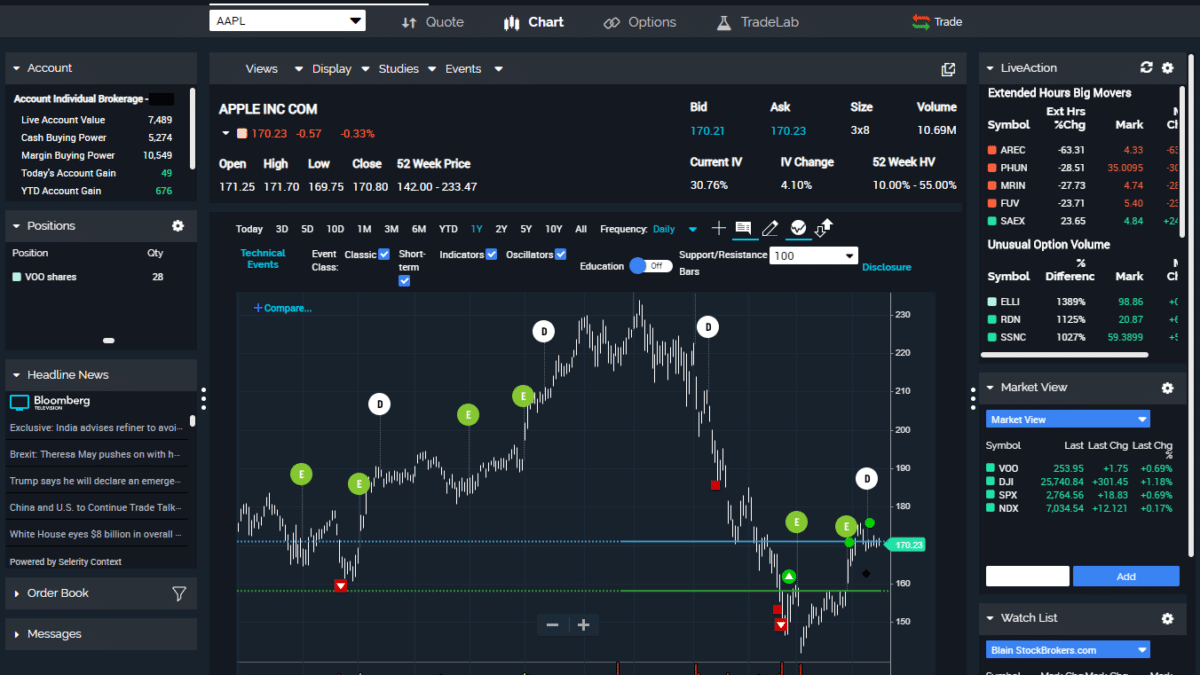

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Are forex traders able to make a living?

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

While money can be confusing, the decision to where it should be stored can be just as complex. You have many options for protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?