Soybean derivatives are traded on an exchange, and can be found on the Chicago Board of Trade. They offer liquidity and hedging capabilities that allow for risk management as well investment opportunities. Before you buy, however, there are important factors to be aware of.

Argentina's soybean crop has been suffering from drought and weather-related challenges. Analysts believe that the recent snowstorm could have adverse effects on the harvest. Moreover, the USDA's annual planting-expectations report is released every year, giving investors a good indication of what supply will look like in the coming months. If the actual numbers of plants planted are lower than expected, soybean futures prices may be affected.

The number of harvested soybeans is another factor that can affect the price. Prices for soybeans can fluctuate depending the number of harvested bushels. However, the bushel count is only one part of the underlying futures prices.

The soybean market is also being affected by the drought in South America. Futures have hit six-month highs over the past few weeks. Investors are trying to adjust their positions by the end the year.

In recent days, wheat and corn futures have both risen. The Chicago Board of Trade's futures contract for wheat traded higher on Wednesday. These commodities are tied to potential demand increases that could happen when China reopens next years.

The drought could be hampering the soybean harvest, traders worry. Although the weather report indicates that there has been some rain in the area, it isn't clear if this has been sustained.

Other factors influence soybean prices. These include diseased crops and delays in harvesting. They also affect the yields of soybeans. Although these factors can have an impact on soybean futures prices, a greater number of bushels is often required to affect the price.

Finally, a number of investors are beginning to back away from their positions in soybean futures. Many of them are taking advantage of their positions before they end the year. Because of the large difference between the spot and soybean futures prices, carrying costs can be covered.

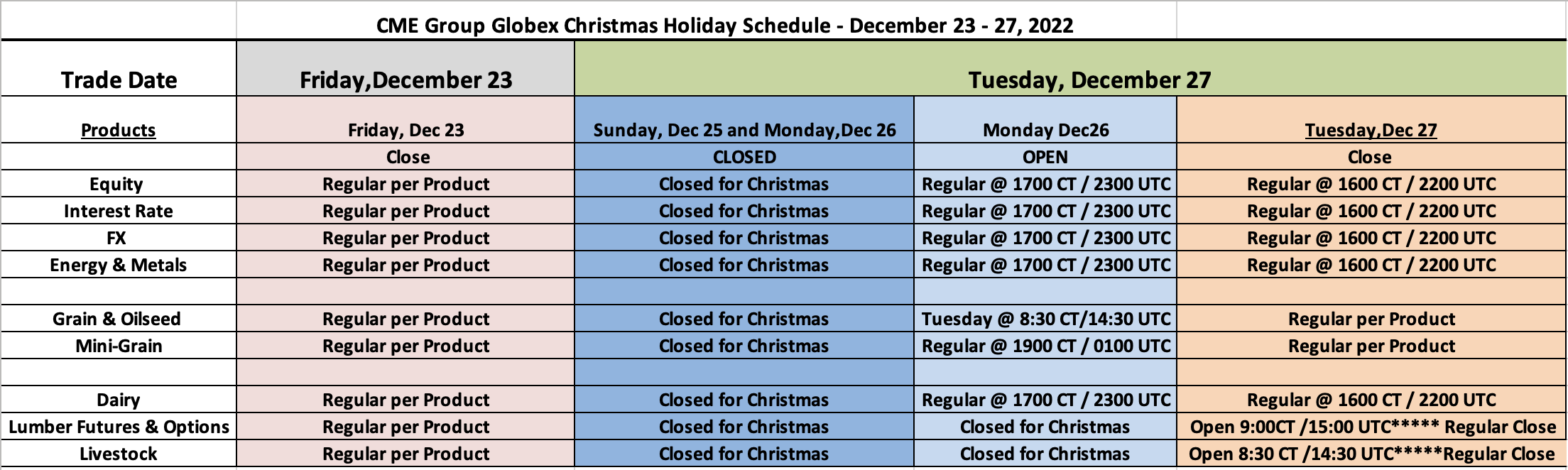

Soybean futures can be bought and sold easily and offer great liquidity. They are available for trading on the Globex or CBT platform. You will need to know when you are going to receive the goods and how much you wish to purchase. The CME Group website has more information. Daily price data for soybean and corn futures can be found on the CME Group website. The CME Group site doesn't publish real-time market information feeds but it does provide reliable, deep liquid options for Soybean forwards.

Learn more about the history and present status of the futures industry by taking the CME Institute's courses.

FAQ

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Where can I find ways to earn daily, and invest?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

It is easy to lose your money, but it can also be difficult to decide where to keep it. A strong security system is essential for your valuable assets. There are several options.

Online storage of investment assets is easy and convenient. You can access them easily from any device. Yet, there are risks involved when using a digital option since electronic breaches may occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?