A few factors determine the price of a call option. The first is the price of the underlying assets. The time remaining until the option's expiration. The contract may also include extrinsic or intrinsic value.

A call option, a derivative contract that allows the buyer to purchase or sell shares of stock at a specified price, is called a call option. This price may be below or above the market price, depending on which contract it is. The price of a call option is generally determined by the asset price. The contract's expiration dates will have an impact on the price. It is a good idea to choose a strike price that is in line with your budget. It is possible to experiment with different strikes to determine how they perform.

If the strike prices of the underlying stocks remain below the call option's strike price, then a call-option can be worth its expiration price. On the other side, a call can lose its value if it's worth more than the strike amount. But a call option that's out of the money doesn't have much value.

A call option is a great way for long-term investors to make income. If the price of the contract rises, you may be able to sell the contract and make a profit. In return, the premium paid is retained. However, calling options are a risky investment. It's also worth remembering that a call's value can depreciate as time passes.

Depending upon your investment strategy, a Call Option is a good bet if the strike Price of the underlying Stock goes above it. You can also sell your call option for a small premium if the stock price drops. A good time to trade calls is before the important earnings report.

Long calls are derivative contracts that are traded when investors expect the stock's price will rise significantly before the expiration date. Call options are available to be bought and sold at any moment before the expiration. Selling a call may be easier than buying, but it is still possible to buy a call.

You should select the strike price that is most in line with your budget to maximize your chances of making a profit. A strike price of 35 is more appropriate if you intend to sell the underlying stock within the next few years. A strike price of 31 would be more attractive if you're considering buying the underlying stock.

The biggest advantage of a Call Option is the potential profit you could make. You can make a profit by selling the option if the price of the underlying stocks rises. You could also purchase the underlying stock at an affordable price and keep the premium that you paid. Whatever you choose, a call option can be a great way to increase your portfolio's volatility.

Knowing how long the stock's price will stay above the contract's strike is key to determining what the best call option price is. You can maximize the return on your investment by knowing this information.

FAQ

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What are the pros and cons of investing online?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

How do forex traders make their money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is safer, cryptography or forex?

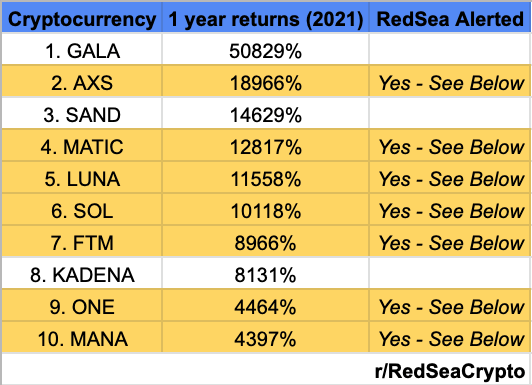

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which trading website is best for beginners

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

When investing online, security is crucial. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last but not least, make sure to use VPNs when investing online. They're often free and easy!