The Chicago Mercantile Exchange (CME), located in Chicago, Illinois, is the largest options and futures contracts exchange in the world. CME markets a wide variety of benchmark products that cover all major asset types, including equity, foreign exchange, energy and agriculture commodities as well as metals. CME Globex Trading System is a global electronic trading system that trades over 90% of the exchange’s volume.

Today - Future of CME Group

CME, in addition to being a marketplace, is also a prominent derivatives clearinghouse. Its primary businesses include CME Group, the world's largest derivatives marketplace; CME Clearing, which provides clearing and settlement services for exchange-traded contracts and over-the-counter derivatives transactions; and the CME Globex Trading System, an electronic trading platform that is used by most of its members.

Globex is an open-access trading marketplace that operates virtually around the clock. It offers a broad range of unique products and traditional futures and options products traded through an open outcry method.

CME Globex, the first electronic trading platform for options and futures, was created in 1992. It was created to enhance the trading efficiency of the exchange's open outcry system and to extend trading hours.

Agricultural Markets

CME Group is the operator of the Chicago Board of Trade's (CBOT), Kansas City Board of Trade's (KCBT) Designated Contract Markets. These markets provide futures on corn, soybeans and other agricultural commodities. CBOT markets and KCBT market provide liquidity for traders and farmers in these commodities. They are designed to offer the highest levels transparency and integrity during significant economic events.

CME's hours were extended to 21 hours a week on Sunday May 20th. This allows for the trading of a wide range oileed and grain options and futures. Based on feedback from over 4,000 farmers, traders and commercial customers, this change was made.

These new hours allow traders and investors to have more time to manage risk in the oil and grain markets. They also increase liquidity and improve market performance. Liquidity facilitates price discovery and movement on the market, and reduces transaction costs.

USDA Reports & Trading Hours

During the next several weeks, trading in CME Group's futures markets will be influenced by the release of key agricultural reports from the United States Department of Agriculture. These reports will immediately influence prices and lead to massive spikes in trading activity.

CME Group constantly changes the rules and regulations that govern its markets. Therefore, the trading hours will also continue to change. These changes are often implemented in response or in compliance with regulatory requirements.

Trading Hours on Globex

CME Globex, which handles 90% of its trading volume, is responsible for nearly all of CME's electronic trading. It is the biggest electronic trading platform in the globe. It's the only system that supports all exchange products, even its proprietary trading platform, CME SPAN.

FAQ

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

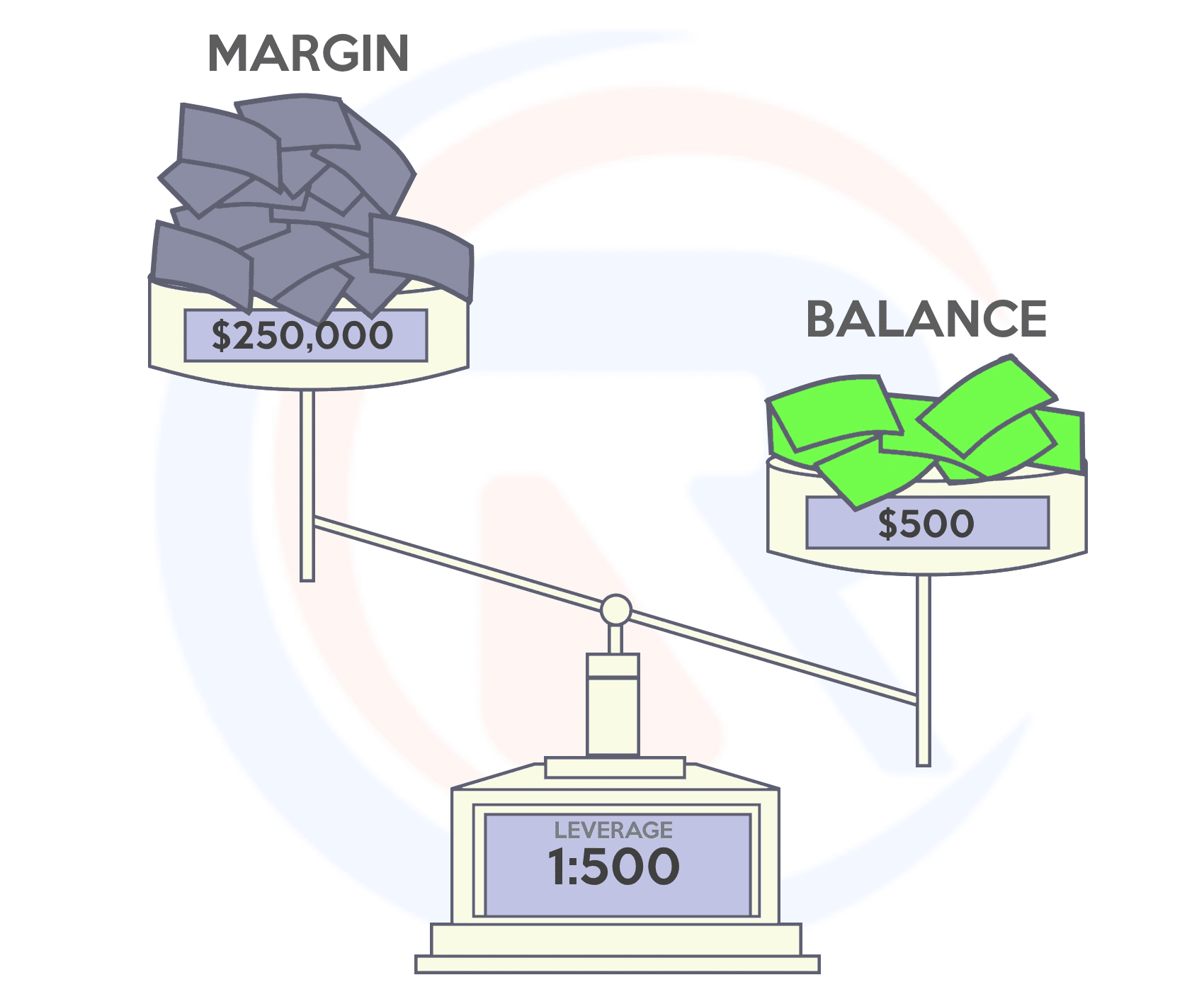

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, make sure to understand the risks associated with each strategy.

Forex traders can make money

Yes, forex traders can make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Frequently Asked Question

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection begins with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Unsolicited email or phone calls should not be answered. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Keep in mind that fraudsters will try everything to get your personal details. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

You should also use safe online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Before you make any investment, read and understand the terms of any website or app that you use.