While cryptocurrency investing can be a fun way to make money online, there are also many potential risks. It is important to fully understand and manage the risks before you decide to invest. Consider a mix of traditional and cryptocurrency investments, such as stocks, in your portfolio. This will help you build an investment portfolio that's well suited to your risk tolerance and financial goals.

Crypto Mining Investment

Bitcoin is the most prominent cryptocurrency. But there are thousands more. The best way to invest in cryptocurrency is to purchase a small number and wait for them all to go up in price. While buying and holding is the most popular strategy for crypto investment, it's not always profitable or easy as many cryptocurrencies fluctuate in price very rapidly.

Contrary to traditional investments, crypto doesn't have the backing of governments or precious metals. This makes it vulnerable to extreme price swings. James Putra from TradeStation Crypto, senior director for product strategy, says crypto should not make up more than 2% to 5% in your total investment portfolio.

You can also hedge cryptocurrencies, or bet against them using contracts for difference and futures, which are financial instruments that allow you to bet on the price of a specific currency in the future. Although this can be a great way to diversify your portfolio, it is highly speculative. You should only do this with the help of a financial professional.

Reddit Crypto Investing

Reddit is a great place to start when you are interested in crypto investing. Here, users can discuss and discuss the most recent news in the cryptocurrency industry. The Reddit community offers discussion on everything, including market thoughts and the most recent ICOs. These are new cryptocurrency projects which seek to raise money by selling tokens.

This site is great for researching a new crypto project. You'll also find comments about founders and company members. You can also learn more about the company's vision, goals, and mission.

Fight Out will transform the play-to-earn and fitness industries with its revolutionary new app. Currently the FGHT token can be traded at over $45 per currency. The company plans on offering a wide range of seasonal tournaments that offer significant prize pools.

Reddit's Calvaria token is another crypto worth looking at. Its RIA token has surpassed 90% in the final stage. It has already raised over $2.8 million, and if it's listed on an exchange it will be an excellent option for anyone who wants to invest in a decentralized gaming network.

If you're a fan of P2E and meme coins, the MEMAG token is another promising option. It is currently in beta testing for games that give a nod to the arcades from the past.

You should never invest in a crypto without doing your research, so always check the ico's website for more information before making any kind of investment decision. It is important to make sure that you are not buying a fake token. If you discover a scam, be sure to immediately contact the company.

FAQ

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

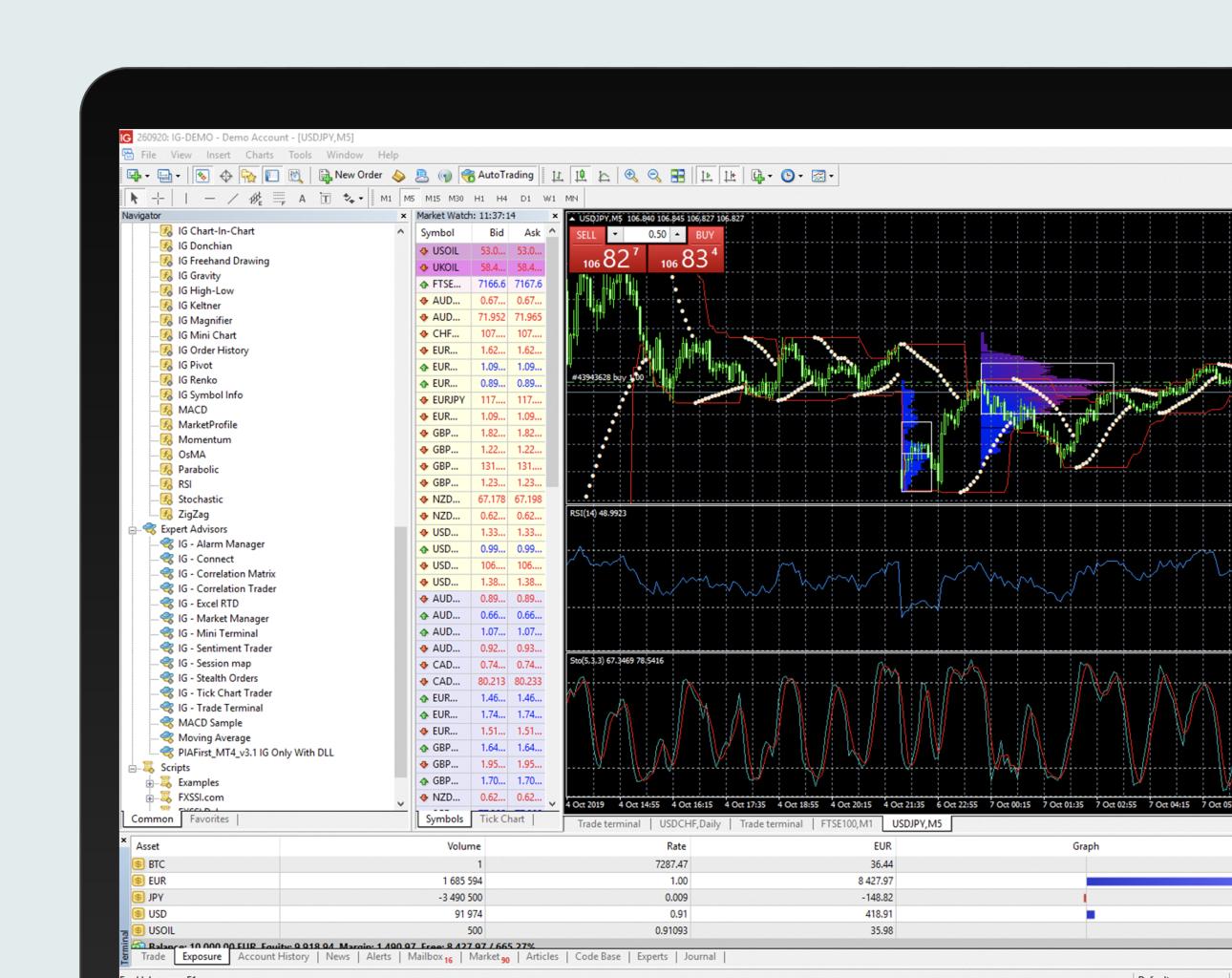

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

It is important to do your research before investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Conduct due diligence checks to make sure that you're receiving what you paid for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!