Crude oil ranks among the most liquid commodities. Crude oils are widely traded and have many uses. There are many applications for crude oils, from producing gasoline to petroleum products and pharmaceuticals. Global demand and supply determine how the commodity's price changes every second.

Two main options and futures are available for oil trading: options and futures. Futures are where buyers and sellers agree to purchase or deliver oil at a particular time in the future. In exchange, the buyer agrees to a specific price. Oil prices are volatile so traders need risk management to invest.

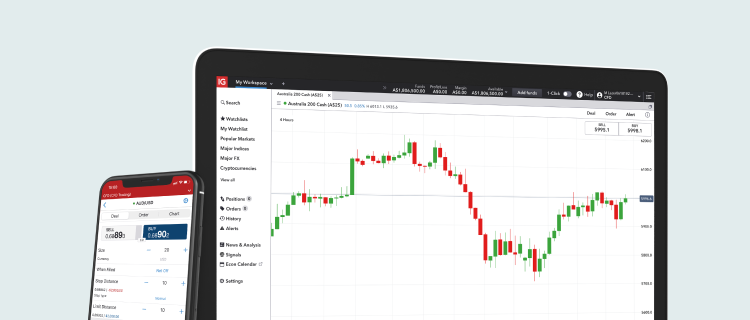

The most direct way to buy and sell oil is through oil futures. They are also popular among speculative trader. However, trading futures requires large margins. In order to trade, some brokers will require 10%. Traders have the option to find a broker that meets their needs. Before opening a live account, traders should first test their strategy with a demo account.

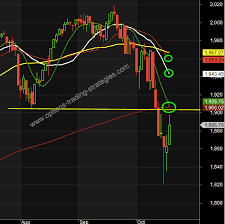

Oil is volatile. A beginner should limit their exposure. Using a trading strategy based on fundamental and technical analysis can help a beginner gain a deeper understanding of the market. Traders are able to identify the market's major turning points by studying supply and demand factors. Traders can also use breakout strategies to profit from market gyrations.

Oil futures are traded on both the New York Mercantile Exchange and the Intercontinental Exchange. These exchanges are the "big three" major oil markets in the U.S. These exchanges' official websites are great for beginners who want to learn more about the industry.

Options are similar to futures, but they do not require the sale of the underlying asset. When the option expires, the buyer or seller has the right to buy or sell the underlying asset.

If you have not been following the oil markets, you might be surprised to know that a major percentage of the world's oil is produced by countries that are members of the Organization of the Petroleum Exporting Countries. OPEC has one primary goal: to manage the global oil supply. Traders can view the meetings of OPEC and get an idea of how oil prices might change.

Trading oil has many benefits beyond the obvious. These include the possibility of higher stock prices, the ability to hedge against adverse price movements and the potential to make a significant profit in a declining market.

Options and futures both offer great ways to trade crude oils. You can purchase or sell 1,000 oil barrels by purchasing futures. This allows for you to benefit from price increases or decreases while still protecting your investments.

FAQ

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is more difficult, forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

How do forex traders make their money?

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Frequently Asked questions

What are the 4 types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Safety is a must when it comes to online investment accounts. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, you want to make sure the platform you're using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It is important to be familiar with the terms and conditions of any online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, you should be aware of tax implications for investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.