Merrill Edge Crypto is an online broker that is part of Bank of America’s financial services platform. It provides a range of investment tools and perks for its customers, including ETF and stock trades that are commission-free. It integrates seamlessly with Bank of America accounts, making transfer of funds easy.

Merrill Edge has no support for cryptocurrency trading. However you can trade cryptocurrencies with a broker such Grayscale Bitcoin Trust or Arkk Invest. These platforms allow you to trade digital currencies at a low cost and have been approved by FinCEN.

You can keep track of all your investments with a crypto portfolio tracker. It is simple and easy to use. It helps you identify profit and loss, organise your investments, and even track price movements.

It is important to remember that cryptos can be volatile and difficult to predict. Although there are many ways to reduce this risk, it is crucial that you do your research before investing.

A platform that does not charge trading fees or high deposits is considered the best for crypto trading. It also offers wide spreads on a variety of crypto assets and boasts industry-leading spreads. This is the reason eToro is a favorite choice for crypto investors.

This feature also allows you copy the performance from other traders. This is a great way for you to learn from experienced traders and help you build your crypto portfolio quickly.

You can also invest with stocks that have strong blockchain presences like IBM. IBM Blockchain is a division of the company that invests in hundreds blockchain ventures.

Merrill Edge accounts don't allow you to invest in cryptocurrencies. However, you can trade stocks whose main focus is blockchain technology. This strategy can be used to help hedge your crypto exposure and gain a high return on your investment.

If you're not a fan of the idea of trading stocks, you can also consider other types of investments with Merrill Edge. It offers a full-service brokerage platform that's geared toward beginner and intermediate DIY investors.

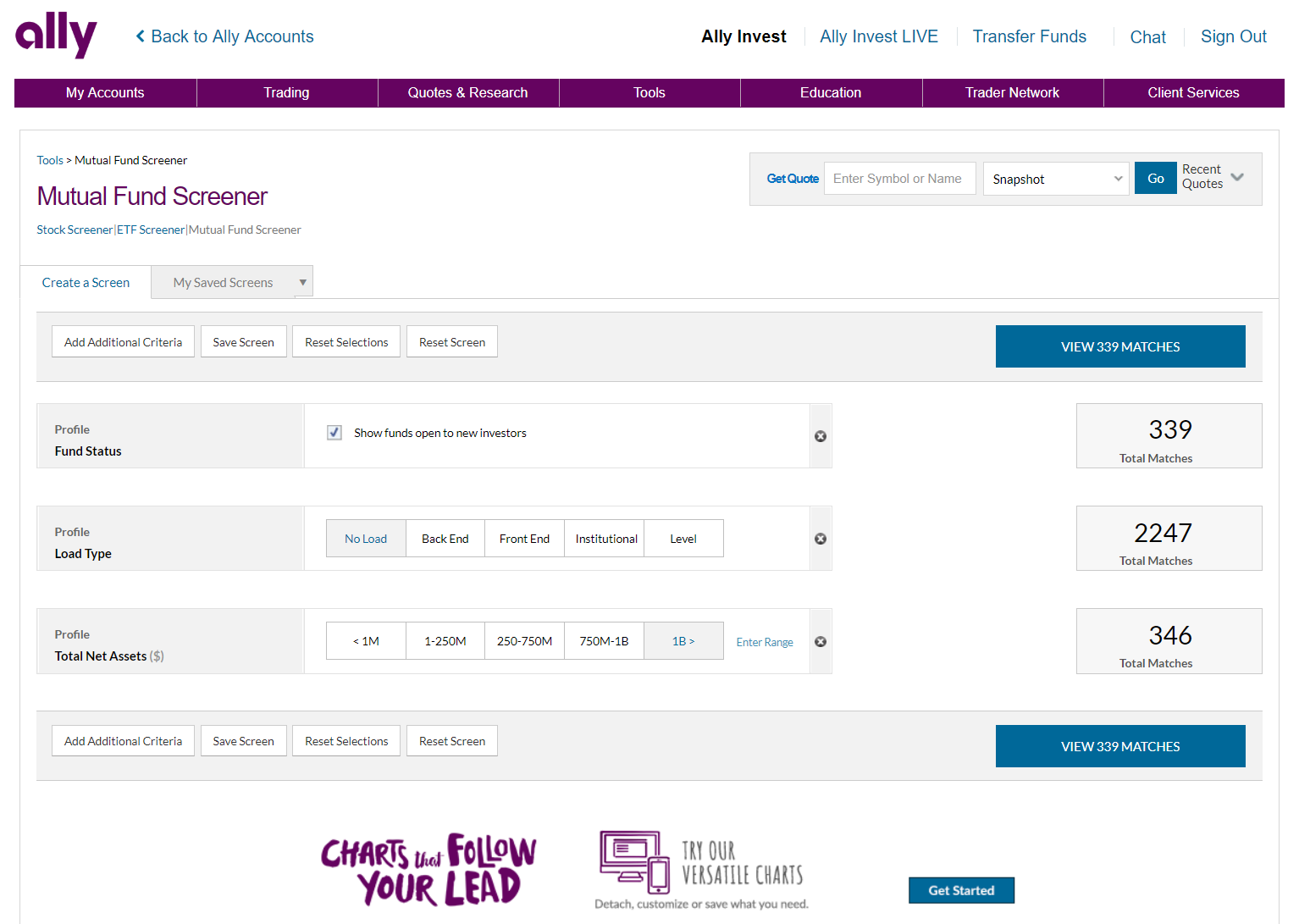

Merrill Edge not only offers ETF and stock trading, but also offers a wide range of research tools. These include screening tools, fundamental data, trading ideas and screeners.

The broker also offers a variety educational resources including videos and webinars to help you learn about the markets. A wealth management center is also available through the broker, with advisors who are available to speak to you.

The website is user-friendly, and you can login securely. You can create alerts for specific prices as well as view historical data or charts.

Sign up to a free trial account today and you can start trading. An account can be opened with a bank account or credit card.

Merrill Edge makes it easy to trade stocks and ETFs as well options and mutual funds. This company offers low commissions and is a great option for beginners looking to learn more about the markets.

FAQ

Frequently Asked questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Understanding the different currency conditions is crucial.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

How do forex traders make their money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Should I store my investment assets online or do I have other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have several options when it comes to protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. The downside is that there may be electronic thefts.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?