S corporations can be described as domestic businesses that are owned by US citizens. They must fulfill a number requirements. They must have no more than one hundred owners, not allow other LLCs or trusts to own them, and they must be incorporated in America.

Although they have similar advantages to LLCs, there are some disadvantages. S corps have one major disadvantage. They are not treated in a similar way by state governments. If the business owner receives all shareholder distributions income, they may face a tax audit. The IRS may also consider reclassifying some distributions as salary. This is something that the IRS will discourage.

Another advantage of S corporations is that they allow their owners to pay themselves as employees. This is possible because they have an elective status. If the owner is considered an employee, payroll taxes will be paid the S corporation. The S corporation will pay the payroll taxes. However, the owner must report the income on their personal income tax return. An S-corp owner can also deduct auto mileage expense and home office taxes.

An S corp should keep records and report to the IRS its income and losses. Its officers and directors supervise the day-to-day operations of the corporation. Scorps must hold shareholder meetings, which is not the case with LLCs. These meetings are typically held to discuss major decisions, like the purchase and hiring of executive directors.

S corporations do have less operating requirements than other types of organizations, but they must still adhere to the corporate laws in their home states. They must also keep a corporate record, and the minutes of corporate meetings. Depending on the company's operational structure, permits, licences, and registration must be applied and obtained.

The Internal Revenue Service pays special attention S corps. All corporations must file a Form2553 with the IRS. This information can be used to calculate both the federal and state tax due on the corporation's earnings. Aside from the information required by the IRS, a corporation must also make an election to receive S corp tax treatment.

If an S corporation is profitable, it may be able to pass some of its profit to shareholders via dividend distributions. All dividends received will be subjected to personal income-tax by shareholders. An S corporation, unlike an LLC can only issue common stock. This can make it difficult to raise capital.

S corps can be referred to as pass-through entities. That means the income and losses of an S corporation are reported on the owner's personal tax return. To be able to report income and losses on an S corporation, it must have a solid payroll program. ADP, a professional payroll service, is a great option for small businesses.

The 60/40 Rule is an informal rule that divides income between 60% of the corporation's salary and 40% from its shareholder distributions. Although not officially approved by the IRS, it helps the owner of an S corporation determine a reasonable salary.

FAQ

Cryptocurrency: Is it a good investment?

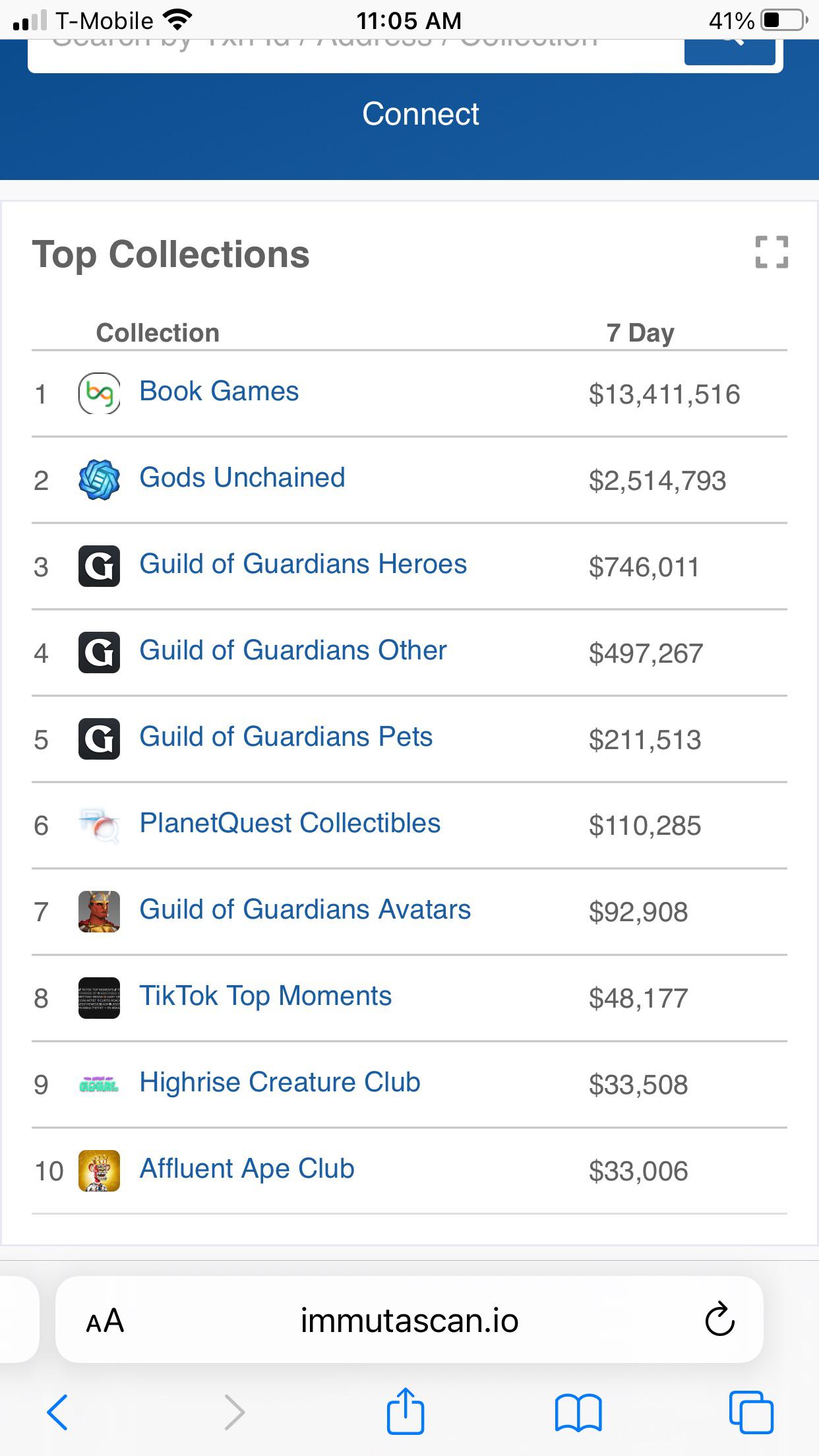

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

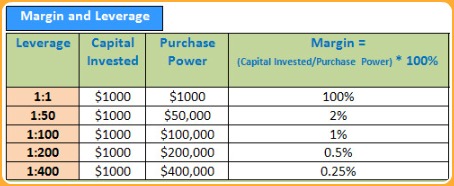

Can forex traders make any money?

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. It can be confusing to choose the right one, with so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Don't respond to unsolicited calls or emails. Fake names are often used by fraudsters. Never trust anyone based solely on their name. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Keep in mind that fraudsters will try everything to get your personal details. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

Secure online investment platforms are also essential. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.