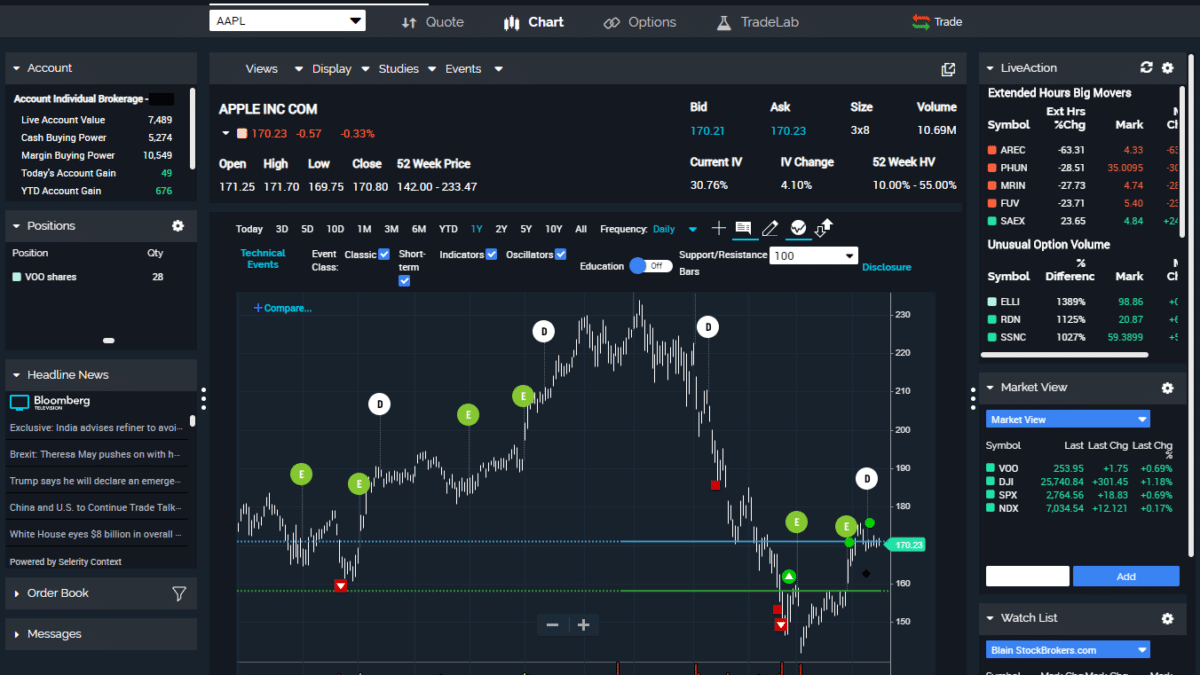

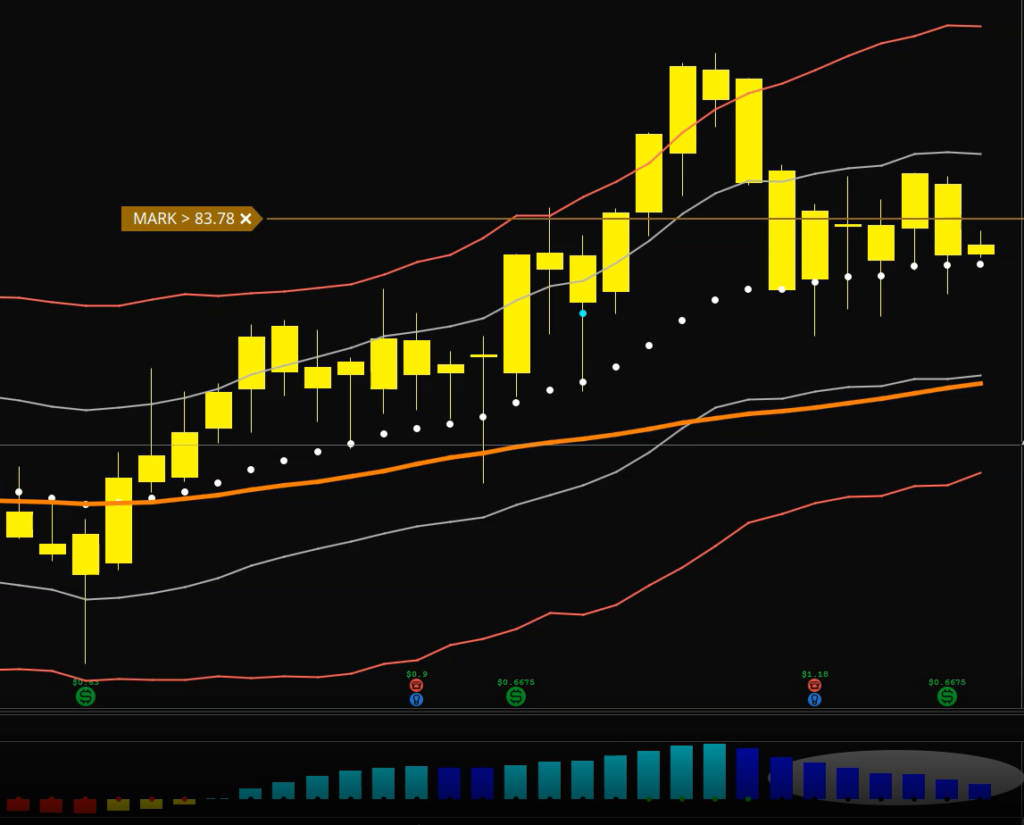

Stock signals are indicators that allow you to spot potential trading opportunities within the stock market. These indicators can be derived from many technical indicators. A moving average crossover could be a short-term buy sign. There are also momentum and volume indicators that can be used as indicators. These indicators combined can help you spot overbought stocks.

Stock signals are often combined with fundamental analysis to determine a stock's price direction. These signals can be used by both day traders as well as long-term investors. You can save time, money, effort, and increase the likelihood of a profitable trade by using these tools. You should be careful when looking for signals.

An excellent signal provider will give you a trial period to allow you to get used the service and make a decision about whether it is right for your needs. Some providers will let you try the service completely free for a one-month period. It is important to evaluate the quality of signal providers' customer support, reliability, as well as the types of signals they offer. This is especially true for beginners.

Many companies communicate with customers via email or mobile apps. WeTalkTrade's new mobile app allows customers to receive push notifications instantly. The app also features an economic calendar which displays different economic news releases.

The Motley Fool is known for its focus on emerging industries. They have a number of trading plans and options, ranging from $1 per month to $47 a month. These plans give users access to swing trading stocks and other financial products. Visit their website for more information. Additionally, there is extensive educational video content.

Elliott Wave Forecast also offers accurate forecasts across all asset classes. This includes equities, commodities and currencies. Their analysts have extensive market research and technical background. Their stock signals are the best in the market. Their services give traders the assurance that they will always have the most recent information.

MindfulTrader is for traders who require more guidance. They are located in Denver Colorado and offer a range services for both individual and institutional investors. From swing trading to daily reports, they're a good option for those who want a reliable resource. They're also one of the best stock signal providers for 2022.

Before signing up for signal providers, you should consider your investment objectives. For long-term investors, you will need basic indicators to guide your investments. Day traders may need the right signals in order to capitalize on an opportunity. It doesn't matter if you are a beginner or an expert in the field, it is important to ensure you get the best possible services.

A money-back guarantee is another important feature to look out for. Some providers will record their wins and losses, which is unethical and misleading. Investing in stock signals is a great way to save time and money, but it's still important to be careful.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Are forex traders able to make a living?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Knowing how to spot price patterns can help you predict where the market will go. You should also trade with only the money you have the ability to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. There are many options to protect your valuable assets.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternately, you can keep your money in physical forms such as cash or gold. However, it is less secure and more difficult to track and requires more maintenance for storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?