The forex market has a high level of activity and is dynamic. Because it moves in line with the laws of supply and demand, many traders try to take advantage of these fluctuations in exchange rates. Forex trading can be very profitable if you are able to recognize trends and reversals.

Both novice and experienced traders can benefit from forex indicators. They are useful for helping to determine key limit points, identify trends, and forecast reversals. They cannot however guarantee trading success. However, they can result in significant losses. Indicators can help you determine when it's time to enter trades, but it is better to rely on fundamental analysis as well as patience.

One of the most popular types of forex indicators is the RSI. The RSI is a tool that measures buying and selling trends using a 100-point scale. It's a sign that there is a change in trend if it is over 30. It will fall below 30 if the trend is expected to reverse. If it bounces back to 30 it indicates that the trend is still in place.

Bollinger Bands is another useful forex indicator. These bands have an upper and lower range based on the standard deviation from the moving average. You can use the bands to determine whether an asset has been priced reasonably by analysing its volatility.

Technical analysis relies heavily on support and resistance. When a trend breaks past these levels, it may raise or lower the price. Likewise, a decline in value can lead to more buyers than sellers.

There are other popular indicators that can be used to evaluate a market's current state. OBV (On Balance Volume), and RSI are two examples. OBV (On Balance Volume) and RSI are both tools that can confirm a trend. However, RSI may also indicate potential reversals.

These indicators are not the only ones that exist. There are also many other types. Some of these indicators can be visualized to show the average price movement, while others offer a general overview of market conditions. Many of these indicators are free to use. Others are more functional and require a lower cost.

In addition to these tools, a number of automated Forex trading systems have been developed. These systems analyze many charts and send alerts via email to traders. Many of them are very simple and don't require advanced knowledge about the forex market.

Forex Trendy is an excellent choice if you're interested in automating your trading. You can scan up thirty-four currencies and receive trade alerts based off patterns. Although it is not intended to be a comprehensive trading strategy, it has been a successful tool for a large number of users.

You should know that no Forex trading program can guarantee success. It is crucial to remain patient and recognize that the market moves in any direction.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. It can be confusing to choose the right one, with so many options.

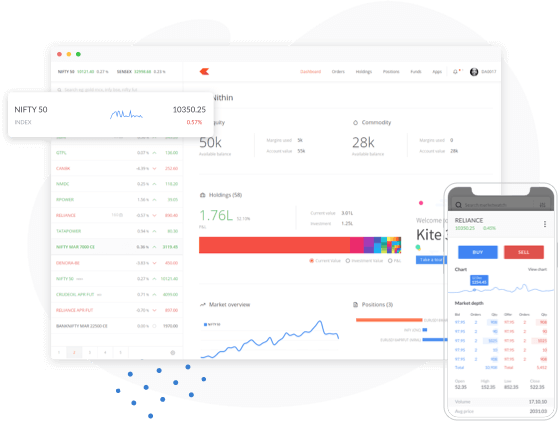

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

You must first ensure that the platform you're using has security. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. You should also be aware of the tax implications when investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.