Webull is a low-cost online stock broker that offers commission-free trading of stocks and options. It is a good choice for beginner traders who are looking for an inexpensive way to trade.

Stocks Free from Webull

Webull has a number of features and tools that can help you make informed investments decisions. Its newswire offers headlines and economic data. The technical indicators are simple to use. It also features a number of charts that can be filtered to show specific indicators. It is also available on Apple and Android devices.

Paper Trading

Trading on paper is a popular option for traders of any skill level to try new strategies before investing real money. You can also use it to practice a strategy before you commit.

There are no fees associated with paper trading, but you will need to provide identification in order to unlock the trading feature. Uploading a photo of you or a copy of your ID with your name on is the easiest way to do this.

Margin Interest

Webull offers a margin option for customers with at least $2,000 of debit balances. This gives you more buying power, but it comes with a higher rate of interest than a non-margin account. You can borrow as much as $25,000 in shares and pay interest.

You can also sell stocks that you bought through a margin. After the sale, you can withdraw your proceeds. You don't have to wait 90 days before you can sell your shares at Webull. This is especially helpful for investors who are trying new strategies.

Get Stock Promotions at No Charge

Webull currently offers a referral program that gives 30 stocks free to users who refer. Referrers will be awarded two stocks in the amount of $3-$3,000 each upon signing up and four additional stocks if they deposit $100 or more.

This is one of the more lucrative promotions that Webull has in some time, and it's a great way to get started.

To qualify for the offer, first register through our link to a Webull account and then deposit at least $5. After meeting the minimum deposit requirement for this offer, you will receive an Email with a redemption Code.

Contact customer support if you don't get the coupon code within five working days. They will send you another code to redeem.

Get Started with Webull

Although Webull is an excellent choice for beginners, it lacks some of the beginner-friendly features offered by Robinhood and Public. It has advanced reporting and analysis tools, making it more suitable for experienced investors.

The website provides a great screener which filters stocks based on several key characteristics. These include a consensus analyst ratings, a 200-period average and whether or not the stock is traded with margin. The search results are presented in an easy-to-read format, which includes financial information as well as an order window.

FAQ

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

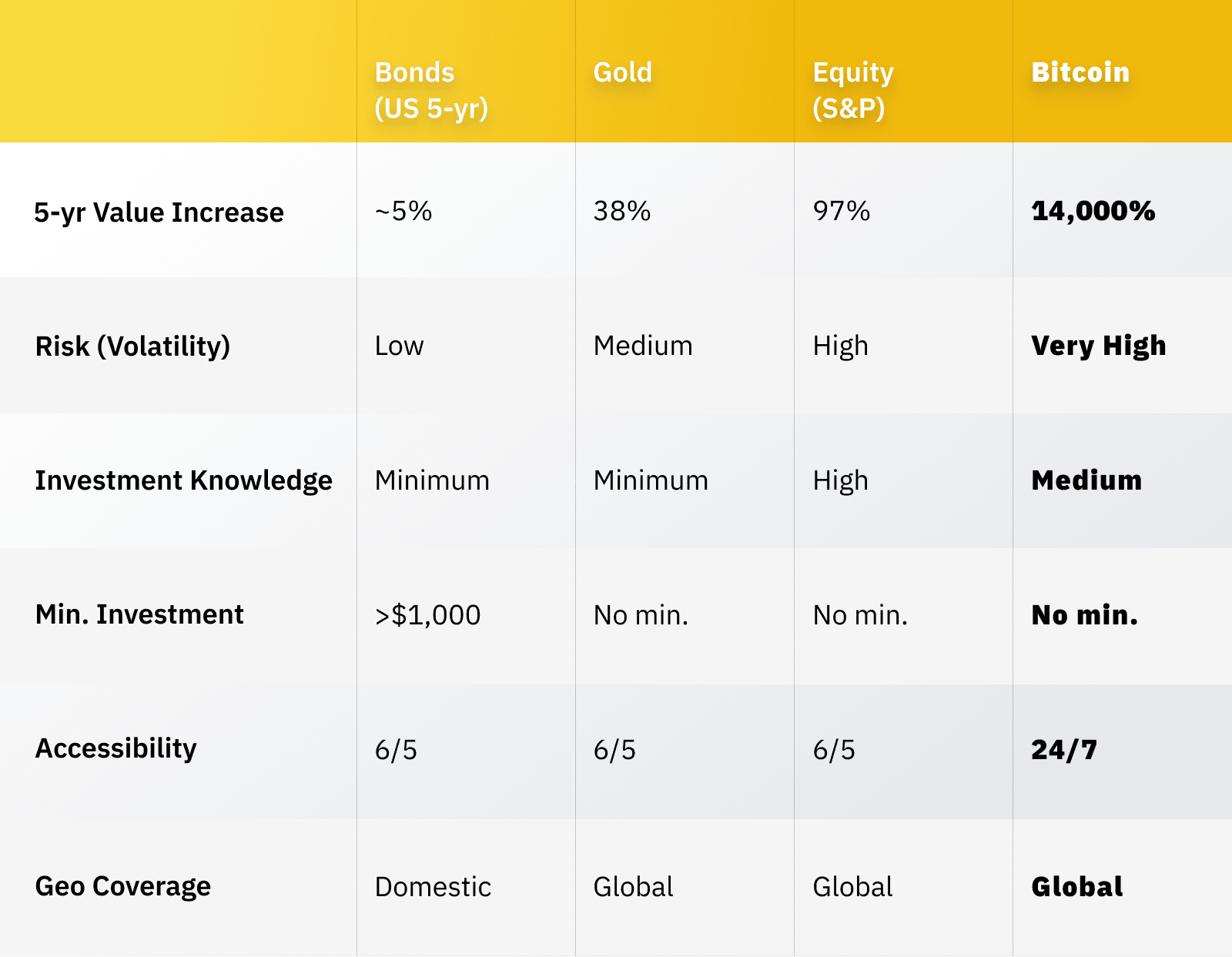

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. You only need the right information and tools to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Forex and Cryptocurrencies are great investments.

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Knowing how to spot price patterns can help you predict where the market will go. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, you want to make sure the platform you're using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Look at user reviews to get a feel for how the platform works. Make sure to understand the tax implications of investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.