Day trading can be a fun way of making extra money, but it is also extremely risky. Day traders invest in stocks hoping that prices will rise in their favor. This is known to be momentum trading. In order to maximize your profits, you must be able to identify and understand trends.

Timing is the most important factor in day trading. By using a variety of strategies, you can identify the best times to buy and sell stocks. To increase your profits, leverage is also an option.

You need patience to be successful. It takes time to learn the ins and outs of the market. However, if you are willing to put in the effort and practice, you can become a profitable day trader.

The key is to make sure you have enough capital to make a profit. You should determine how much money you can afford to invest in your day trading account before you begin. In general, you need to have at least $10,000 to begin. You can also borrow money for a day trading account. You should be able to clearly understand your risk tolerance before you borrow money for a day trading account. Otherwise you may find yourself in financial trouble.

Online brokerages that offer comprehensive trading tools and detailed trading information might be an option. A company that allows stock trading without commissions is also a good option.

First, you need to be educated. This includes learning as much as possible about the market. There are a number of free tutorials available to help you get started.

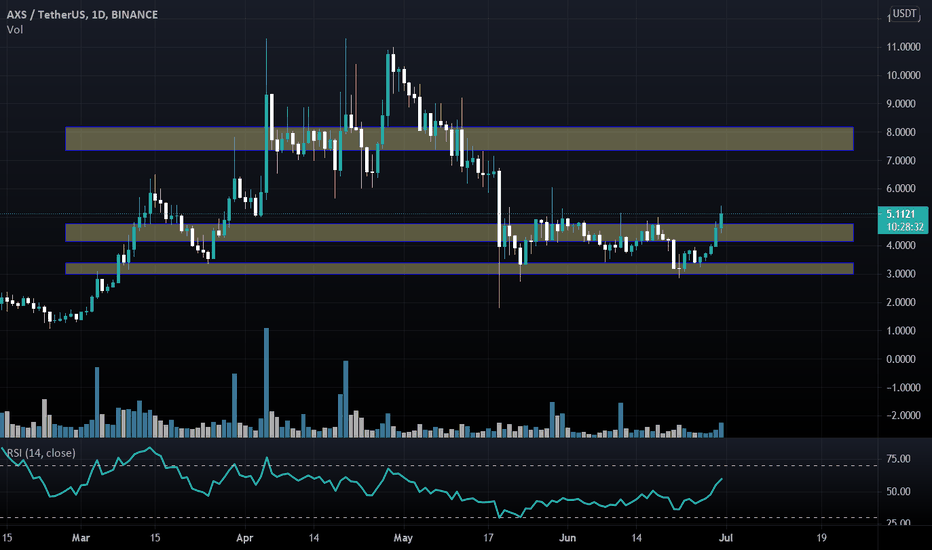

Another tip is to use technical analyses. Technical analysis is a tool that helps you spot patterns in the volume and price of stocks. If you are lucky you may find a pattern that predicts changes in the market.

In the end, the best advice for day traders is to take your time and follow a clear strategy. You should also avoid trading with borrowed money. Many traders lose their initial investment, and end up in debt.

The other important lesson is to pick a reliable broker that offers a variety of tools and services. You can invest in stocks, ETFs, or Forex with a broker. Some brokers offer commission-free trading, while others charge a fee for each transaction.

The best time to trade is early in the morning. This is when the market is most active. Prices can move by fractions of a cent in the span of a few seconds. That is why you should keep your emotions in check when you are trading.

The right strategies should be implemented. You should also know how to read charts. If you don’t have a deep understanding of the market and charts, they can be deceiving. One of the most important strategies is to learn how to sell your stock when you think it is about to go up.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Can forex traders make any money?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Is Cryptocurrency an Investment Worth It?

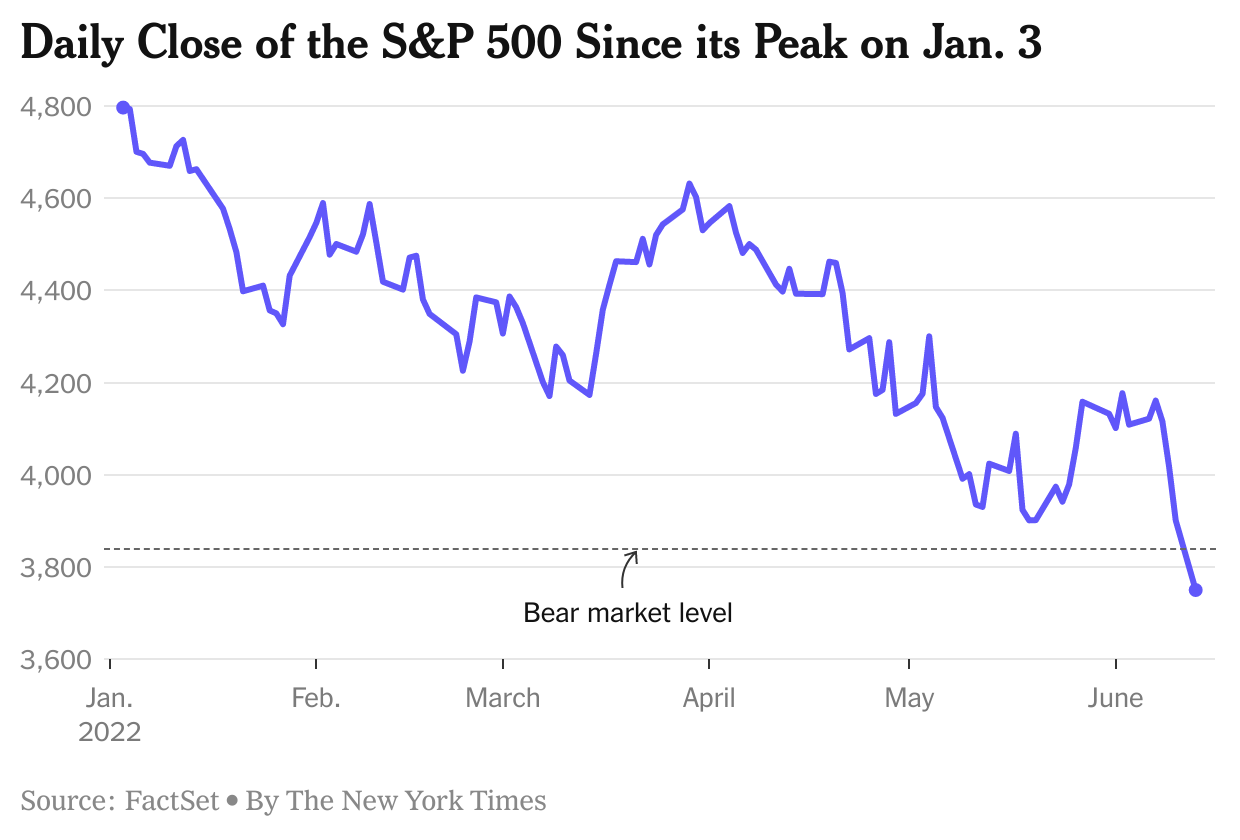

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Don't respond to unsolicited calls or emails. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.