There is no denying that Facebook (FB) stock is a global juggernaut, with more than two billion daily active users and $120 billion in annual sales. It is important to be familiar with the key facts and figures about the company and stock before you make a decision to buy shares in the social media giant.

It is a good idea that you review the company’s financial reports and investor presentations before making an investment in FB Stock. This will allow you to determine if the stock is suitable for you and your financial situation.

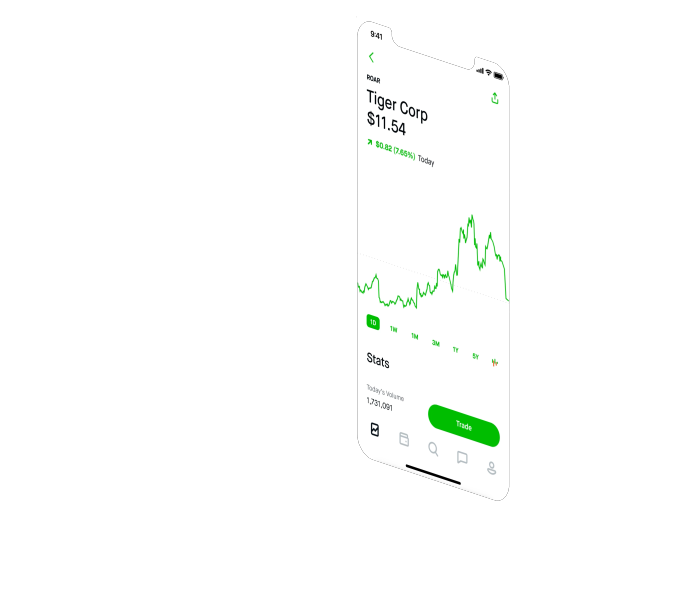

An online brokerage company can help you open an account to invest in FB stock. The best brokers offer a wide variety of services, fees and investment options to suit your needs.

In order to open an Account with a Broker, you will need to give some basic information. This includes your Name and Address. After your application is accepted, you'll receive confirmation emails with a password and a number.

You can view your investment portfolio, check your account status and access your investments. You can also access your holdings to make changes.

Before you start trading stocks, it's a good idea that you read up on various investing strategies. For example, you may wish to consider dollar-cost averaging by purchasing the same dollar amount of a stock over time. This will help you reduce your risk of volatility and save you money on the cost-per-share over time.

Consider your financial plan and other investments before purchasing a Facebook share. Depending on your financial situation, it may be in your best interest to avoid buying shares of this stock until you have saved enough money for retirement or an emergency fund.

It can be a good way to diversify your portfolio by investing in large companies, such as Facebook. However, it can also be risky. There are a number of factors that could impact the value of your investment, including government regulation, competition from newer social media platforms and data privacy scandals.

You should also consider the performance of FB stock in comparison to its benchmark indexes such as the Nasdaq 100 or S&P 500. This will help you identify if the stock is currently overvalued or undervalued.

When a stock is undervalued, you should buy it before it begins to rise in price. This strategy may help you get a higher return on your investment.

Another option is to buy a CFD contract for difference. These are derivative products that let you speculate on stock price movements without actually owning them.

Finally, if you're looking to improve your portfolio's return potential, you may consider investing in an ETF (stock exchange-traded funds). These funds pool many stocks into a single fund that is less risky and more efficient than individual stocks.

FAQ

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. There are many options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Are forex traders able to make a living?

Yes, forex traders can make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Frequently Asked Fragen

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investment is not without risk. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!