A prop trader refers to a person who trades on behalf or a company. Proprietary traders use leverage and various strategies to make a profit on the stock market. Because they have access to sophisticated data and software, they are often more successful than average investors. If you are considering a career in proprietary trading, you should know the advantages and disadvantages of this job. This will help you decide if it's right.

Proprietary trade requires that you have a trading plan and a track record. Prop trading requires that you are familiar with the risk management rules. You must follow certain guidelines such as your daily drawdown, trade restrictions per asset and profit targets.

Many companies will only hire trader that has demonstrated a high level of paper trading performance. The company will provide a simulator account that you can use in order to get more information about the trading platform. It is important to ask questions such as whether you will get paid on a regular basis or on a commission. You can choose between a fixed or profit-sharing salary. Some companies even offer higher share percentages.

Proprietary trade is a lucrative career for those who can work hard and will stay with the firm. In the early stages, there will be some difficulties. Keep in mind that you will be working with a lot of people, and the best way to develop your skills is to connect with other traders.

As you gain more experience, you might be able move to another department within the firm or to a hedge-fund or other company. Additionally, you have the option to search for investors that will fund you on your own.

Prop trading companies will offer mentorship and training opportunities for new traders. These firms will allow you to be exposed to different markets. A fee for the use of the trading platform, software, and desk fees may be required.

Proprietary trade offers more options than traditional stock and option trading. There are many types and rules to trading. To get started, it's important to study the various markets and then create a strategy. You'll eventually be an expert in every market. Once you have established yourself, leverage and other strategies can be used to increase your profits.

Although it is highly competitive, proprietary trading has its benefits. Proprietary traders have better trading software and more complex modeling programs than the average investor. Unlike stock or options traders, you can't just quit your job. Proprietary trading provides a steady and consistent income. Plus, it provides you with access to a large pool of funds, which means you have more potential for growth.

As you gain more experience, your fund will give you more money. Before you can trade, you need to apply for a fund. Depending on the fund, background information and trading experience will be required.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

How can I invest bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

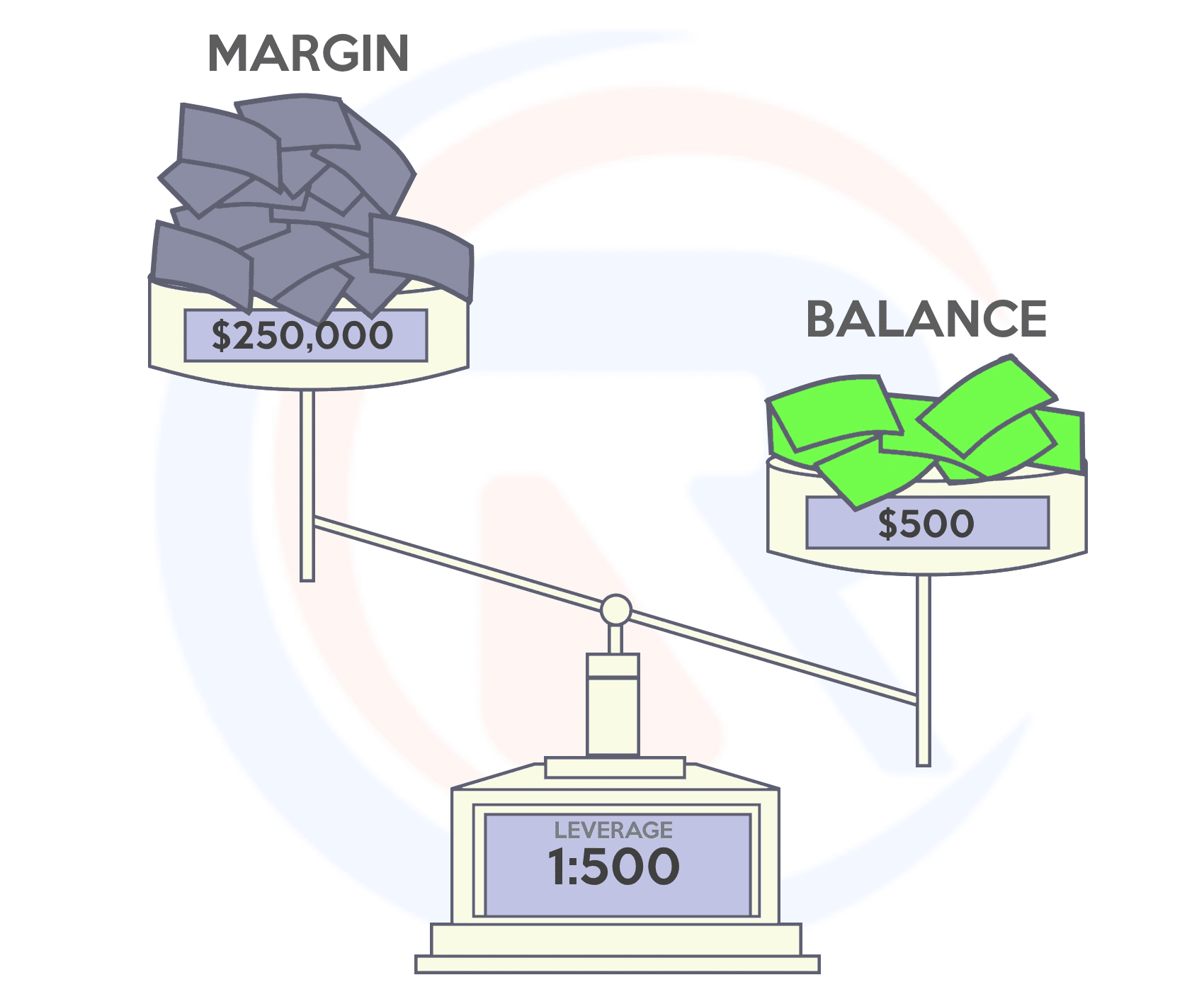

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Forex traders can make money

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

When investing online, security is crucial. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Finally, invest online using VPNs whenever possible. They are usually free and simple to set up.