The Chicago Board of Trade is where soybean futures can be traded. They offer a simple way to manage risk and provide positive returns. Many factors affect the decisions farmers make when it comes to planting, harvesting, and selling their crops. Depending on the region in which you live, local prices will often be correlated.

The futures market and the cash market for soybeans are closely linked. In December, soybean prices fell to their lowest point in 10 years. This decline harmed farmers who were cash market sellers of soybeans. A depressed market caused farmers to avoid selling.

CBOT claims that the cash and futures markets for soybeans can be affected by many economic factors. Individual traders have made purchases that have influenced market prices. The decline in soybean prices has been influenced by weather, shipping costs, and other factors. CBOT disagrees. They believe it is too hard to establish the extent of the injury, and that the damages cannot be recognized under antitrust laws.

The case involves plaintiffs who claim that the Chicago Board of Trade (CBOT), on July 11, 1989, declared an emergency resolution. This led to an anticompetitive strategy to lower the price of soybeans both in cash and futures markets. They allege that the individual defendants who participated in the scheme intended to benefit their clients in trading houses. These plaintiffs are a non-profit organization that represents the interests of farmers.

The causation issue was not addressed by the district court, aside from the allegations made in the complaint. It instead relied on McCready's interpretation by lower courts, which states that plaintiff's injury must be sufficient to cause an anticompetitive scheme.

The plaintiffs represent a group farmers that were unable to sell their soybeans after the price drop. Although they could not show that the decrease of price was due to the CBOT resolutions, the plaintiffs can provide proof of how the decrease in price was reflected on the soybean cash markets.

The private letter sent by the CFTC directly to Central Soya was another potential cause of the price decline. It forced Central Soya into compliance with an earlier regulatory exemption. Ferruzzi stated in the letter that Ferruzzi was threatening to orderly liquidate soybean futures. If Ferruzzi had refused, the CBOT would have required him to liquidate his large soybean futures position.

The suit was brought by the American Agricultural Movement against the Chicago Board of Trade, and other defendants. The American Agricultural Movement claims the CBOT's Emergency Resolution of July 11, 1989 enabled a conspiracy to lower soybean cash and futures prices. They claim that the defendants were tasked to create an artificially low soybean prices in order for the Platts South American Soybean agreement to continue being profitable for investors.

Although many factors aren't relevant to the current inquiry, they are all relevant for the possible effects the CBOT Resolution could have on the cash- and futures market for soybeans. Brazil's domestic market pricing has a significant global impact. Thus, the decision of the government to increase the exchange rate on soybeans exported in September may have an impact upon the cash and futures markets. The drought problems in Argentina are well-known, and they could also impact the cash and futures markets of soybeans.

FAQ

Where can i invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is best forex trading or crypto trading?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

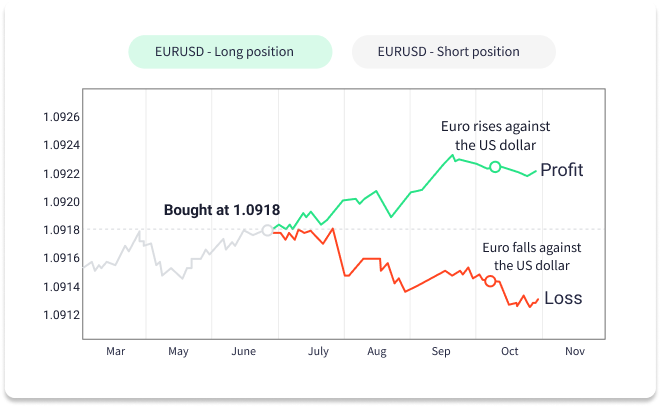

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is harder, forex or crypto.

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. It's vital that you protect your data, assets and information from unwelcome intrusion.

You must first ensure that the platform you're using has security. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. A policy should outline how personal information shared with them will be managed and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Third, you need to know the terms of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, you should be aware of tax implications for investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.