Commodities can be defined as commodities that are essential to daily life for individuals or companies. Commodities are generally affected by factors such supply and demande, exchange rates, inflation, health, and general economic health.

The best way to invest in commodities is to purchase commodity ETFs. These ETFs can also be bought like stocks. They provide diversification and low expense ratios with no margin trades. They can also act as a hedge against inflation which makes them an excellent investment choice.

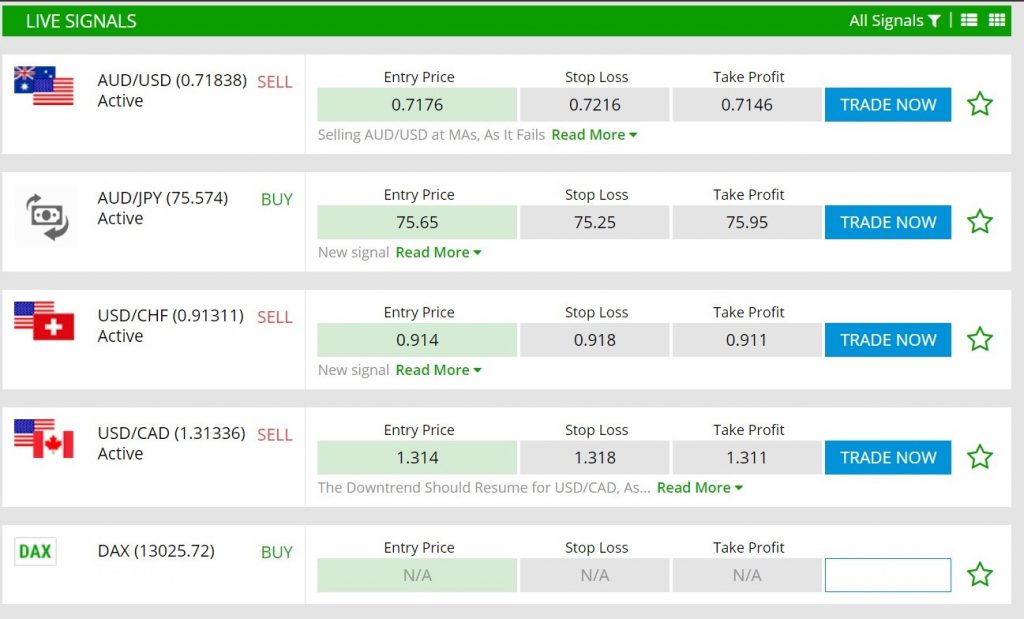

Choosing a good broker for commodities is important to success in the market. The right broker will ensure you are trading with a secure, reliable, and efficient platform. You will find a team professional traders and experienced traders to help you with any questions you may have.

A commodities broker list may include brokers who specialize in one particular commodity or industry. These brokers may also offer a variety of products, such as Forex, cryptocurrencies and shares.

You can find many of these commodity broker lists online. These lists can help you find the right commodity broker for your needs.

Skilling and CMC Markets are just a few of the best commodity brokers you can find online. These brokers are known for their reliability and ease of use, and they can be used by both beginners and experienced investors alike.

The best commodity brokers also have the reputation of being competitive in their fees and offering excellent customer support. These brokers offer both short-term trades and long-term options.

Investing in commodity stocks is a risky business, and you should always do your research before investing. It is a good idea to speak with an expert if you are uncertain about the type of investment that you should make.

Agriculture Stocks

The best commodities stocks are those that are related to agriculture and agribusiness. These stocks offer high dividend payouts and have a strong track record of increasing their dividends over time.

Archer-Daniels-Midland (NYSE:ADM) is an agribusiness that offers everything from animal nutrition to food processing and commodities trading. Its reliability and track record make it one of the best commodity stocks to invest in 2023.

Nutrien (NYSE.NTR) is an internationally-recognized fertilizer and potash producer. It has enjoyed some of the most impressive pricing and production in recent years. The company enjoys exceptional profitability, cash flow margins and profits during this boom cycle.

BHP Group (NYSE :BHP) is a mining company that specializes primarily in copper, iron ore, and coal. It is involved in several exploration and production projects around the globe. Over the last few decades, its profits have been steady.

Rio Tinto is an international multinational mineral company. It operates a number of high-quality projects and mines in Brazil and the United States.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Frequently Asked Fragen

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Keep in mind that fraudsters will try everything to get your personal details. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Secure online investment platforms are also essential. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.