A good trading platform is essential if you want to trade stocks and other assets. A reliable platform with useful tools and data that helps you make informed decisions about the portfolio is essential.

There are many trading platforms available on the market. Each platform has its own benefits and features. Some are meant for beginners, while others support advanced analysis and multiple asset types.

A trading platform that can be customized and has the right tools for you is the best. It should be easy-to-use and provide features that will enhance your trading experience.

A platform that works with all your trading devices should be able to import data from multiple brokers or platforms. This will allow you keep track and manage all your trades in one location. It should also support multiple asset class and be able manage the volume you need for your trading day.

Trademetria and TraderSync are two of most popular trading journals. Both of these platforms track a range of trading data including price, volume, and more. These platforms are customizable and offer easy-to-use charts, indicators, and other useful features.

Tickeron allows you to have a more personal and intuitive experience. This platform uses artificial Intelligence to automatically generate trade suggestions based upon price patterns. Its algorithms have a proven track record of successful trading.

TD Ameritrade has a Thinkorswim platform that makes it a top choice for active trader. Its mobile and desktop apps are easy to use, and include all the features necessary for stock and ETF trading. In addition, TD Ameritrade offers a paper money account to test your strategy risk-free.

This makes it an excellent choice for beginners investors because it doesn't charge any commissions. Its no-fee robo-advisor can help you manage your investments based on your profile and goals.

Robinhood is an online trading platform that offers a free service. You can trade stocks, ETFs and other financial instruments. It also has a variety of trading tools, company information, and other resources to help you get started.

Another top trading platform for new and experienced traders alike, TradeStation is a robust platform that offers advanced analytical tools. It includes trading strategy backtesting and customizable charting. Its learning center is a great resource for new traders, and the broker's educational resources can help set you on the path to success.

Although it is not as popular as some trading journals, TraderSync provides a reliable way for traders to monitor their trading activity and make real-time decisions. The service allows you to import your trades and analyze them in a single interface, and it's compatible with more than 70 different trading solutions.

It can be challenging to find the right trading journal that suits your trading strategy. You want to find one that works well for your needs and fits into your budget. This can be tricky, so it's best to look for a trial period before you decide to commit to any product. Check out the reviews from other traders to find out if they are satisfied with its functionality.

FAQ

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Frequently Asked Fragen

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

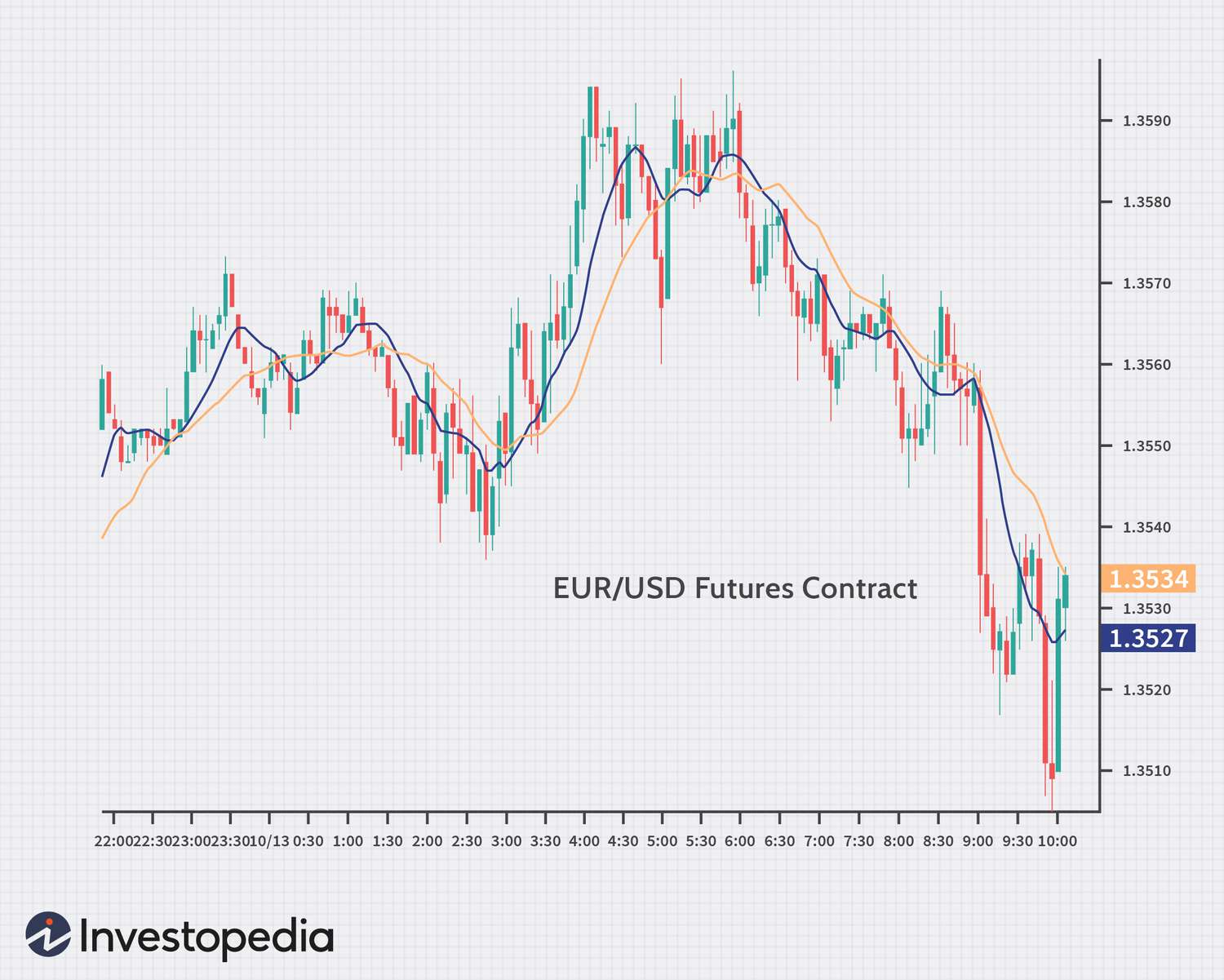

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

What are the pros and cons of investing online?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Security is essential when investing online. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Start by being mindful of who you're dealing with on any investment app or platform. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!