Futures could be a good choice if you are new to trading. But, you need to be aware that this type trading can be dangerous and will require significant capital investment upfront.

Learn how to trade futures

You can find many courses that will teach you how to get started with futures trades for beginners. These courses will cover the basics of futures as well as what it takes for a trader to succeed. You will also learn how to use a broker, and how to set your account up.

CME Group offers a free course called Learn To Trade Futures. It will teach you how to trade futures step-by-step. You can revisit this course as many times as you want, and it's a great way to get your feet wet in the world of futures trading.

Futures Trading

To be successful in futures trading, you need to develop a strategy that is based on your goals and objectives. This includes having a plan that you can use for every trade.

You should also consider setting a risk cap and size your trades accordingly. Because futures are a highly leveraged asset, it is best to keep your trades smaller.

This can reduce losses and help to ensure your trading account doesn't get negatively affected in the event you lose. It's also important that you know the amount of margin required by your broker.

Tick Increments Trading

A futures agreement is an agreement to purchase an asset or sell it at a particular price at a future date. There are many kinds of futures contract, with different expiration dates and standard features.

These features are designed for traders to reduce risk and improve their emotional control. Standardized features make it possible to trade in smaller quantities, which can prove useful for novice traders.

Use the Charting Tool

Understanding charts and how they work is crucial when you trade in futures. This will help you gain an advantage in trading and make you more successful in the market.

Additionally, you'll need to understand how to read futures charts to identify support and resistance levels. While these areas may be difficult to spot, it is essential that you understand them so you can make the right decisions and avoid losing.

The Market Auction Theory

This is a key element of trading the futures markets and can be a little confusing to newcomers. The futures charts have two types: bids (buyers), and offers (sellers).

Bids are those who are interested in purchasing a futures contract, while offers are those who are selling a futures contract. In general, the bids should have a higher price than the offers, but they do not always.

FAQ

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

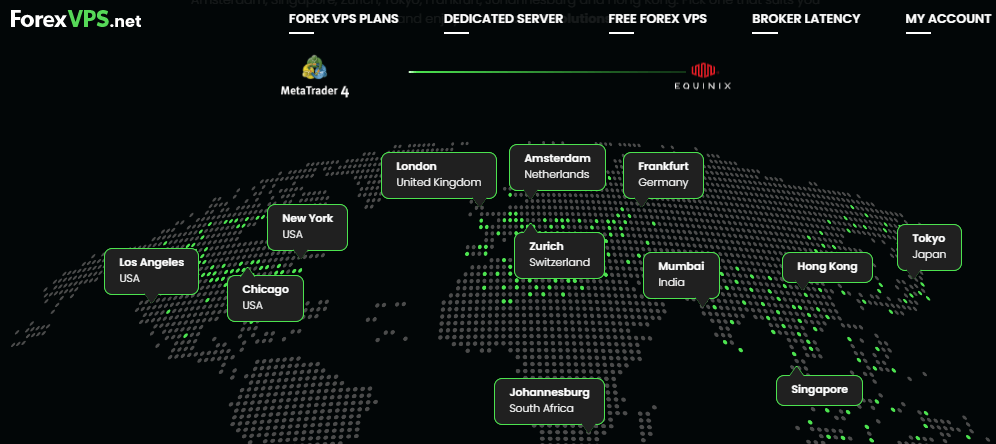

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which trading site for beginners is the best?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

You can also invest in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

What are the pros and cons of investing online?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Lastly, always remember "Scammers will try anything to get your personal information". You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

Secure online investment platforms are also essential. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.