OTC stock refers to a range of securities that aren't listed on major stock exchanges. These investments can be very risky. They can also offer huge potential gains.

OTC stocks can help diversify your portfolio. These can be a great option to purchase a share in a rapidly-growing company at an affordable price. But they have their limitations. Some companies are not regulated, making them prone to fraud and scams. Additionally, they can be more difficult to sell and buy because they are less liquid.

The popularity of penny stocks is due to the fact that they allow investors to buy large numbers of shares at relatively low prices. This is especially important for investors looking to make a quick profit. However, it could also cause big losses if the company goes under. You need to research penny stocks and understand the risks involved in order to avoid losing your money.

Companies trade on OTC because they avoid the high listing fees charged by larger exchanges. However, companies may not have the capital to meet the requirements of larger exchanges. Some companies may not have enough capital to meet the volume and float requirements of a larger exchange. OTC markets have lower entry barriers, which can attract firms that don't meet the strict requirements of mainstream exchanges.

There are several types of OTC stocks available, including penny stocks as well as mid-tier or mid-size companies and cryptocurrencies. Each OTC stock has its risks and advantages. For instance, a mid-tier stock is a great option for young, growing companies in the US. It is helpful to be familiar with the terms and classifications of OTC shares to make sure that you are investing in a trustworthy, long-term company.

There are other OTC stock options that are less well-known. One of these is the gray market. Although it is not considered an OTC stock market, it is a place where you can invest in smaller companies. A second option is the pink sheets, which are unique ways to sell stock. These are more risky than other OTC options, even though they aren't regulated.

Unlike traditional stocks, OTC stocks tend to have wider bid/ask spreads. The market's size and the availability of stocks to trade determine the spread of bid/ask. If there are fewer stocks for trading, it is easier to manipulate their prices. Stocks can be purchased at any price or you may need to wait for the stock to become available.

OTC markets are not as liquid and accessible as major exchanges but they can still be a viable option for investors. It is a good way to diversify and even make a profit.

FAQ

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

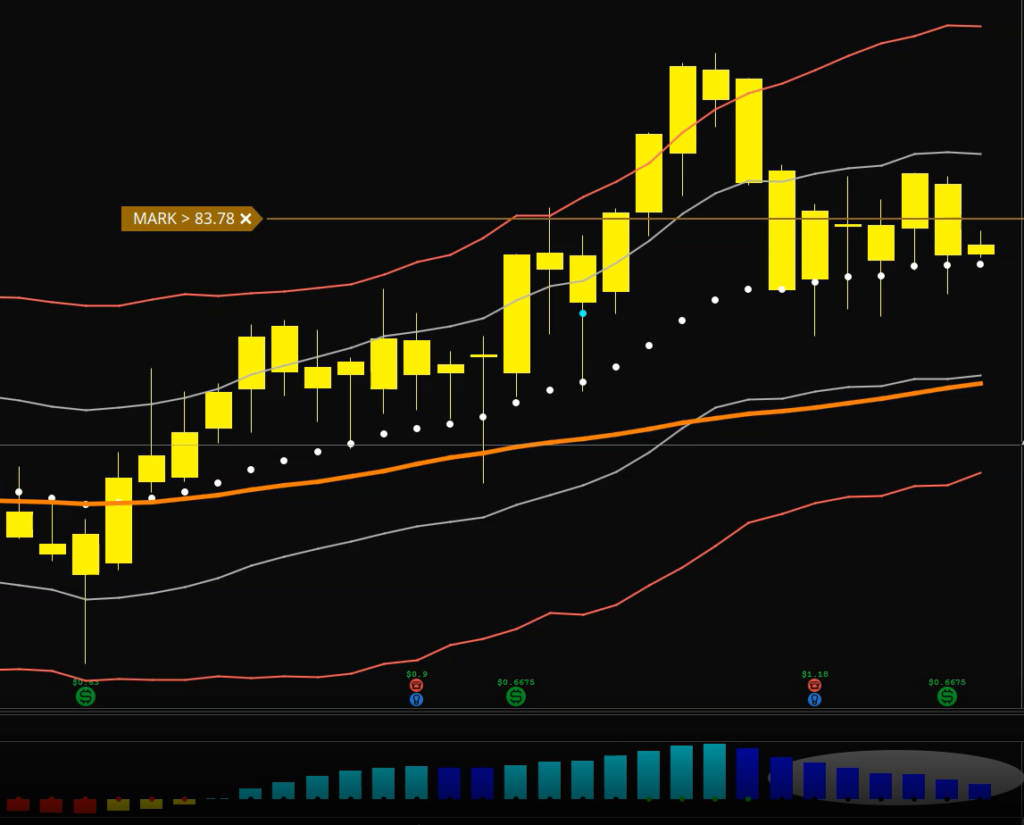

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Knowing how to spot price patterns can help you predict where the market will go. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

How can I invest bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which trading website is best for beginners

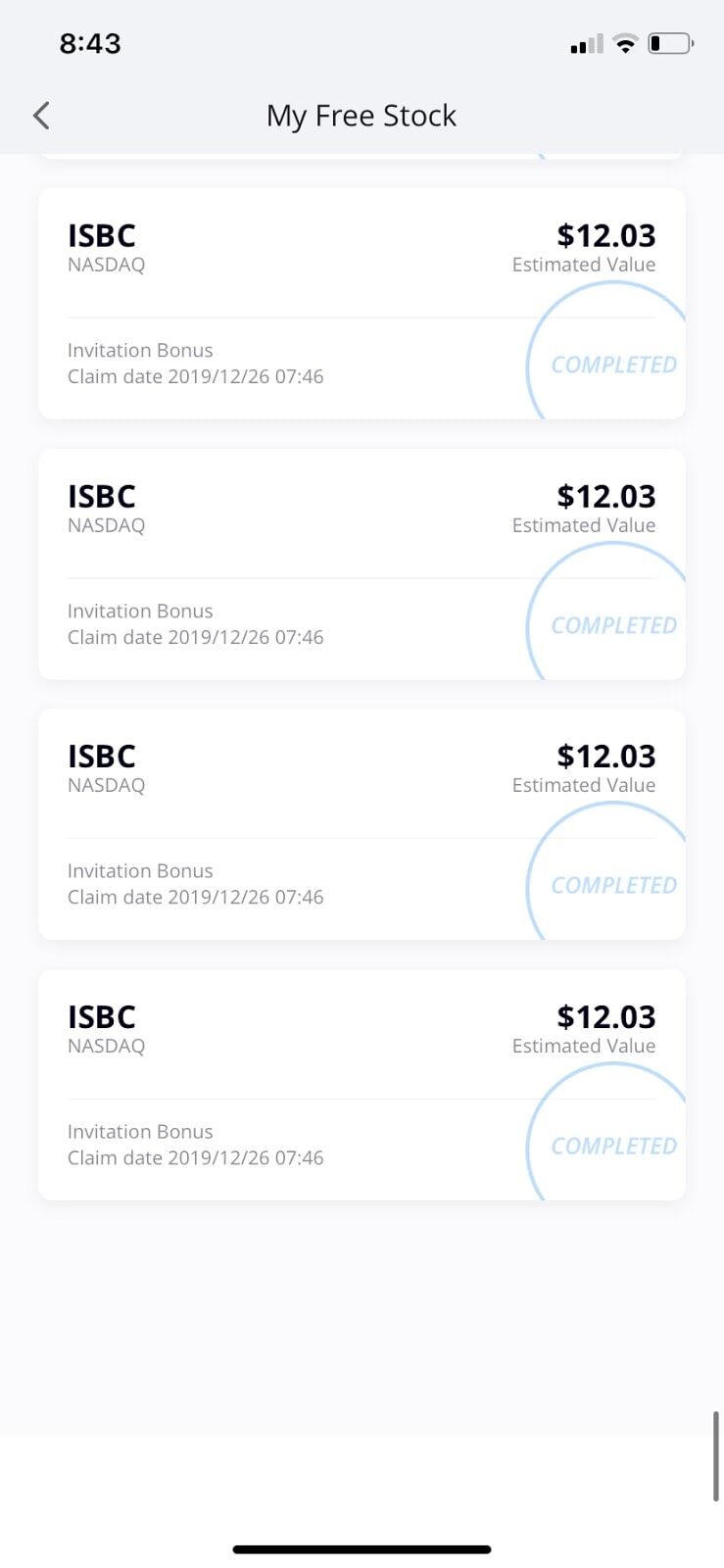

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Where can I invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many options.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Don't respond to unsolicited calls or emails. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, thoroughly research investment opportunities independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Keep in mind that fraudsters will try everything to get your personal details. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

You should also use safe online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.