DappRadar, a decentralized app aggregator and community, is called DappRadar. It provides users with insight and actionable market intelligence. It supports over 9,000 apps across 30 protocols. Among the features are the Portfolio Tracker and the NFT Value Estimator. Additionally, there are a number of token utilities.

DappRadar recently introduced the RADAR token. The DappRadar platform provides premium access via the RADAR token. It is based upon the Ethereum blockchain. RADAR aims rewards users for contributing to the ecosystem.

DappRadar's platform offers a range of services, including payment and governance. It is intended to become the go-to store for dapps. DappRadar was launched in April and has been visited by over 1,000,000 people.

The company wants to make the ecosystem of dapps more transparent. This will enable users to have a better experience and understand the ecosystem. DappRadar developed a contribute-to earn mechanism. Users are rewarded for writing reviews, contributing to conversations, curating content, or contributing to them. A smart contract manages claims and withdraws. This will allow users to access a wider range of portfolio tools and expand their coverage.

The NFT Collection Explorer is another feature that will be added to the site. This tool gives data on the most popular NFTs as well as their creators. It tracks the evolutions of collections. By combining the information, digital asset collectors can see what is going on in the dapp ecosystem in one place.

DappRadar uses an SSL certificate, which encrypts data when it passes from the user's browser over to the server. The DappRadar website also includes a community that monitors Twitter servers and Discord for any abusive or criminal actors.

DappRadar is also partnering with LayerZero. LayerZero allows cross-chain staking across EVM compatible networks. They have also introduced the proxy token, which minimizes the fees associated staking.

DappRadar will also be introducing a smart-contract that will enable it to broaden its reach and help it pursue quicker listings for emerging projects. The site will allow users to vote on projects and make recommendations. In the future, the company plans to introduce a token rewards scheme.

The RADAR token should be airdropped only to loyal, long-term users of DappRadar. Additionally, the token will be available to purchase through DappRadar’s wallet. There are a total of 10 billion tokens in the system, with a circulating supply of 576,191,039.

Considering the volatility of crypto, investing is a very personal matter. For example, some analysts predict that the DappRadar token will reach zero value in a year. However, these price predictions are often incorrect. You shouldn't invest money you don't have the means to lose. Always do your research.

Although DappRadar has experienced significant growth, experts now predict that it will slow down in the coming years. The Wallet Investor predicts that the DappRadar token's price will drop to $0.160 within the next year. Nevertheless, the DappRadar platform's current position shows that it has a bright future.

FAQ

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, gather any additional information to help you feel confident about your investment decision. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

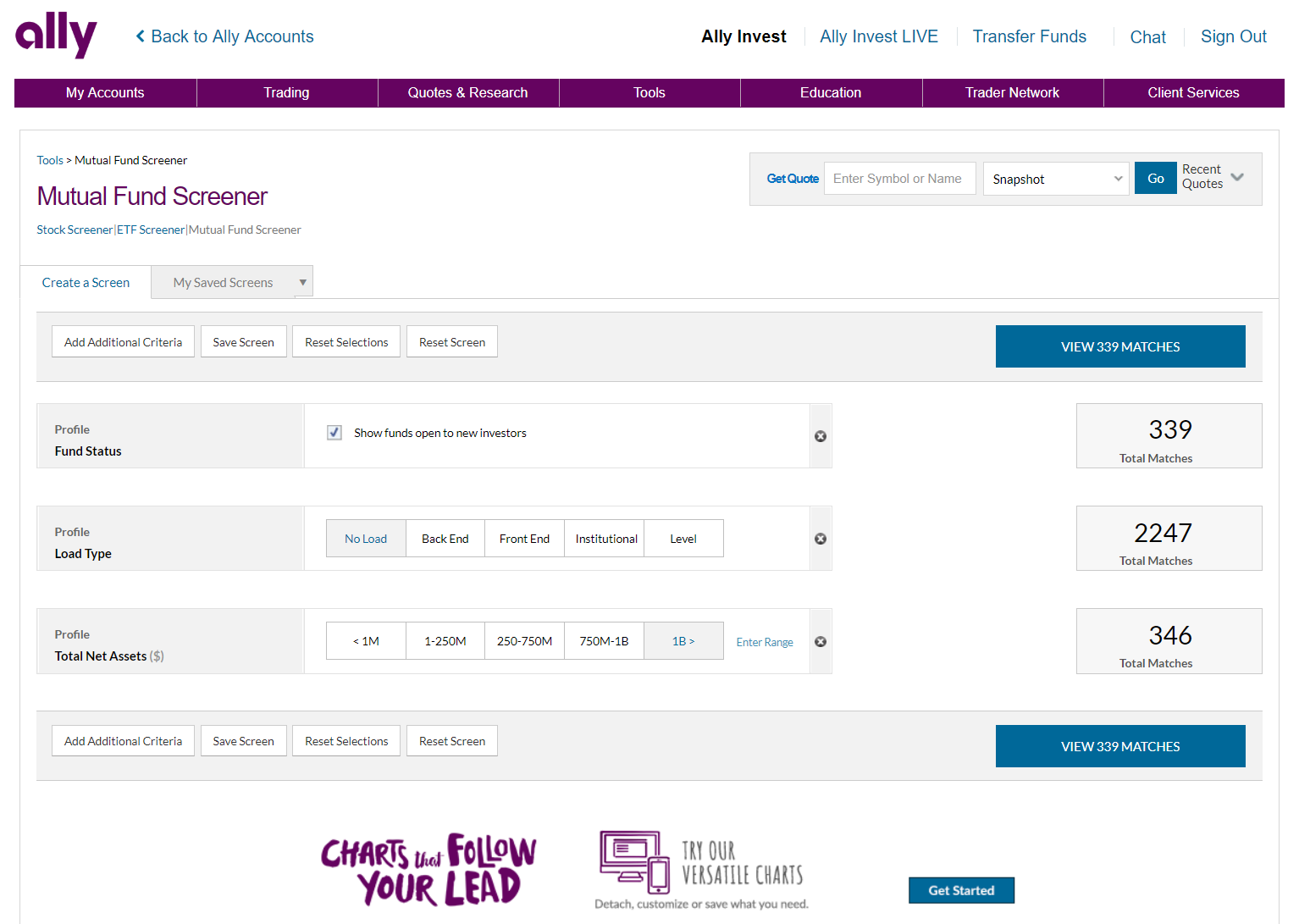

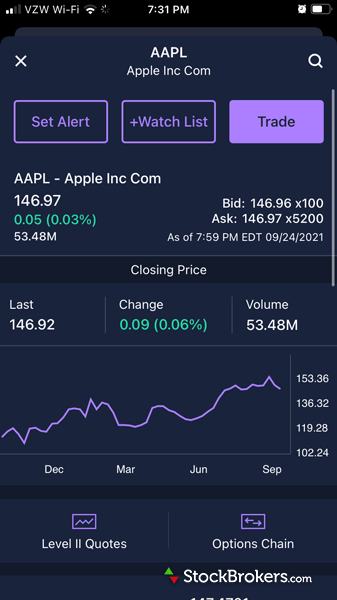

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts must be secure. Protecting your assets and data from unwanted intrusion is essential.

First, make sure that your platform is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will ensure your online investment account is protected against any possible threats.