Non-fungible tokens (NFTs) are an emerging digital asset market. These are digital artifacts made using distributed ledger technologies. A non-fungible token can only be worth what another person is willing to pay. Many have made millions trading NFTs. The industry is still new and volatile. Before you invest, it is important to be familiar with the basics of NFT trading.

First, a crypto wallet is necessary. To store your NFTs, you can use MetaMask, a popular wallet. This will allow for you to send or receive your tokens. This is a convenient way for you to store your tokens. However, there will be a conversion cost.

Once you have a cryptocurrency wallet, you will need to locate a trustworthy NFT marketplace. NFT marketplaces come in a variety of formats. Some are peer-to–peer exchanges while others function as auctions. Auctions work much like eBay listings, but the auction takes place for a set period of time. The auction goes to the highest bidder.

Another option is to sell NFTs and buy them back on a primary market. Because they offer the most competitive prices, primary markets are often the best places to purchase NFTs. It's helpful to have a research tool in case you aren't sure where to start. A research tool will allow you to assess the value of a specific NFT collection. They can also give you information about its latest news and updates.

The most popular NFT marketplace is OpenSea. This platform lists hundreds of NFTs. Many of them are based upon the Ethereum blockchain. Lucky Block NFT can be purchased on the primary marketplace for $1,500.

NFTTrader, another popular NFT exchange is also available. This site offers a wide selection of tokens, and is also compatible with MetaMask. You'll need to deposit a few ETH via MoonPay and a bank wire in order purchase or sell NFTs. You will then need to approve the transaction. You will also be charged a 1% charge for selling an NFT.

Binance is another NFT market. This service allows you to trade NFTs directly with other users. You can choose from a variety of NFTs and pay a 1% commission when purchasing an NFT. They also offer mystery packages, which are a great way to find rare NFTs.

NFT Launchpad, a brand new marketplace for NFTs, is now live. It can carry a variety NFTs that are sports-related. These tokens are extremely rare and competitively bid. This one is still relatively new in comparison to other platforms. However, it is expected that it will become a major player within the NFT marketplace.

A 32 ETH transaction for Bored Ape Yacht Club's collection was one notable NFT trade. Originally priced at less than $200, the collection sold for over $1 million per token when it was released several months later. Celebrities have paid up to seven figures for NFTs.

NFT trades that are notable include the Bubble Gum Witty Weasel Trade. This was a significant win for NFT creators. They resold the tokens to make a profit.

FAQ

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

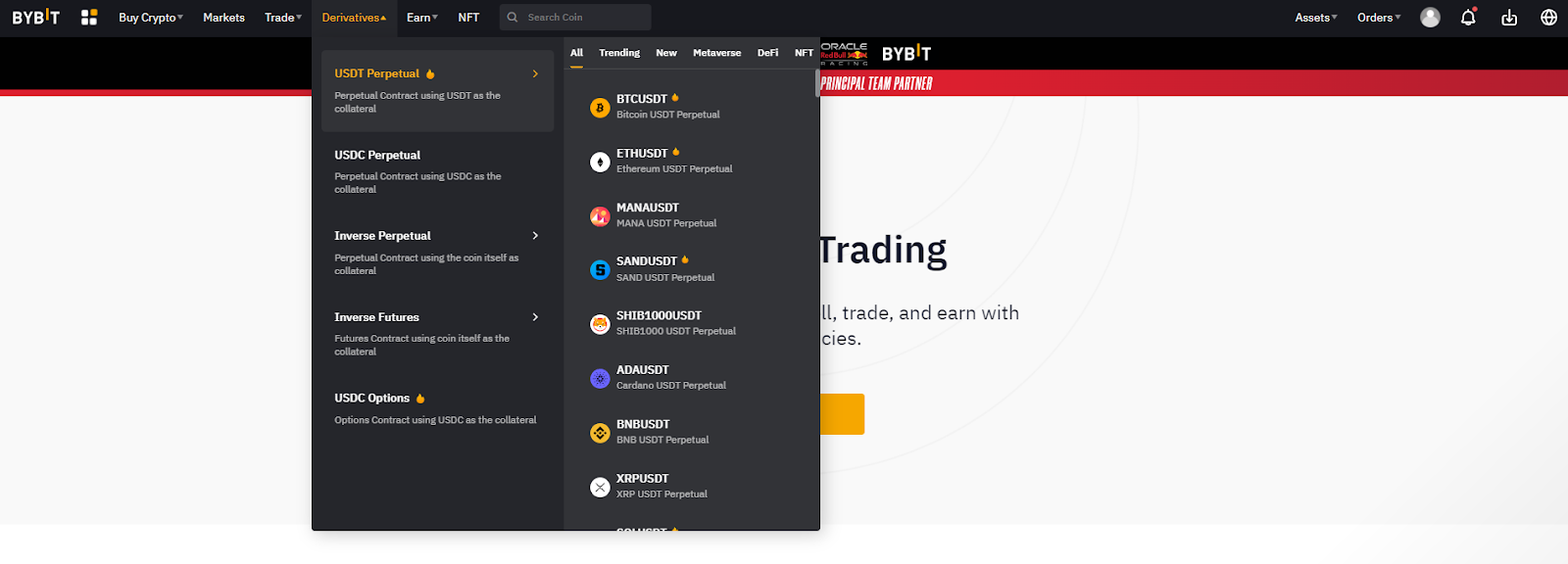

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

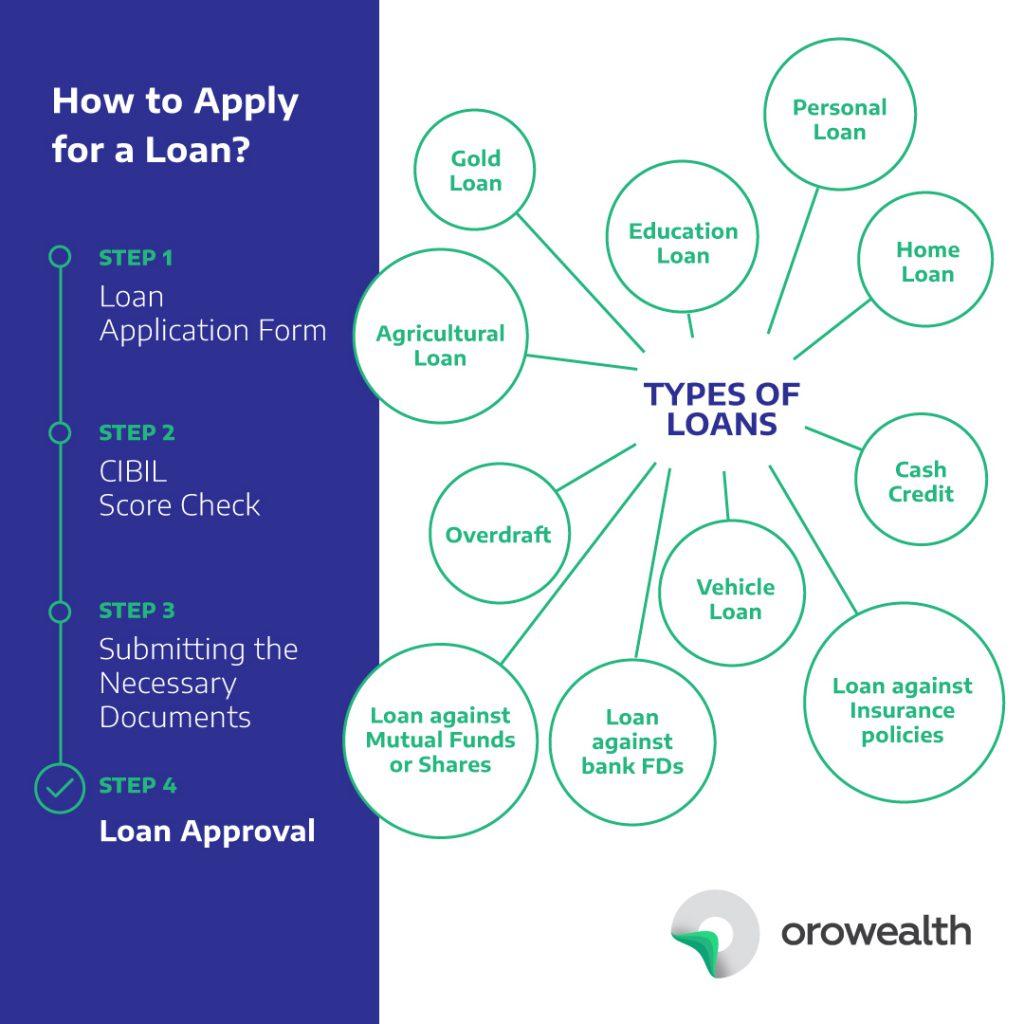

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There might be restrictions or a minimum deposit required for certain investments.

Are forex traders able to make a living?

Forex traders can make a lot of money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure your platform has the right security protocols to protect your data against theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Frequently Asked Questions

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Where can i invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.