The Chicago Mercantile Exchange (CME), located in Chicago, Illinois, is the largest options and futures contracts exchange in the world. CME markets a wide variety of benchmark products that cover all major asset types, including equity, foreign exchange, energy and agriculture commodities as well as metals. CME Globex Trading System, which is used by more than 90% to trade on the exchange, was established.

CME is an international market and a top derivatives clearinghouse. CME Group is the world's biggest derivatives marketplace. CME Clearing offers clearing and settlement services for swap-traded contracts. CME Globex Trading System is an electronic trading platform, used by most members.

Globex, an open-access trading market that is available 24/7, allows you to trade virtually anywhere in the world. Globex has a large selection of options products and traditional futures that are traded via open outcry.

CME Globex was developed in 1992 as the first global electronic trading system for futures and options. It was established to enhance trading efficiency, extend trading hours and complement the exchange’s open outcry systems.

Agricultural markets

CME Group operates the Chicago Board of Trade (CBOT) and Kansas City Board of Trade (KCBT) Designated Contract Markets, which offer futures on corn, soybeans, soft red wheat and other agricultural commodities. The CBOT and KCBT markets provide liquidity for farmers and traders in these commodities, and are designed to deliver the highest levels of transparency and integrity during important economic events.

CME extended its hours to 21 hrs a days on Sunday, 20 May, for a wide range grain and oilseed options and futures. Based on feedback from over 4,000 farmers, traders and commercial customers, this change was made.

These new hours give traders and investors more time to manage risk in the grain and oilseed markets, while enhancing liquidity and improving market performance. Liquidity improves market performance by allowing for more price discovery and movement, as well as reducing transaction costs.

USDA Reports & Trading Hours

During the next several weeks, trading in CME Group's futures markets will be influenced by the release of key agricultural reports from the United States Department of Agriculture. The initial reactions to these reports will impact prices and cause massive spikes of trading activity.

CME Group is continually changing its rules and regulations to govern its markets. This will mean that trading hours will keep evolving. These changes are often implemented in response or in compliance with regulatory requirements.

Globex Trading Hours

CME Globex's trading platform is used for almost all of the trading. This platform handles more than 90% of CME’s total volume. It is the biggest electronic trading platform in the globe. It's the only system that supports all exchange products, even its proprietary trading platform, CME SPAN.

FAQ

What is the best trading platform for you?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This information will help you narrow down your search and find the best trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Which trading site is best suited for beginners?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Frequently Asked Fragen

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

Statistics

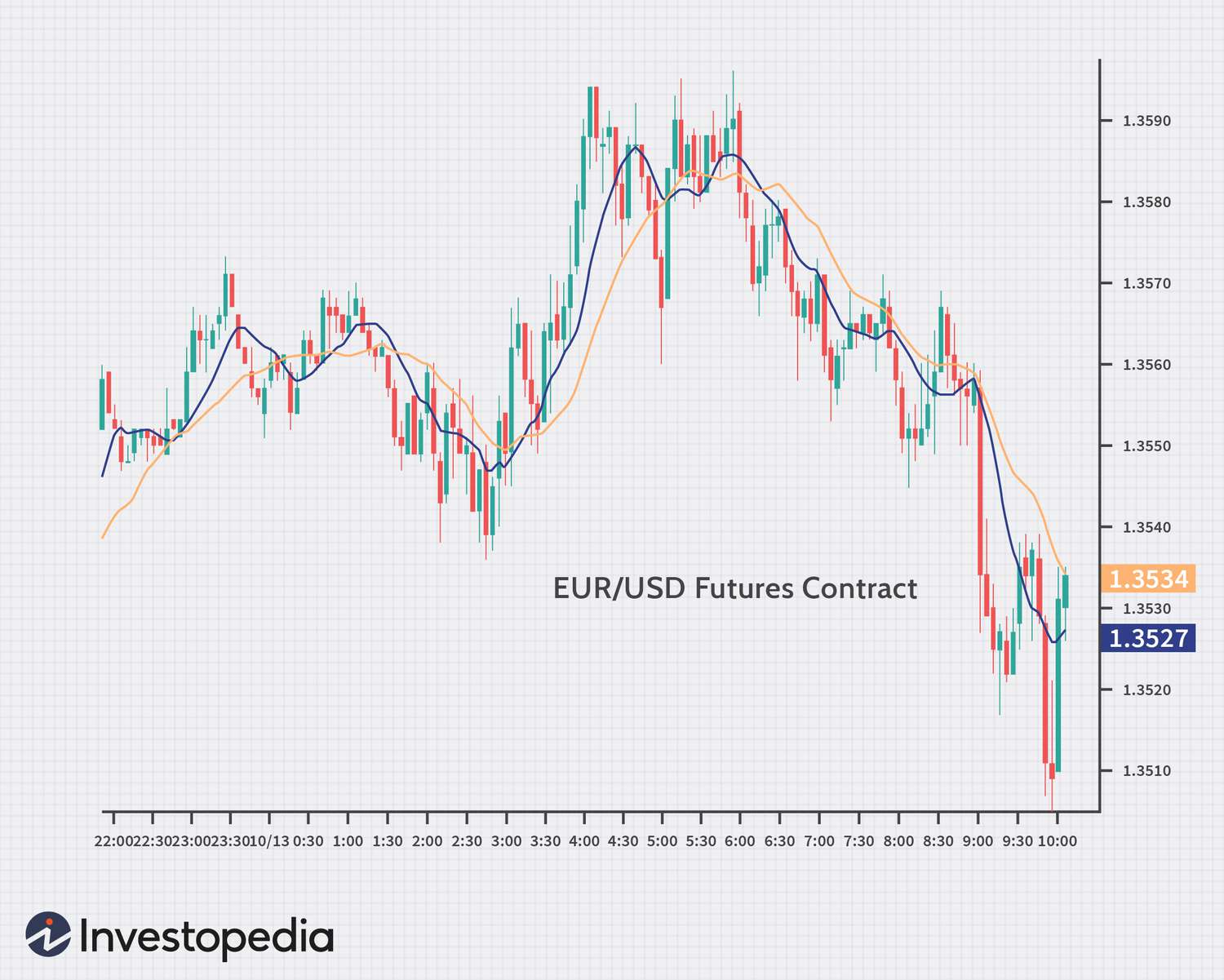

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When you invest online, it is crucial to do your homework. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.