Put is a financial instrument, similar to an insurer policy. It allows the buyer to have the option of selling an underlying asset at a fixed price, within a defined timeframe.

The strike price (or option strike) is the price at expiration of a put option. Option premium refers to the premium paid for a put option. The total amount of money a trader may lose from a call is equal to both the premium received, and the stock's price less that amount.

When to Use Put Options Strategies

A put option can be a financial instrument that allows an investor the ability to purchase an investment at a fixed strike price. However, the investor is limited in the potential loss. It is often purchased by investors who believe that the underlying security will lose its value. However, it can be resold if it has already fallen.

Buy a Put if you own stock that is vulnerable to price swings. It can limit your losses while also helping to protect your profits. This strategy comes with risks, so it's important that you understand them.

When to buy a place

The best time to buy put options is when the price of the underlying security will decline. The trader can retain the entire premium for the put option. To decide whether to buy a call option, the trader needs to consider the stock’s volatility as well the expiration date.

When to sell a stock

If the stock price has fallen too far and the trader is unable to pay for the stock with enough money, they can either sell the stock directly or buy a put. The trader is only responsible for the difference between the stock's price and the premium they paid. However, this can be offset if the underlying security's market value increases after the option expires.

Calculating the Married Put

A protective put, also known as a married put, is a bullish trading strategy. It works much like an insurance policy. This strategy is often used by traders or short-term investors who believe a stock will rise in price but need to be protected against sudden price swings.

Trader may hold two stock positions simultaneously in the same stock. They can have the actual stock or a put option, which gives them the ability to sell the stock for a predetermined price and within a defined time frame. The option can be exercised by the trader to sell the stock if it falls below the strike value of the option before the contract expires.

How to calculate a put’s maximum gain, loss, or breakeven point

Maximum gain is the difference in strike price and stock market value. If the stock's prices rise so much that it makes the put option worthless, then the maximum loss will be the premium plus any commissions. The breakeven price is the point at the stock's price rises so much that the premium exceeds the amount of your premium.

FAQ

Which trading platform is the best for beginners?

It all depends on how comfortable you are with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which trading platform is the best?

Choosing the best trading platform can be a daunting task for many traders. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

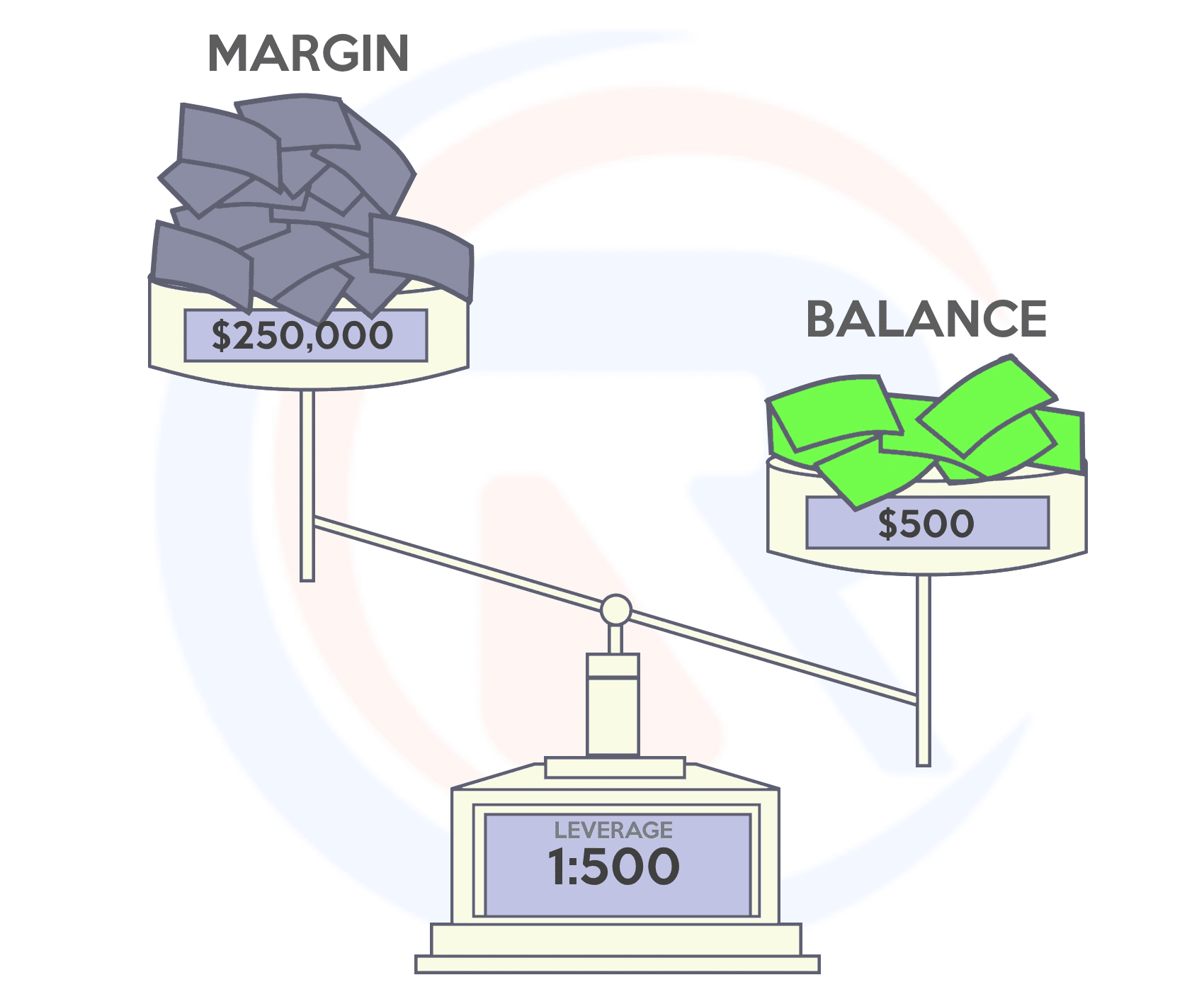

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

It is easy to lose your money, but it can also be difficult to decide where to keep it. A strong security system is essential for your valuable assets. There are several options.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?