Top Penny Cryptos to Invest in 2022

A popular way to make money on the cryptocurrency market is to invest in penny cryptos. These coins usually trade at $1 per token and can be considered conservative investments in comparison to larger-cap coins. Larger-cap coins can be more volatile. Some penny cryptos have great potential to double or even triple their value within the next few years.

Meta Masters Guild (MEMAG)

MEMAG is a cryptocurrency which allows investors to be part of the world's first mobile game ecosystem. It is backed in part by innovative technologies. The unique features of MEMAG are sure to appeal to many investors. The MEMAG presale has already raised over $1.5 million, and it is expected that this will continue to grow in the near future.

Tamadoge

TAMAdoge is another option for penny crypto enthusiasts that want to be part of a rapidly growing cryptocurrency project. The project is currently among the top 10 most popular meme coins according to volume. It has made tremendous gains since its presale. TAMAdoge, despite its recent downtrend looks poised for a breakout in near future with more developments and a continued focus to grow its network.

IBAT

IBAT Blockchain Project is currently developing a P2E sport game. This game is interconnected with metaverse and allows users to engage in different fantasy sports activities and compete against other people from around world. It also has a variety of utility-oriented features that will allow users to get the most from the IBAT platform. This makes it one the most promising penny cryptocurrency investments in 2023.

Battle Infinity

Battle Infinity is a fully-featured P2E gaming platform. It has attracted a lot of interest from investors and has a bright future. Its NFT-based P2E fantasy games, such as the IBAT Premier League are a key feature. They have already received considerable interest from both crypto enthusiasts to this game.

Love is a hateful thing about inu

This is a fun-filled, innovative project that has received tremendous hype since its initial pre-sale. In less than three days, Love Hate Inu raised more than $220k, and has the potential to explode in 2023 with its revolutionary platform that rewards users for their opinions on polls and events.

Chiliz

CHZ is another excellent choice for penny crypto investors. Chiliz offers fans a wide range of voting and fan engagement options, along with exclusive merchandise for members. A dynamic token burn strategy is used to reward team performance. It also offers club voting perks, early ticket sales, and other unique incentives.

eToro

eToro is an online trading platform that allows you to trade stocks, commodities, currencies, and indices on a commission-free basis. It also provides a range market, including cryptocurrency trading, and allows you to use a variety different tools. Buying or selling a crypto coin through eToro is a hassle-free process and offers a safe and secure way to make a profit.

FAQ

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

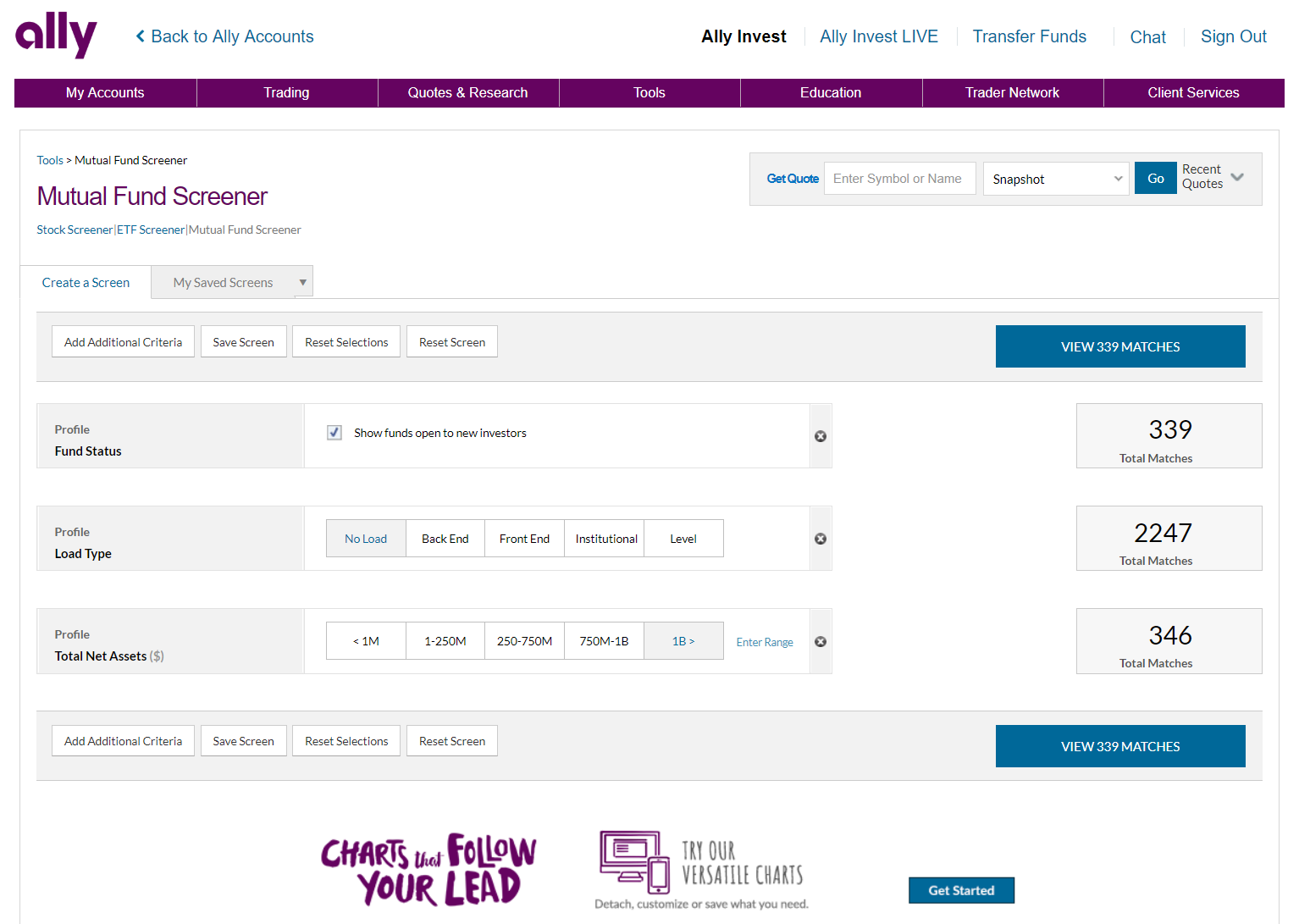

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment comes with its own risks. You should research all options before you decide on the right one. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

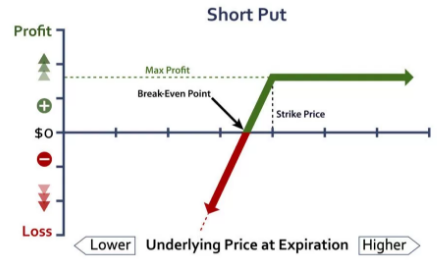

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection begins with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Unsolicited email or phone calls should not be answered. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Remember that scammers will do anything to obtain your personal information. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.