Stock brokers are financial companies that assist investors in buying and selling securities. They are regulated by the Financial Industry Regulatory Authority in the United States. They offer many services, including account management or guidance. There are also some stock brokerage accounts that offer full-featured online trading platforms.

The best stock brokers offer a variety of investment tools and resources that will help investors build and expand their portfolios. These services are free or inexpensive and can include investment research, financial advice or even a robotic advisor. You should not only consider the tools and services available, but also high-quality customer support.

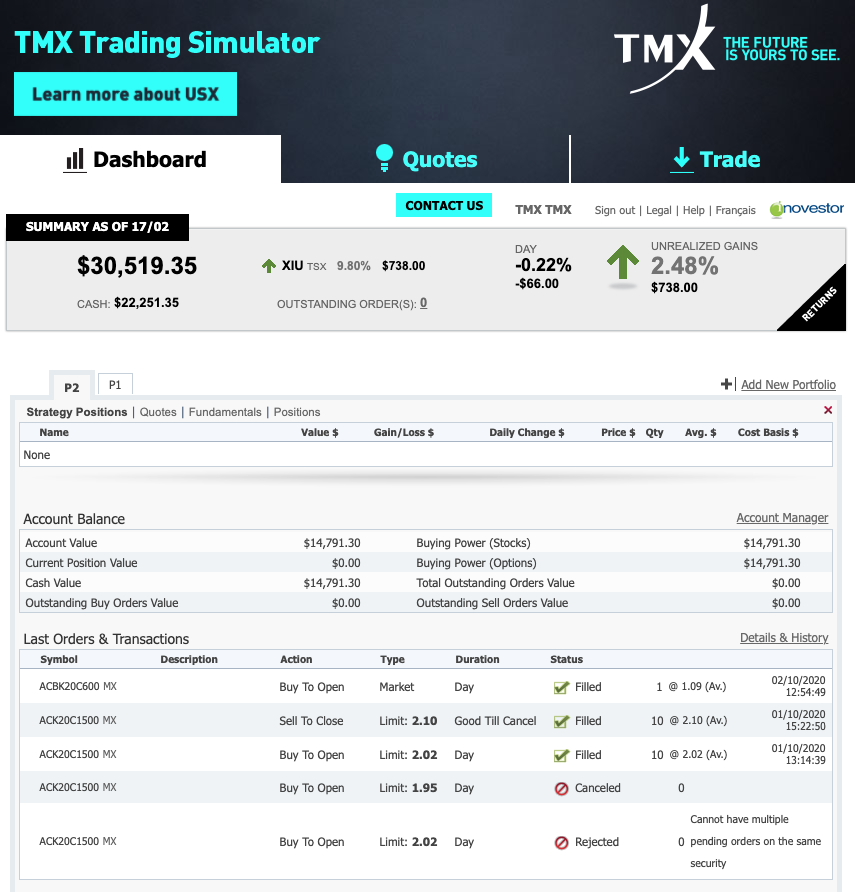

When choosing a broker, it is important to research thoroughly. You want to find a company that matches your investment style as well as has the features you require. A few companies offer a demo account that allows you to experience the platform before making a deposit. A demo account allows you to experiment with different products like mutual funds.

One of the biggest advantages of using an online stock broker is the access to a wide array of investment tools and resources. A good broker will offer easy-to-understand education material. This can be especially beneficial for newbies who are just starting out in the market. Many companies will also offer commission free trading for stocks or ETFs.

It can be challenging to invest. An ideal broker for beginning investors is one that requires a minimum investment and provides no-fee ETFs. There are many stock brokers that offer a variety of research providers. It is worthwhile to do your homework before you choose one.

An experienced trader may prefer to work with a brokerage that offers access to a large number of currencies and markets. This is particularly important if your goal is to trade in foreign currencies. Interactive Brokers offers clients the opportunity to trade in over 90 markets and 24 currencies.

You can find out how much it costs to open an account with an online broker by comparing the various fees. Opening a brokerage account is free for most online brokers. Some brokers, however, offer other financial services, like a credit line.

Many stock brokerages offer no-fee funds. This is a great way to get started investing. Many stockbrokers offer education and tools for investing with no fees.

Online stock brokers can be a great way to get started investing without opening an account. Many companies offer an extensive range of ETFs that are low-cost and branded. Another advantage to having a brokerage account, is the ability of transferring money to your bank accounts. Although the process is simple, it can take several days.

It is important that you understand the basics and principles of stock trading before investing. Even if you have experience in the stock market, it can be difficult to predict price fluctuations. An expert guide can reduce the chance of losing your money and can increase your chances of success when dealing with volatile markets.

FAQ

Which is safer, cryptography or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Can you make it big trading Forex or Cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts require security. It is vital to secure your assets and data against any unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, be sure to know about any tax implications that investing online can have.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.