Online investment companies offer a lot of advantages over the traditional method. They offer low fees and high convenience. Some even offer educational resources to help maximize your money. In addition, they have a wide variety of options, including ISAs, SIPPs, and international trading. Online investing has its downsides. Here are a few of the most common.

It is essential to choose the best online investment firm. You should be familiar with the different features offered and have an understanding of how the platform operates. There are many platforms that charge a fee but others that do not have any fees for basic accounts. You can start by looking at the websites of multiple providers. Check for promotions, bonuses, and other incentives. If you have a large account, you may qualify for a free trial or other incentives.

Online investment companies must not only provide the basics but also a great customer experience. TD Ameritrade provides traders with free trades, and a large toolkit. There are no minimums for opening an account and the commissions are low. However, if the goal is to buy shares in IPOs (or other high-risk investments), you might prefer to keep your account open at a traditional broker.

Personal Capital, an online investment company, makes it simple to manage your money. Their dashboard serves as a central hub that allows you to track your portfolio performance, create a budget, and discover ways to save more. It also provides financial education and free tools to help you stay on track.

Intelligent Portfolios by Schwab is a comprehensive service. It includes both the risk assessment and the automatic rebalancing. There is a small fee for balances above $100,000. The service is well worth the effort.

Motif is another comprehensive service. This platform is unique among online investing companies because it offers an affordable and low-risk option. The platform's automated investment process makes it easy for investors to get in on the market. It can be daunting to invest for the first time. This feature gives investors a fair chance of winning shares in a startup.

FutureAdvisor, another option for investing online, is also available. This site focuses on retirement savings and is available to clients with an existing online account. The best thing about this site is their automated investment process. However, they also provide action plans that are generated by advisors. Depending on which plan you select, you can monitor your advisors trade, review their advice, and gain a better understanding about your portfolio.

Betterment offers another free service. There are two types of no-fee services offered by Betterment: Basic and premium. Premium includes all the benefits of Basic as well as a variety of consulting services and in-depth whitepapers. However, the Basic plan doesn't have a minimum investment requirement.

Wealthfront is another online investing company that deserves a look. It offers a user-friendly interface that is great for starting. You can choose from a range of ETFs, and create an ESG portfolio using them. You can also take advantage of the extensive information available on the blog.

FAQ

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. You can manage your investments online, from anywhere you have an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing has its limitations. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

Real estate is another option. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

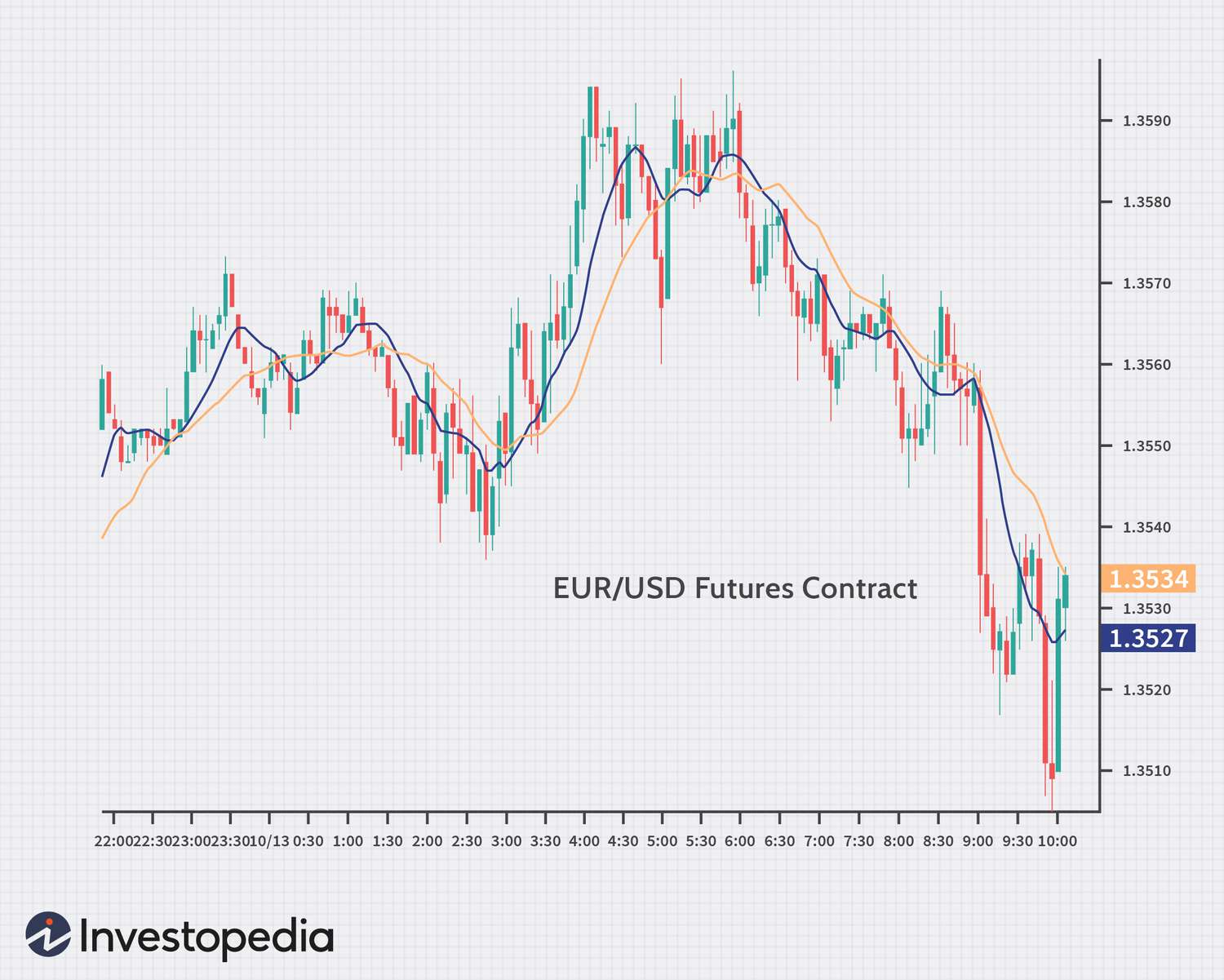

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts should be safe. It's essential to protect your data and assets from any unwanted intrusion.

You want to ensure that the platform you use is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, make sure you do thorough research about the company before investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, be sure to know about any tax implications that investing online can have.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.