The rise in popularity of non-fungible tokens (NFTs) has had a major impact on the digital art and technology world. They are a type of crypto coin that is used to purchase digital assets, such as digital artwork and gaming items. However, unlike fungible tokens, NFTs are not interchangeable and have their own unique identifier. This ensures that digital items can be traded and collected. The original artwork is also protected by this method.

The NFT has changed the way we use blockchain technology. Artists can now monetize their work through a curated platform. These platforms allow only authorized artists to mint and sell digital art tokens. Many artists are jumping on the NFT bandwagon. Some are questioning its security.

NFTs not only allow artists to monetize the work of their art, but also create a sense if scarcity in today's digital world. Scarcity increases the asset's value. One copy of an original work of art is more valuable than many copies. You can also increase the cost of the NFT if you have limited editions.

NFTs have been around for a while, but their adoption in the art and gaming markets is skyrocketing. There are many NFT trading platforms online. SuperRare, Rarible and OpenSea are some of the most sought-after NFT marketplaces.

While some people may be skeptical about NFTs being legal, many artists are optimistic. They believe that technology will ultimately transform the industry. Moreover, the NFT could help usher in a new era for art.

NFTs are also able to provide transparency to collectors. Collectors are able to purchase a piece of art and verify its authenticity on the blockchain. That means that the artist will get paid after every sale.

Digital art is a long-standing trend, but it is often undervalued. Artists are tired of the low return on their labor. NFTs could provide them with a new avenue to take advantage of their growth.

MusicArt is another unique NFT platform. Music industry executives founded the company. They wanted to create a space where musicians could sell their music and exchange digital arts. MusicArt will be available online and accept various cryptocurrencies. It will also pay royalties for resales.

NFTs allow each digital item to have a unique identifier, unlike fungible coins, which can be traded and copied. Additionally, artwork must be approved by an independent process.

You should visit a reputable platform to buy or sell digital art. Many artists are moving to NFTs in an attempt to find an audience willing to invest in their unique work. It is necessary to have your own cryptocurrency wallet.

MetaMask is one of the best. You can use this Chrome extension to buy and hold cryptocurrencies from your computer or smartphone. You can also buy or hold BUSD which is the currency on Binance.

FAQ

Where can I invest and earn daily?

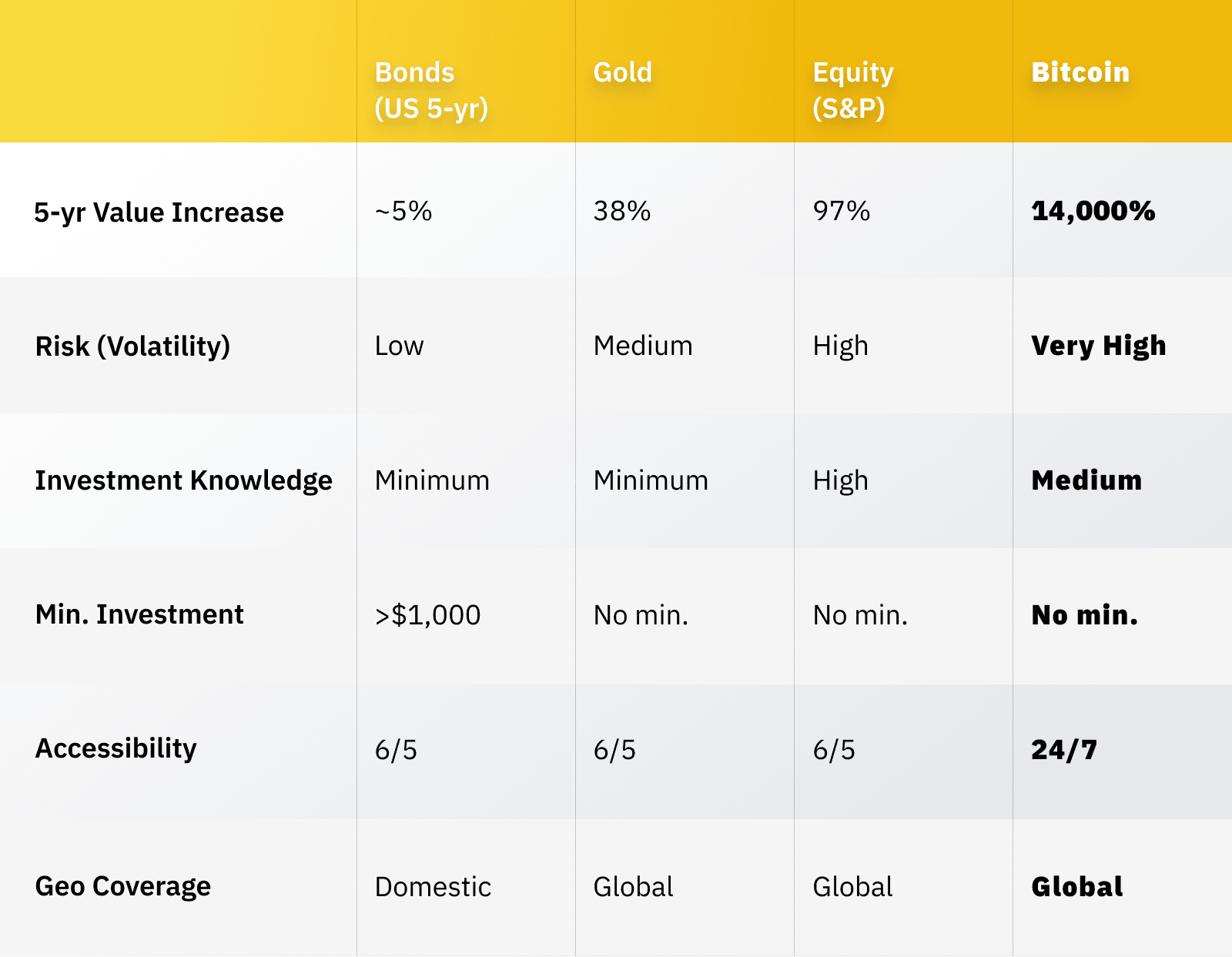

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which trading site is best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How do forex traders make their money?

Forex traders can make a lot of money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investment is not without risk. Online investments are a risky way to protect your financial and personal information.

Begin by paying attention to who you are dealing on investment platforms and apps. Reputable companies have good customer ratings and reviews. Before you transfer funds to them or give out personal information, do your research.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. To ensure your account security, disable auto-login on all devices. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!