Robinhood Crypto, a cryptocurrency exchange, is available in 46 of the 50 US States. It's not available for New Hampshire or Hawaii. This means that you will need to use another platform to purchase crypto if you are located in these states.

There are many different crypto brokers. Robinhood and Coinbase are two of the many crypto brokers you can use to purchase cryptocurrency. Some of these exchanges also offer additional features such as wallets and automated trading. Before you sign up for a service, consider what your needs are.

For a start, there are some big differences between the various crypto exchanges. You should also consider security and customer service, in addition to fees. Particularly, think about whether you want to be responsible in storing your crypto in a way which could cause total loss in the event that it is lost or stolen.

Robinhood is one the first brokerages to offer no-commission trading. While there are many other platforms that offer similar services, Robinhood's user-friendly interface and mobile app have made it particularly popular among younger investors. You may want to learn more about investing before making your investment.

Coinbase provides an easy-to use interface that allows you transfer crypto into the exchange’s digital wallet. The service requires you to verify your identity as with Robinhood. Additionally, you will need to create a separate crypto-wallet in order to store your coins. To do this, you'll need 12 words of recovery code to put your private keys.

Coinbase is not like Robinhood and does not charge commissions for its services. However, you will pay a slightly higher rate than the market rate. This is largely dependent on the currency that you use.

No matter what platform or platform you choose crypto is not a secure investment. Because of this, you should only consider buying cryptocurrencies if you have a risk tolerance and understand the risks involved.

Another thing to remember is that some of the better crypto platforms do not accept bank accounts, so you might need to get creative in order to move your crypto. While using a credit cards will make it easier, you should still review the policy of your credit union to see if funds can transfer.

Robinhood's Canadian and US crypto services are now available. There are seven supported cryptos at the moment, including Ether. Dogecoin. Bitcoin Cash. There are also two additional tokens you should consider: Bitcoin SV (BSV), and Ether Classic(ETC).

Compared to traditional exchanges, Robinhood's Crypto is a well-capitalized service that offers a seamless experience for buying crypto. The business model is also well thought-out. The quality of your customer service speaks volumes about a company.

Although it's not available in all states, Robinhood's crypto service is a good choice for many people. They have a broad range of assets available, and their mobile apps can be used easily.

FAQ

What are the advantages and drawbacks to online investing?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Trading forex or Cryptocurrencies can make you rich.

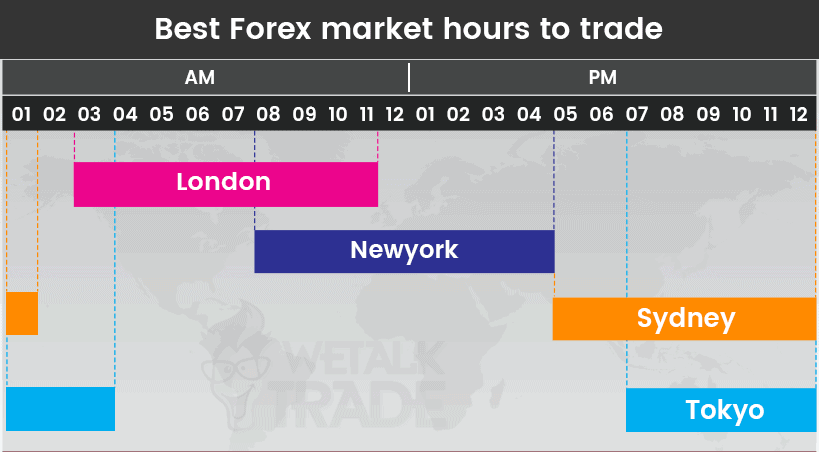

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

How do I invest in Bitcoin

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

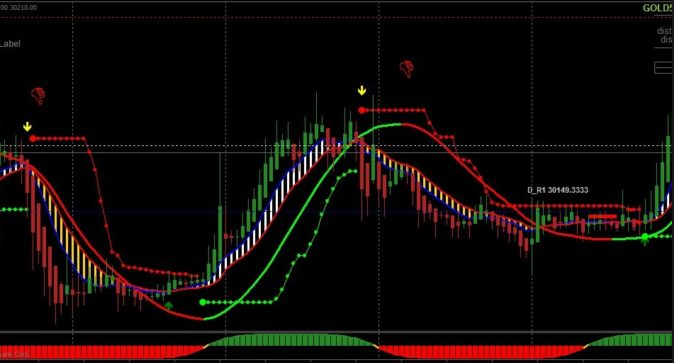

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts should be safe. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, make sure that your platform is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, make sure you understand your investment platform's terms and conditions. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, be sure to know about any tax implications that investing online can have.

Follow these steps to ensure your online account is protected from potential threats.