The hours of commodity trading vary depending upon the exchange or financial instrument traded. While a variety of commodities, including crude oil, gold, silver, and wheat, are available for trading on a 24-hour basis, other items such as commodities index contracts and ETFs are closed on weekends. You can also change trading hours based on daylight saving time.

Many commodities can be traded on futures markets. While demand and supply will influence the prices of particular commodities, there are other factors that can affect the price. Supply and demand can be influenced by geopolitical and economic factors such as oil supply. Organization of Petroleum Exporting Countries controls the price of oil. Saudi Arabia is their leading decision maker. OPEC has the option to agree to lower production, which can affect oil prices.

Commodities can be traded through options, stocks and futures. Investing is a great way to minimize risk and can yield positive returns. It is important to remember that commodity investments are volatile and can pose high risks for novice investors. It is also important to use a risk management system, such as stop loss orders. You can access a list containing all the commodities available for trading via the Internet at Trader's Resource Center.

Commodities are usually traded from 10:00 AM to 5:00 PM, although in the winter months, the session can be extended to 11:00 PM. Some days, the morning session will be closed due to national or regional holidays. The evening session is typically also closed. These hours can bring more volatility to the price of a particular product.

The pre-opening session is at 9:00 a.m., and the open outcry will remain at 9:30 a.m. Until the evening session is closed at 11:55 p.m. During the afternoon, you may find some trading in energy-related commodities such as crude oil.

After-hours trading is often less active than regular trading sessions. However, you can also find greater liquidity and strategic trading opportunities during after-hours trading. You should be aware that after-hours trading may have wider spreads than normal and offer limited liquidity. These conditions can make placing an order and having your money transferred more difficult.

CME Group's trading hours expanded in recent times, but many other exchanges announced plans to follow suit. For example, the Kansas City Board of Trade is planning to extend its trading hours to the same time as IntercontinentalExchange Inc., and the Minneapolis Grain Exchange is planning to do the same.

The timing of the stock exchange is another important factor in the timing and timing of commodity trading hours. The stock exchange opens around the same time every day. Prices can change quickly if there's a lot of activity before the bell rings. This is why it is important that you are able to recognize support and resistance levels. Also, be aware of macroeconomic sentiments as well as publicly released output figures.

FAQ

What are the advantages and disadvantages of online investing?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

Which is harder crypto or forex?

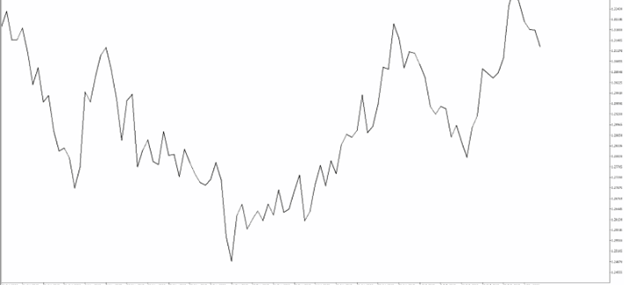

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Do forex traders make money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which trading site is best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Frequently Asked Question

What are the 4 types?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investing is a risky venture. Online investments pose risks to your financial and personal data. Take steps to reduce them.

It's important to be aware of who you are dealing directly with on any investment platform or app. Be sure to choose a reputable company with good ratings and customer reviews. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!