A futures market is where you can trade contracts to determine the future price of an asset like oil, orange juice, coffee, and other commodities. Both investors and speculators use them to speculate on the price of the underlying asset. The market for these contract is extremely liquid and active. They are often used for hedging or as a way to diversify a portfolio.

You need to be familiar with the basics of trading. It is possible to find a broker who offers educational resources and tools. Another option is to seek out a website that allows you practice trading using "paper money", before you actually invest in the market.

Fidelity provides many educational tools that can help you understand futures trading basics. You will find a mutual funds evaluator as well as a strategy matching tool. You can also use a hypothetical trading platform to help you evaluate an idea. A strategy evaluator can help you decide which strategy is best for you.

Etrade provides a wide variety of futures options to diversify portfolio. This includes many different currencies and commodity, as well large numbers of equities as digital assets. The etrade app makes it easy to trade futures on the go!

You can trade futures both long and short, so you can profit from changes in price in your favourite assets. By short-selling a stock for example, you are betting that its price will fall. This can help reduce your risk exposure and protect you against volatility.

These exchanges can be regulated and monitored, which ensures that all participants trade fairly and that the market functions in an honest and fair manner. Many exchanges also have clearinghouses that guarantee futures contracts will be honored.

There are many global exchanges. However, all are run by specialists in the field. The exchange requires that these companies meet certain criteria. They must also have strong financial records and comply with regulatory requirements.

Futures exchanges offer standardised trading, pricing information, clearing services and other important features. They also provide incentives to their participants. These rewards are usually based upon the volume of trades or the dollar value.

Futures trading is not for everyone. But it can help you gain access to many different products. Futures trading also offers numerous benefits. You can leverage your investments, and you can control a substantial contract amount with little capital outlay. But it is also a volatile market so you need to be mindful of the risks.

FAQ

Frequently Asked Questions

What are the 4 types of investing?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which trading site for beginners is the best?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

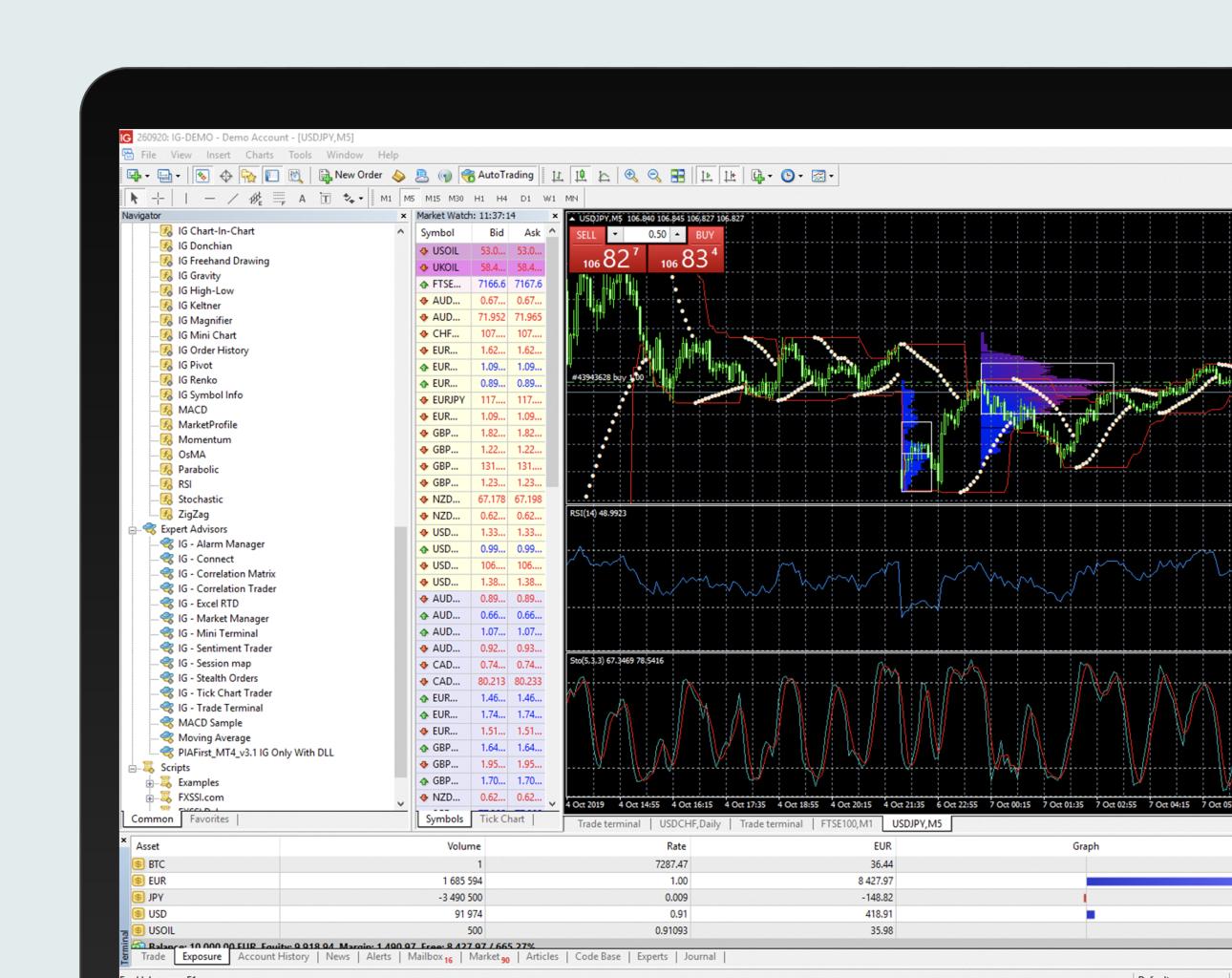

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There might be restrictions or a minimum deposit required for certain investments.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investment is not without risk. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Be mindful of whom you are dealing with when using any investment app. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Never click on any links in email from unknown senders. Don't download attachments unless it is clear to you. Always double-check a website security certificate before entering personal information into a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. You should also use different passwords to protect each account from being compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!