The CME soybean futures contract is one of the major trading instruments in the agricultural markets. This contract allows farmers to hedge their price risk by buying and selling the soybeans they grow. Soybeans may be traded in Argentina or the United States.

A farmer can purchase and sell futures contracts to have control over a significant portion of his crop while spending very little money. This is because futures contracts are highly leveraged. The margin of a farmer is usually 10 percent lower than the initial price of soybeans. He may also choose to hold back a portion of his contract, and sell it when the harvest arrives.

While soybeans are the primary focus of the market's trading, traders also trade other commodities. Wheat and corn futures can be traded on the Minneapolis Grain Exchange. Soybeans can be traded on CME Group. Brazil and China are other important exporters of soybeans, in addition to the USDA. Price fluctuations due to trade tensions between the two countries are a known fact.

A farmer must consider these factors when purchasing a CME soybean futures contracts. Soybean plants reach maturity in between 100-150 days depending on their growing season. After that, a farmer can choose to sell his soybeans on the cash market. On the other hand, he can buy back his CME soybean futures contract once the harvest is harvested.

The primary factors that influence a farmer's decision to purchase or sell soybeans on a CME soybean futures contract are the harvest time, the size of the soybean crop and the price. A soybean farmer who plans to grow 2022 crops will retain his bushels up to the beginning of the next year. He will purchase his soybeans back at October's end if he doesn't sell them by harvest.

CME soybean prices are driven primarily by the U.S. drought, as well as a poor South American soybean crop. A farmer's risk exposure is increased when there are increased imports. However, soybean meal demand is on the rise compared to last year. These factors and the high crush price of soybeans encourage companies to increase their production.

A maintenance margin is an important aspect of CME soybean futures. The contract allows for a 1,000-bushel margin. Depending on how many bushels the farmer wishes to hold, margin deposits may range from three to twelve per cent of the contract value. If the farmer decides that he wants to sell his soybeans he will have to pay a maintenance margin of 10 percent on the remainder of the contract.

CME soybean contract can be an option for farmers that don't have much time to invest on soybean crops. The market is available to offset the risk that he will overpay for his soybeans.

FAQ

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

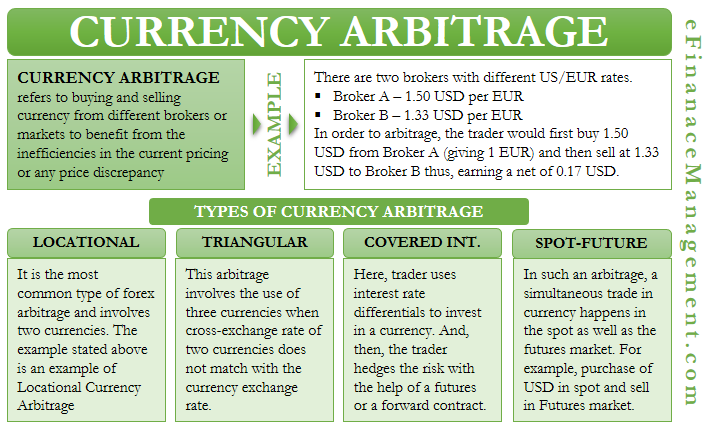

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. With online investing, you can manage your investments from anywhere in the world with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Do forex traders make money?

Forex traders can make good money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Frequently Asked Question

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.