OspreyFX was a new company that entered the financial industry. It offers a wide variety of services to professionals and traders alike. The company's administration promises total protection for customer's funds. They are currently applying to get a license. This company has its limitations.

First, OspreyFX is not regulated. This means that OspreyFX does not have any regulations or rules to enforce and there is no international regulator to verify its performance. This means that there are certain risk factors that can affect your trading experience. Deposit security and inactivity fees are not included.

A lack of educational materials is another worry. OspreyFX does not offer videos or webinars on its website. Instead, customers can contact support via email and live chat.

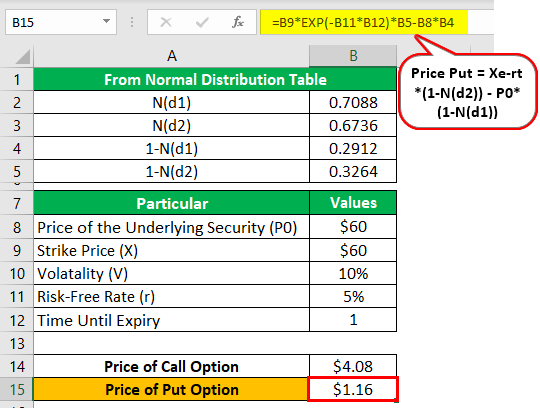

The average spread is a key indicator when searching for a forex brokerage. The spread is the difference in the price of an asset and how much the broker charges each lot. Tight spreads can help reduce risk, but they can also increase the possibility of losing money. It is best to select a broker that offers protections, including legal recourse, and negative balance protection.

OspreyFX doesn't have a regulated location. It is not an issue for US traders. However, it is not an issue if residents of other countries follow certain guidelines. To open an account, a user must fill out a registration form. Once the registration is complete, the user will get login information instantly.

In terms of trading assets, OspreyFX offers a wide range of options. Trade options for traders include stocks, commodities, metals and cryptocurrencies. Leverage is another option that traders have, and it can prove to be an advantage for both novice and experienced traders. The leverage rates can range from 1:500 up to 1:500. This can increase the impact of losses and allow you to make more profit.

OspreyFX doesn't charge any fees for withdrawing money, but there are some restrictions regarding the type of payments that may be possible. Some types of payments, such as wire transfers, require a charge of up to 25 USD, while debit and credit cards can be used with no additional fees. OspreyFX can charge a commission depending on which payment method is used.

OspreyFX can be a great choice for traders of every level. Although there is no guarantee that the company will perform, customers can feel confident in OspreyFX's competitive pricing and wide range of deposit and payment options. There is a free demo account available, and you can take a test drive of the OspreyFX platform before committing to a real-money account.

OspreyFX gets a lot of positive feedback. One reviewer commented that the company is "the new big thing". OspreyFX offers a demo account for traders who are either new or experienced. This allows you to test the platform and see if it suits you.

FAQ

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Frequently Asked questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Where can i invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Security is essential when investing online. Online investments are a risky way to protect your financial and personal information.

Be mindful of whom you are dealing with when using any investment app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Keep track of account changes that might alert identity thieves such as account closure notices or unexpected emails asking to verify information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last but not least, make sure to use VPNs when investing online. They're often free and easy!