Trading crude oil futures is a great way to profit from the volatile nature of this commodity. It is crucial that you choose the best trading method. You should also consider your financial situation, as well the risks involved in the industry. Additionally, it is important to have sufficient funds in your account to pay for any losses.

Before you decide on which method of trading to use, you will need to learn more about the markets. Day trading on the futures market requires discipline, as well as an understanding of its fundamentals. It is important that you have a thorough understanding of all the factors that affect crude oil prices, including the political, economic, and technical. This will enable you to make sound decisions about where you should enter and exit trades.

The crude oil futures market offers two main trading options. The other is to sell and buy futures contracts. These are typically traded within a day and the prices move fast during heavy trading hours. ETFs can be traded as an alternative. These are baskets of top oil companies, allowing traders to be diversified without the risk of trading the physical commodity itself.

To trade crude oil derivatives, you must open a trading accounts with a broker. You might need to deposit minimum funds depending on the broker. Some brokers will only allow you to trade with $1000. Others will require that your money be substantial in order to make profits.

You can purchase crude oil futures contracts with different expiration dates. You can purchase crude oil futures contracts that expire in April, October, June, December or December. You can also spread your contract months to benefit from changing commodity expectations. To get familiar with the industry and to learn more, you may want to open a demo account.

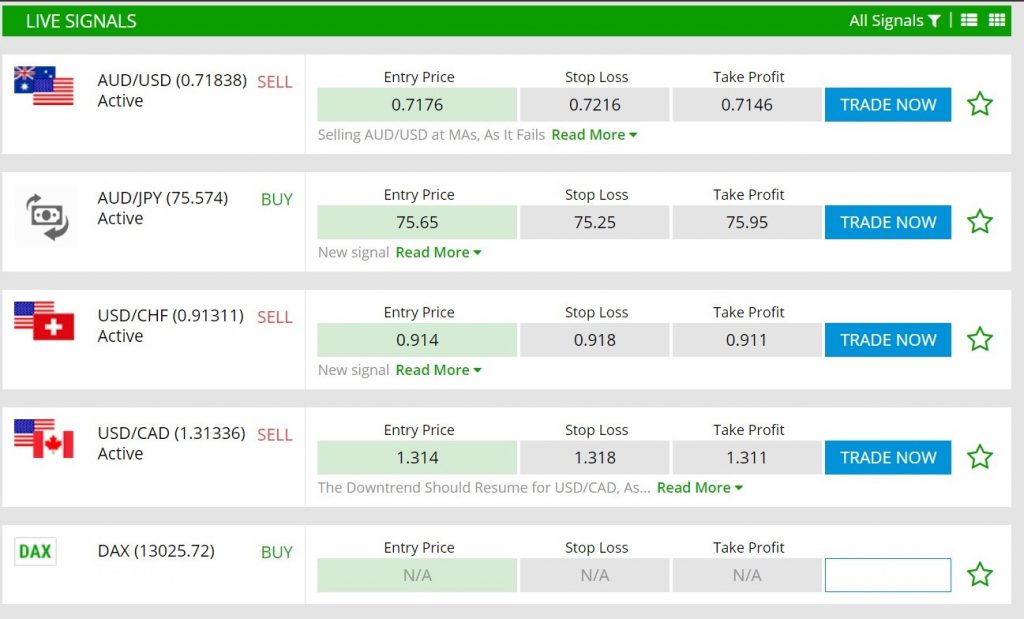

To determine the best place to enter or exit a trade, a trader may use a directional proxy like the Oil Volatility Index. Traders can usually buy or sell at either the high or lower end of a range. This improves their chances of success.

Crude oil futures offer a solid choice for both experienced and novice day traders. It doesn't matter if you trade futures, CFDs, or ETFs. Understanding the market is key to developing a trading strategy. Once you have the basics down, you can trade in the crude oils futures market.

Crude oil is one of the most popular commodities for day trading. Crude oil can be traded and earned profits by selling or buying it before the contract expires. Although crude oil can fluctuate by the day and week, traders who are skilled and aggressive will be able to make a profit from it.

CFD trading accounts offer traders the chance to trade in volatile markets at high leverage. You can also enjoy no-fixed-trading-costs, which is perfect for traders who are traveling.

FAQ

Which trading platform is the best?

Many traders find it difficult to choose the right trading platform. It can be confusing to choose the right one, with so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

What are the disadvantages and advantages of online investing?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Do your due diligence and make sure you get what you pay for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!