The Motley Fool offers several services that can provide guidance for investors on a wide variety of topics, including cryptocurrency. There are many services that can help you to invest wisely, such as the "Dividend stock alert" newsletter or the "Rule Breakers” portfolio service.

Dividend stock alert is a monthly newsletter focusing on high-growth companies that pay high yield dividends. It also offers stock watch lists and recommendations for buy-and sell. You can also receive a quarterly recommendation, as well as precise portfolio allocation advice. Additionally, you will have access interviews with Fool analysts. For those interested in microcap investing, Everlasting's Microcap Stock Advisor is a subscription service that provides information and guidance about smaller, microcap stocks.

Next Gen, another service, provides advice on new technology. Its stocks portfolio revolves around a theme like self-driving car or "cord cutting". This service is only currently available in the US. The company plans to launch it soon in Canada as well as other countries.

Motley Fool Market Pass - a premium portfolio service, offers four analyst teams. Each team has its own focus and subscribers receive one recommendation per month. For instance, the "Rule Breakers” team is focused on cannabis-related companies. The "Next Gen" team seeks out new tech-driven companies that have a potential for 40x growth.

Motley Fool is proud to offer a suite of services called Everlasting. These services are focused upon innovation and growing. This group also includes the portfolio service "IPO Trailblazers" and the upgrade service "Everlasting Stocks Upgrade".

The company has introduced an AR trading service called Extreme Opportunities. The service was previously known as Discovery: IPO Trialblazers. Since its launch, the portfolio's value has steadily increased, reaching over 120% in January. Currently, it's worth around $8,700. But in the coming months, expect the price to drop when speculators begin to burn through their supply of money.

Although crypto currencies have been featured in the news a lot recently, it is important to remember that they are not a sound investment. The purchase of crypto currencies is gambling. There are no guarantees of profits. It's growing in popularity and you have a few options. Talking with an independent financial adviser before you make a decision is important to ensure that it is a sound one.

FAQ

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

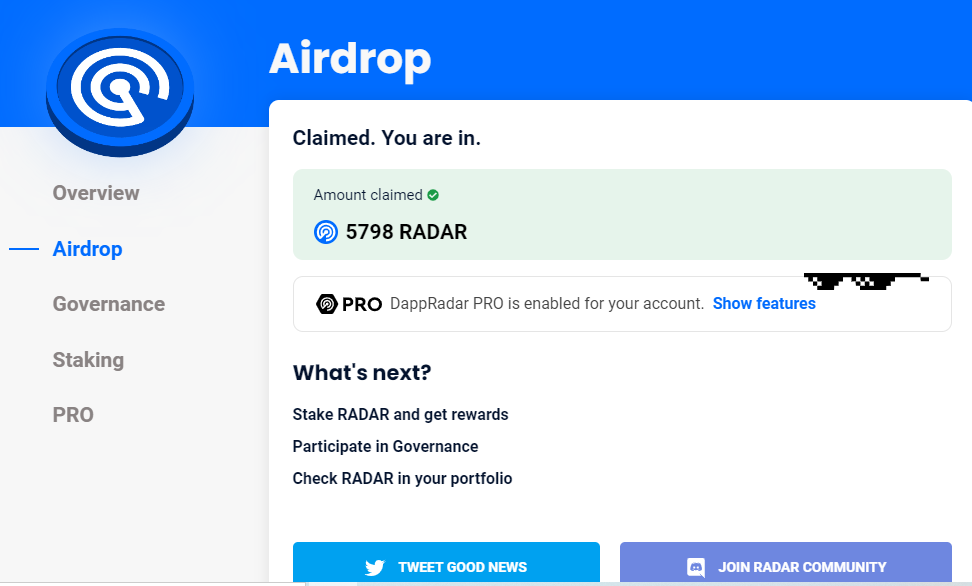

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

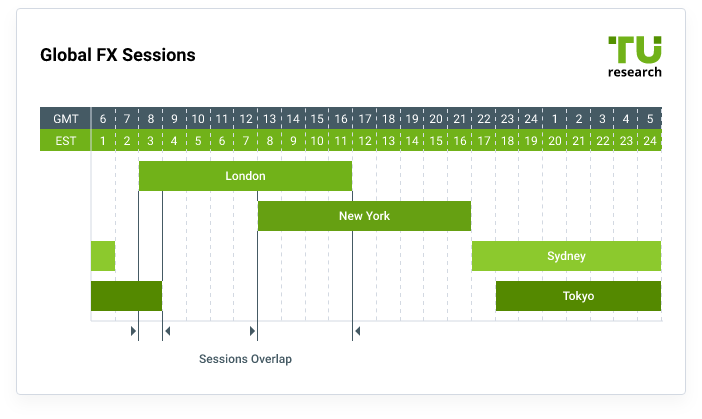

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Is Cryptocurrency a Good Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protect yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Never forget that scammers will try any means to steal your personal data. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.