Webtrader offers traders the opportunity to trade online using any device. Webtrader is an online trading platform that doesn't require any software to be installed on their devices. This makes it a great choice for anyone who wants to transact without taking up much space.

MT4 webtrader

MetaTrader 4 is an incredibly popular online trading platform that has many features that make it easy to use. One of the best features of MT4's user interface is its ease of use. It also offers a number of different tools and indicators to help traders better analyze the market and make more informed decisions.

MT5 webtrader

MetaTrader 5 - Another popular online trading platform can be used on both desktops as well as mobile devices. It provides all the same features of MT4 in an online format. This makes it an excellent option for people who use multiple devices and want to trade from anywhere.

Plus500 Webtrader

Plus500 is an online Forex and CFD broker. It offers both novice and seasoned traders an exceptional trading experience. The company offers a free demo account, which allows you to practice your trading strategies and learn more about the platform before investing any real money. You can even trade with $40,000 worth of fictitious money.

Plus500 has a number of features that can help you improve trading strategies and increase your profits. These include the ability to set a Close at Profit’ or Close at Loss’ rate on your positions. This can help preserve your gains or minimize your losses.

There are also a number of other tools to help you manage your risk and avoid losing more than you can afford. There are two options: the ability to set your pending order to close once prices reach a particular level; and the ability monitor your position status, analyzing it in realtime.

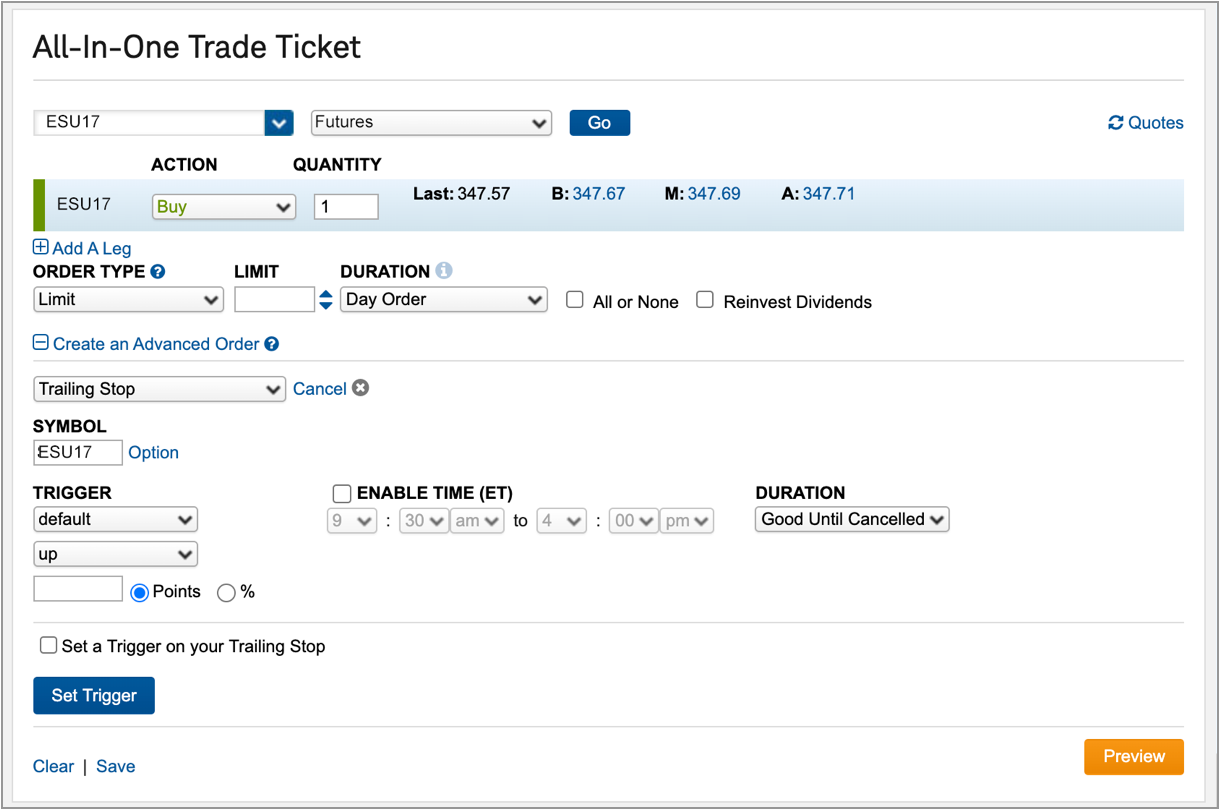

Interactive Brokers Webtrader

Interactive Brokers offers investors the opportunity to trade forex stocks and CFDs worldwide through a range of platforms. WebTrader is the most widely used platform. It features an easy-to-use user interface that allows you to easily access your account.

IG Webtrader

The IG webtrader is an online trading platform that is available on most browsers and has an intuitive interface. A number of technical indicators are included that can be extremely useful to traders. These indicators can be used to help you understand trends and predict the future.

IG also has a number of add-ons that can be used to customize the platform and enhance your trading experience. These add-ons can include stealth orders or mini terminals, which will allow you to tailor the IG webtrader to fit your trading style.

IB Webtrader

Forex investing is risky. You should choose a trusted and safe broker to help you make your investment. Do your research on the broker and go to their website.

FAQ

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Crypto is more complex because it is newer and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Forex traders can make money

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts must be secure. Protecting your assets and data from unwanted intrusion is essential.

First, ensure the platform you are using is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. You can read user reviews and ratings about the platform to see how it works and what users have said about it. You should also be aware of the tax implications when investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.