Investopedia Simulator allows you to practice investing by using a virtual trading platform that simulates stock and option trades. It is easy to use with powerful tools to place simulation trade orders. It is a great tool to learn new investment strategies and test them on real-time data.

The Investopedia Simulator was created for beginners who are interested in learning the basics of investing. The simulator is also useful for professionals who wish to test a new strategy. It allows you to track the value and performance of your positions in real time. You can also join games, which will help you compare the performance of your investment to the other participants.

The Investopedia simulator is a great resource for information but it lacks modern features and has an old interface. It is free but you can purchase a premium account to access additional features and special services. The app isn't the most user-friendly in its category.

Investopedia Simulator is a rich source of data that includes stock news, fundamental analysis and advanced portfolio summaries. A powerful research module allows you to gain an even deeper understanding of the financial performance of companies. Register for an account free of charge to get started. Then you can either play a simple game or create one. After you've created a game you can start playing by choosing a company or asset. You can trade options, stocks, or short-selling depending on the game.

The Investopedia Stock Simulator provides over 6,000 equities both from the Nasdaq or the NYSE. You will also find a lot of resources to help you get started. You can also learn about the P/E ratios for different companies and the value of the simulated stock positions. Compared to other virtual trading platforms, Investopedia Simulator has a competitive edge that makes it more realistic. You can also set your commission rate and compete against other players in a contest.

Although the Investopedia simulator is one of the most popular of its kind, it does not have the latest features. The platform has been outdated for years and the functionality is limited.

The Investopedia Simulator's biggest drawbacks are its outdated platform and the lack of a professional version. Another problem is its cluttered layout. It is crucial to do your research before investing in securities. There are many factors to consider such as your financial plan, time constraints and personal preference.

Regardless of the reason why you are interested in investing, you should always remember that practice is the key to success. Even if it's your first time investing, you should try several different strategies before making a big investment.

FAQ

Most Frequently Asked Questions

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which is the best trading platform?

Choosing the best trading platform can be a daunting task for many traders. It can be confusing to choose the right one, with so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

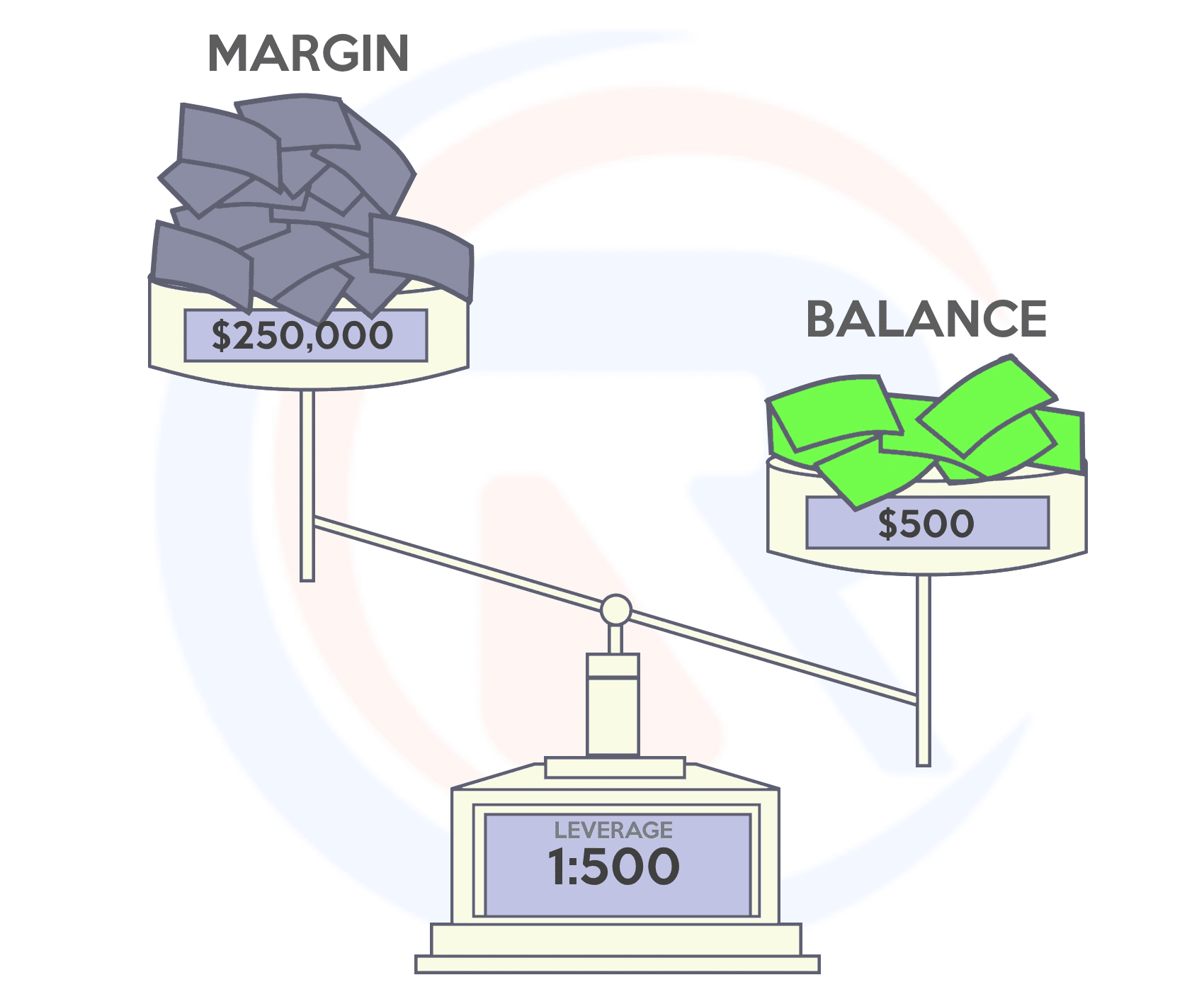

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which trading website is best for beginners

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Research is critical when investing online. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Be skeptical of promises of substantial future returns or future results.

Learn about the investment's risk profile and review the terms and condition. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.