Stock signals are indicators that allow you to spot potential trading opportunities within the stock market. They are derived from a variety of technical indicators. A moving average crossover, for example, can be considered a short term buy signal. Other leading indicators include momentum and volume indicators. Combining these indicators can help identify overbought or oversold stocks.

Stock signals often combine with fundamental analyses to determine a stock’s future price direction. They can be useful for both day traders and long-term investors. These tools will save you time, money, resources, and increase your chances of making a profit. When looking for signals, there are some things to remember.

A good signal provider should offer a trial to get a feel for the service and help you decide if it's right for you. Some providers will let you try the service completely free for a one-month period. It is also important to review the quality and reliability of the signal provider's customer support as well the type of signals available. This is especially true for beginners.

Many companies use mobile applications or email to communicate with their customers. WeTalkTrade, for instance, offers a new mobile app that allows subscribers instant push notifications. You can also access an economic calendar that displays various economic news releases.

The Motley Fool, however, is known for their emphasis on emerging industries. You can choose from a range of trading options and plans, starting at $1 per month up to $47 per months. These plans grant users access to swing trading stock and other financial services. Visit their website to learn more about their services. Also, you can find extensive educational video content.

Elliott Wave Forecast offers an alternative option. It provides accurate forecasts for all 78 asset classes including equities and commodities as well as currencies. Their experts have extensive experience in both fundamental and technical analysis, as well market research. Because of this, they are able to provide the best stock signal in the market. Subscribers to their services can rest assured that they will have the most current information about the markets.

Mindful Trader is a great option for traders who want more guidance. They are located near Denver, Colorado. Their services include a variety for individual and institutional traders. They offer a range of services, including swing trading and daily reports. They are also one among the best stock signal providers 2022.

Before signing up for a signal provider, consider your investment goals. If you're a long-term investor, you'll need fundamental indicators to guide your investments, while day traders might need the right signals to take advantage of an opportunity. It doesn't matter if you are a beginner or an expert in the field, it is important to ensure you get the best possible services.

Finally, make sure you get a money back guarantee. Many providers will keep track of their losses and wins, which can be misleading and unethical. While investing in stock signals can be a great way for you to save money and time, it is important to exercise caution.

FAQ

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

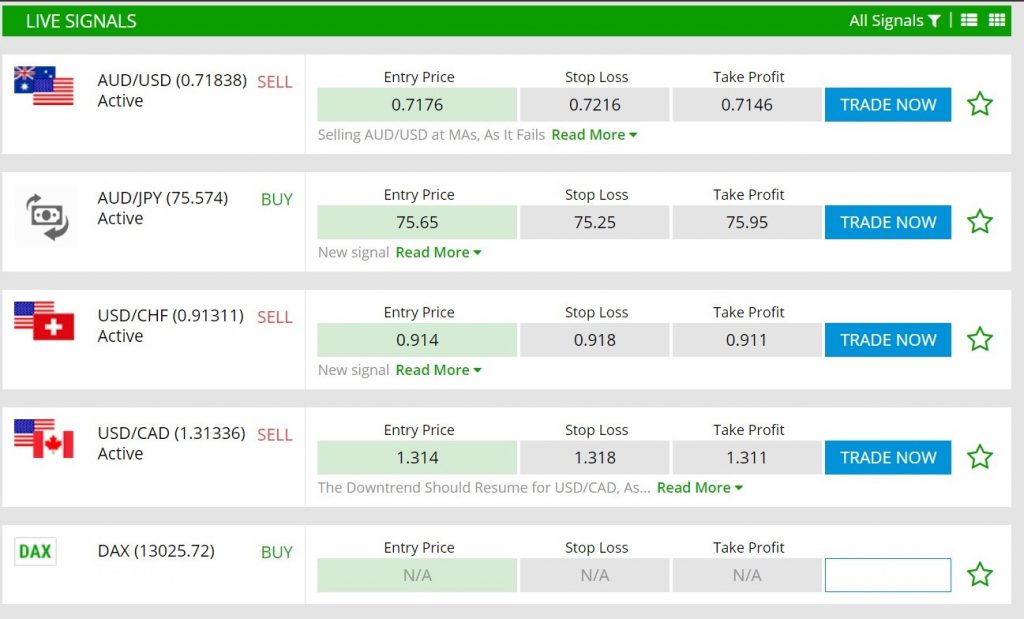

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Frequently Asked Fragen

What are the 4 types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protect yourself. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

You should also use safe online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.