TD Ameritrade offers many options to forex traders. The broker provides a range of trading tools including an online platform that allows you trade currencies from your mobile or computer.

Traders have easy access to a broad range of assets via the TD Ameritrade platform. These include stocks, mutual fund, ETFs, bonds, and many more. You can also access the Thinkorswim platform for trading, which is available on desktop, web, and mobile devices. Whether you're an experienced trader or you're just starting out, you can find a strategy that works for you.

Forex leverage is something you should consider before making a trade. It can either increase or decrease your profits. To prevent any damage to your account, it is crucial to develop a risk management program and limit your leverage.

The TD Ameritrade website features a large selection of investment options including stocks, bonds, and other financial products. It is simple to use and easy to navigate. It also has a number of free trading platforms and tools that are useful for beginners.

TD Ameritrade also offers a free education program that will help you trade the forex market. The company's educational videos and articles provide an overview of the basics of currency trading, as well as tips and strategies for successful forex investing.

Trade Account with TD Ameritrade

To open a TD Ameritrade account, the first step is to complete an application. You can either fill out the application online or call to speak with someone. Once your application is accepted, you'll be assigned a username and password along with a trading account numbers.

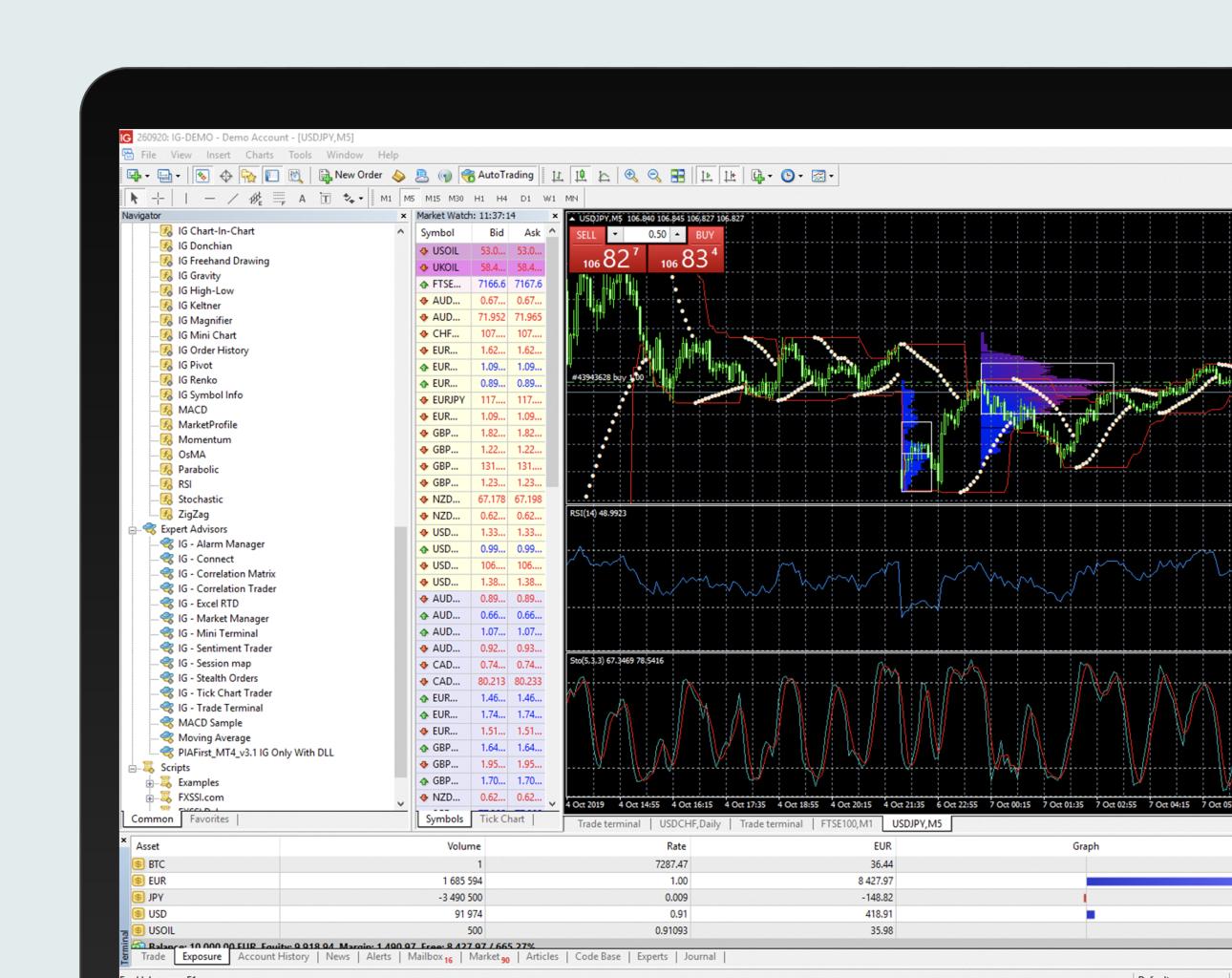

TD Ameritrade, a well-respected and reputable forex broker, offers competitive rates and a robust platform to traders. Its thinkorswim trading platform, which is available in desktop and mobile versions, offers many of same advanced features and options as MetaTrader.

How to Trade FX With TD Ameritrade

Once you have opened an account it's time for trading. You can place orders, monitor trades and make payments using the TD Ameritrade platform. The platform also provides real time news and market data to help you make informed investment decisions.

How to Fund Your TD Ameritrade Foreign Account

After you've established your account, you can fund it with a deposit or withdrawal method of your choice. TD Ameritrade offers a range of withdrawal and deposit options including wire transfers, checks, and wire transfers.

Electronic bank transfers are also an option to replenish your account. These are quick and easy. Withdrawals made from TD Ameritrade's Thinkorswim typically take five minutes. While wire transfers take between 24 hours and 6 business days, they are processed in approximately 5-6 minutes.

The TD Ameritrade platform for trading has many advanced features. These include expert advisors and news as well as charts and technical analysis tools. This platform is great for anyone looking to add forex to their portfolio. It is also easy to use.

FAQ

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with yourself. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, thoroughly research investment opportunities independently.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Never forget that scammers will try any means to steal your personal data. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Also, it is important to invest online using secure platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.