There is no denying that Facebook (FB) stock is a global juggernaut, with more than two billion daily active users and $120 billion in annual sales. However, before you decide to purchase shares of the social networking giant, it is important that you understand key facts about the company as well as its stock.

It is a good idea that you review the company’s financial reports and investor presentations before making an investment in FB Stock. This will allow to you decide if the stock is right for you.

By opening an account with an internet brokerage, you can invest in FB shares. The best brokers provide a variety services, investment options and fees to fit your needs.

A few basic details are required to open an account at a broker. These include your name, address and phone number. After your application has received approval, you will get a confirmation email containing your account number as well as a password.

Once you have created an account, access to your investment portfolio can be accessed and you can also check the status. You can also access your holdings to make changes.

It is a smart idea to learn about various investing strategies before you begin trading stocks. You might consider dollar-cost average, which is the practice of buying the same amount of stock each time. This will lower your volatility risk and save you money over time on the cost per share.

Before you purchase a share of Facebook, you should consider your budget and other investments. It may be in your best interests to wait until you have enough money saved for retirement or an emergency fund before buying shares of Facebook stock.

A large company such as Facebook is a great way of diversifying your portfolio. But it can also come with risks. You should consider the following factors when deciding whether to invest in Facebook: government regulation, competition, data privacy scandals, and competition from other social media platforms.

Consider the performance of FB stock compared to its benchmark indexes (e.g., the Nasdaq 100 or S&P 500). This will help you identify if the stock is currently overvalued or undervalued.

Buy a stock that is below its value before it rises in price. This strategy may allow you to get a better return on your investment.

A CFD (contract for Difference) is another option. These are derivative products that allow you to speculate on the price movements of stocks without actually owning them.

If you are looking to increase your portfolio's potential return, you might consider investing in an exchange-traded fund. These funds pool large numbers of stocks together to create a single fund. They are also less risky than individual stock investments.

FAQ

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How can I invest Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

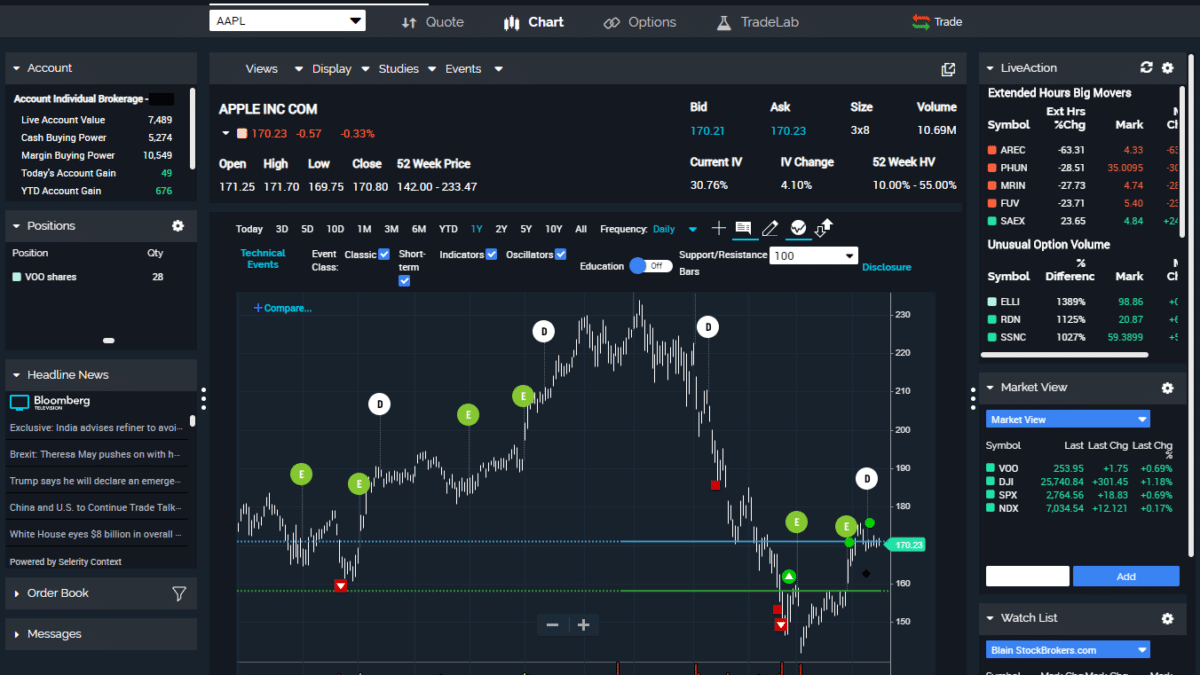

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Frequently Asked Questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Are forex traders able to make a living?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts are a matter of safety. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, make sure that your platform is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It's also important to fully understand the terms, conditions and fees associated with your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, make sure you do thorough research about the company before investing. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, you should be aware of tax implications for investing online.

Follow these steps to ensure your online account is protected from potential threats.