You might consider opening a brokerage account if you are interested in becoming more involved with the financial market. These brokerage companies charge a fee to act as agents for buyers or sellers of stocks or other investments. They often offer customers the option to conduct transactions online. But not all brokerage companies are created equal. Before you decide on the right brokerage firm for you, compare the different features and fees they offer.

Depending upon the firm you choose to work with, your account might include stocks, bonds (ETFs), mutual fund, or other investment vehicles. Each vehicle comes with a different level of risk and profit potential. The most risky are options, currency trading, and futures. On the other hand, less risky vehicles include municipal bonds and mutual funds.

It is crucial to assess your investment experience and whether you plan to trade frequently when looking for a new brokerage. For beginners, it might be better to use a brokerage that specializes in one or two types of investments. You should also look for brokers that offer educational materials at no extra charge.

Another factor to consider is the customer service. A full-service brokerage provides personalized recommendations and suggestions on how to invest. They typically charge a higher fee. Another option is a robo advisor, which is basically an automated portfolio manager. Although robo-advisors are still relatively new in the financial sector, they are intended to offer investors easy-to-manage investments at low costs.

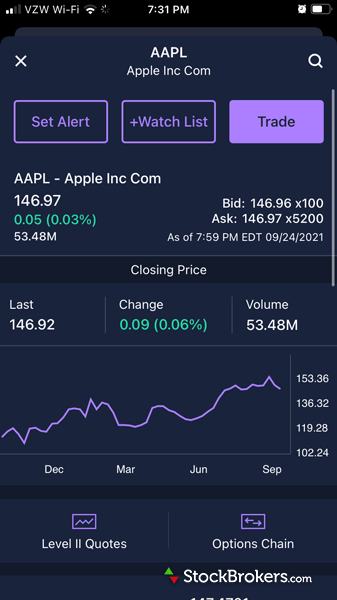

When searching for a brokerage, you should also consider the variety of investment vehicles and tools that are available to trade and research. A few brokerages offer free accounts to allow you to get a feel for the platform before you sign up for full-service. For active traders, a broker that offers advanced trading platforms is a good choice.

The best brokerage firms offer customized solutions for high-net-worth investors. Aside from working closely with their clients, they also help them understand their goals.

Brokers may offer ETFs at a fraction of the cost or no-load mutual funds. Others focus on more traditional desktop trading platforms. Some accounts have zero-frills strategies. This means there is no minimum deposit to open an account. Some platforms even let you practice FOREX trading for free.

While you're reviewing the options, be sure that you check out the online broker dashboard and research tools as well as educational materials. Many offer watch lists and other features that will help you keep track your trades.

No matter your level of experience, whether you're a beginner investor or a seasoned investor you will be able to benefit from the variety of investment vehicles. Choosing the right one can mean the difference between success and failure.

Fidelity is the best choice if you want to be in the market as cheaply as possible. Fidelity Investments is a Boston-based investment company with over $4.5 Trillion in assets under its management. It's an ideal place for beginner investors, as well as for those who want to buy and hold. But if you're a more active investor, you'll want to check out TD Ameritrade or Etrade.

FAQ

Forex and Cryptocurrencies are great investments.

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. The interface should be intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading site is best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. Your valuable assets require a strong security system and you have a few options.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?