Forex is the most important financial market worldwide. Foreign exchange is a 24 hour market that has an estimated turnover of US$6.5 billion. It is used by businesses, banks, and hedge funds to buy or sell national currencies. There are many factors that influence the currency market. These include the economic strength of a country and its social and political factors.

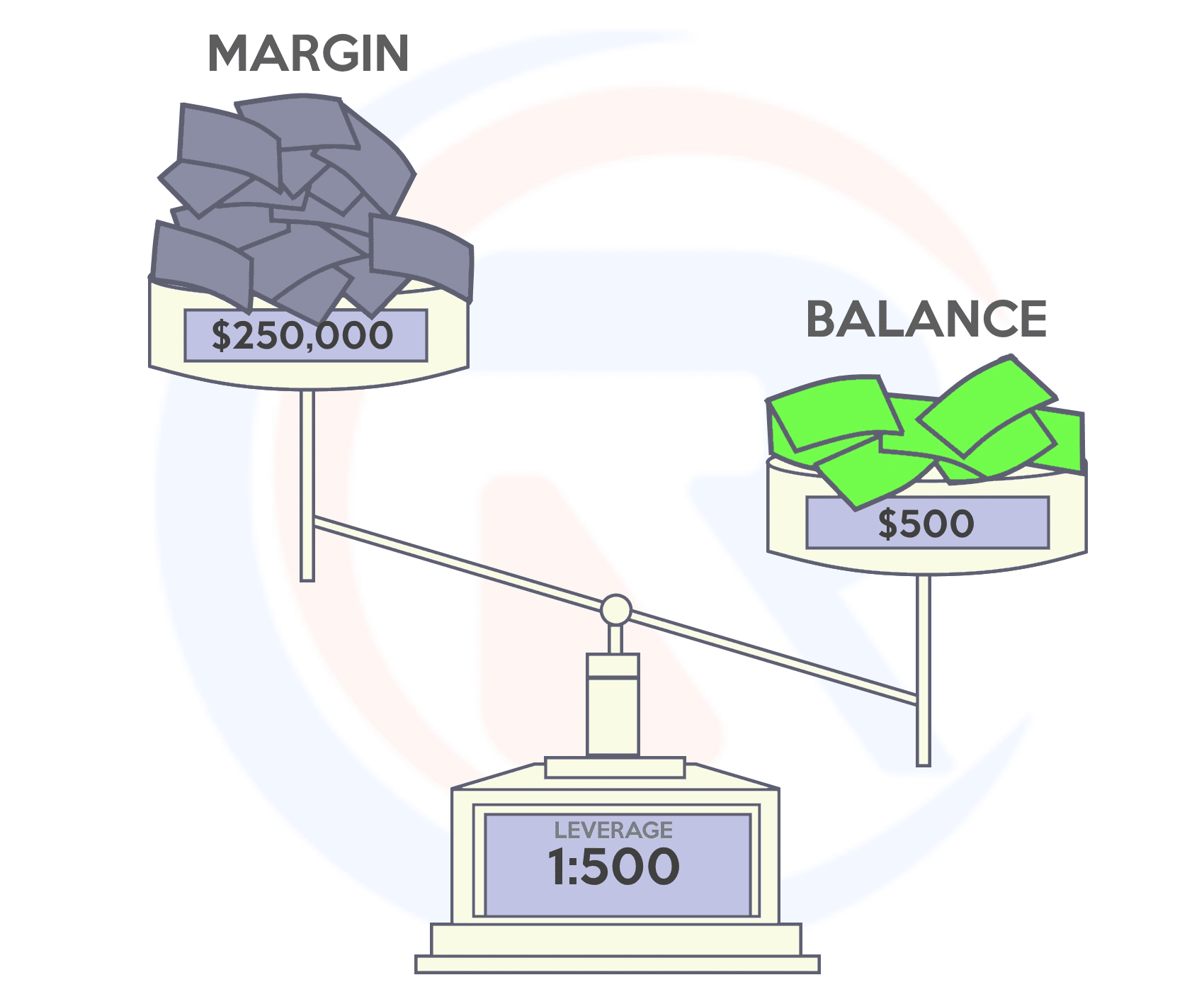

Trades are best made when the market is active. Traders should also consider the impact of leverage on trading. Leverage can make it difficult to keep track of losses and results. Traders should follow a systematic approach. By following the path of least resistance, a trader should be able to maintain a profitable position and avoid drastic price movements.

In addition, traders should be aware of the impact of different markets on the forex market. Trading becomes more volatile when several markets are open simultaneously. This can lead to significant fluctuations in the price of a specific currency pair. Trader should also be alert for major news releases that may have an immediate affect on the currency. Traders should be careful not to overtrade or blow their accounts.

To determine the best time to trade, you should know what pairs are the most popular. The most popular currency pairs are EUR/USD and GBP/USD. These four majors account to more than 80% each of forex trading volume. However, there are many other currency pairs that are less traded. They are usually more expensive than the majors and often have wider spreads.

Other important factors to consider when trading in the daily forex market are the timing of key events, such as speeches by the heads of the main central banks and international political meetings. These events can have a direct effect on the dollar. A completed acquisition can lead to a drop or a rise in the dollar's value. Similar to the previous example, strong U.S. economies can encourage investor demand for their currencies.

It is important to understand the calendar of economic events if you are interested in a career as a forex trader. This calendar provides a guideline for major events that may have an impact on the currency market. You should also be aware of the potential for major news releases to cause a 70 pip decline.

Another important factor to remember is the overlap between the London and U.S./London sessions. This occurs between 8:00am and 5:00pm EST. Trading from this window is the most beneficial because the overlap between the two markets is the longest.

The NASDAQ Stock Exchange and New York Stock Exchange also have a significant role in the forex market. These two markets can overlap for only a few minutes, but they can have a significant impact on the currency market. The USD/JPY is one of the most well-known currency pairs on the NASDAQ.

FAQ

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is harder forex or crypto?

Each currency and crypto are different in their difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which is the best trading platform?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

How do I invest in Bitcoin

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What are the advantages and drawbacks to online investing?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. It's essential to protect your data and assets from any unwanted intrusion.

First, you want to make sure the platform you're using is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Third, you need to know the terms of your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, be sure to know about any tax implications that investing online can have.

Follow these steps to ensure your online account is protected from potential threats.