NFTs can be complicated to sell or buy. NFT trading is unregulated and open to manipulation and fraud. Popular crypto exchanges and wallets don't require users verify their identities. This allows them to make it easy to trade and buy without any oversight. This has caused a boom in frauds. Some NFTMs even reward traders based on their trading volume.

Wash trading, or wash trading as it is sometimes called, involves multiple trades of the same NFT. It makes NFT appear more valuable that it actually is. The purpose of this is to create the appearance of a demand for the asset. Although no hard data is available to support this assertion, it is probable that this activity contributes to the artificially large volume of NFT transactions on the open markets.

Das et.al. have recently done a study on the NFT markets most and least likely to be exposed to security threats. They found that most NFT markets, including OpenSea, Looksrare and Etherdelta, were not as secure as one might hope. The result is that financial criminals can exploit a multitude of opportunities.

One of the most common scams is known as pump and dump, or PD. A typical PD promises potential investors big profits or even a possible increase in value. The hype is often misleading. These schemes are merely a way for scammers extract funds from unsuspecting investor.

Wash trading, in that the same person/entity sells and then buys the exact same asset multiple time, is another. The objective is to create the illusion there is a demand and to increase the volume transactions by an artificially large amount. While this is not a new phenomenon it does require some creativity. It's possible with technology.

NFT market has other security vulnerabilities that aren't well-known. MetaMask was the victim of a phishing attack that stole $1.7million in NFTs. It was actually quite small. If this were to happen in the real world, it would likely be difficult to track down and prosecute.

On top of these concerns, there is also the question of what is the best way to protect yourself from a scam. Even though most US states ban manipulation of stock transactions, there are still some potentially dangerous projects. These projects are often the work of con artists so avoid them.

The CDF is another option. The CDF (cryptocurrency information framework) is a comprehensive database that provides detailed information about all crypto markets. When considering whether to invest, it is important to consider the CDF. This includes information about the market's volume, exchanges, and transactions.

It can be overwhelming to choose the best cryptocurrency to invest, especially when considering the numerous NFTs. A smart way to keep your money safe is to invest in a reputable exchange, such as Bitfinex or Coinbase.

FAQ

How can I invest Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

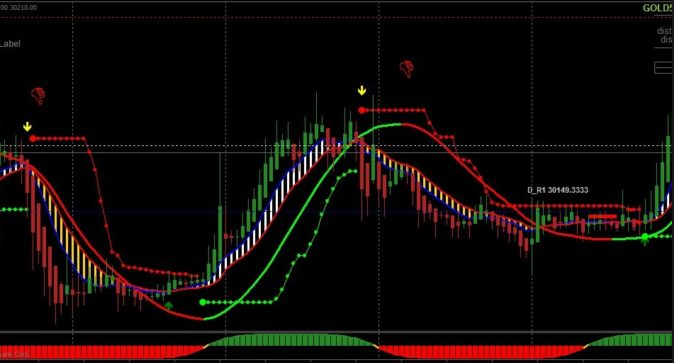

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Trading forex or Cryptocurrencies can make you rich.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts must be secure. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

It is important to be familiar with the terms and conditions of any online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, make sure you are aware of any tax implications associated with investing online.

Follow these steps to ensure your online account is protected from potential threats.