Tradovate, LLC, a Futures Brokerage company, offers its clients a wide range trading tools and features. Rick Tomsic founded the firm. It offers an advanced platform for active futures trader. Its mission is provide innovative technology to the futures industry while keeping it accessible and affordable. It is a popular choice for investors due to its attractive commissions and a variety of features.

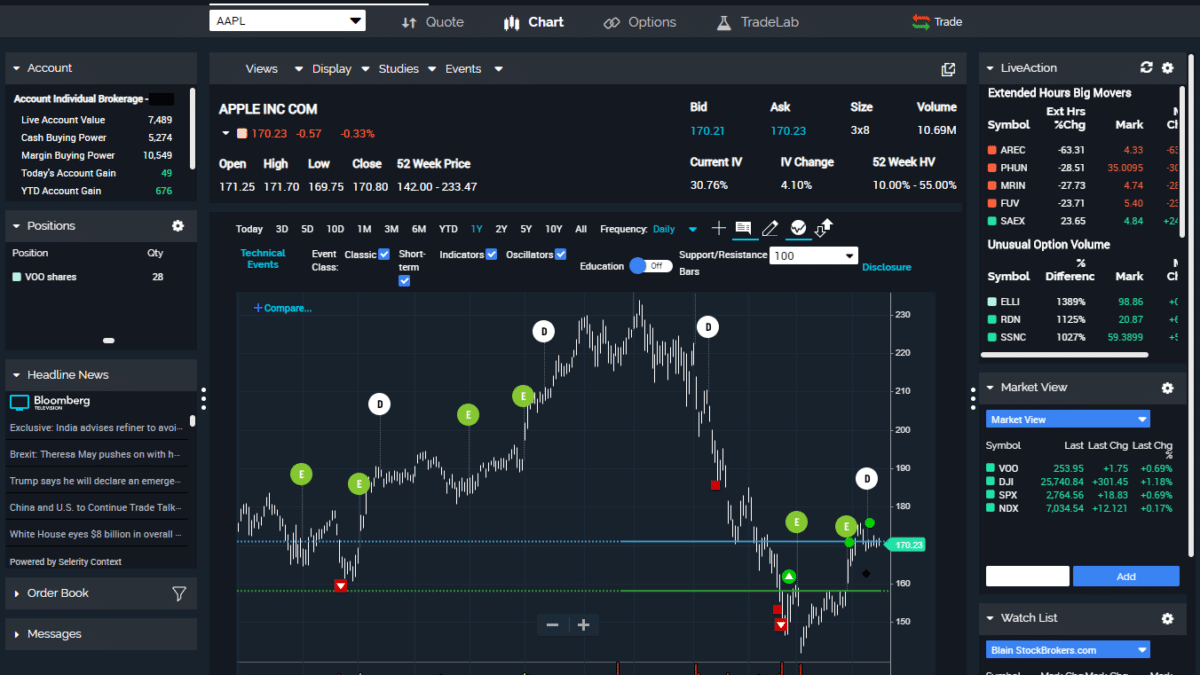

The broker's platform features a variety chart types, including line, bar and basic candlestick charts. Advanced Heikin Ashi and Renko charts are also available. It supports market profile and volume charting. Other indicators are available, including trend lines, moving averages, and Fibonacci retracement. Users can also set up dozens of customized indicators.

Tradovate provides a forum for investors to share strategies and tips. They can also learn and share their trading experiences with other traders. If you're a first-time investor, you can use the free two-week demo to get a feel for the platform. You can also sign up for a membership plan to have access to a full suite of trading tools. This plan costs $25 each month.

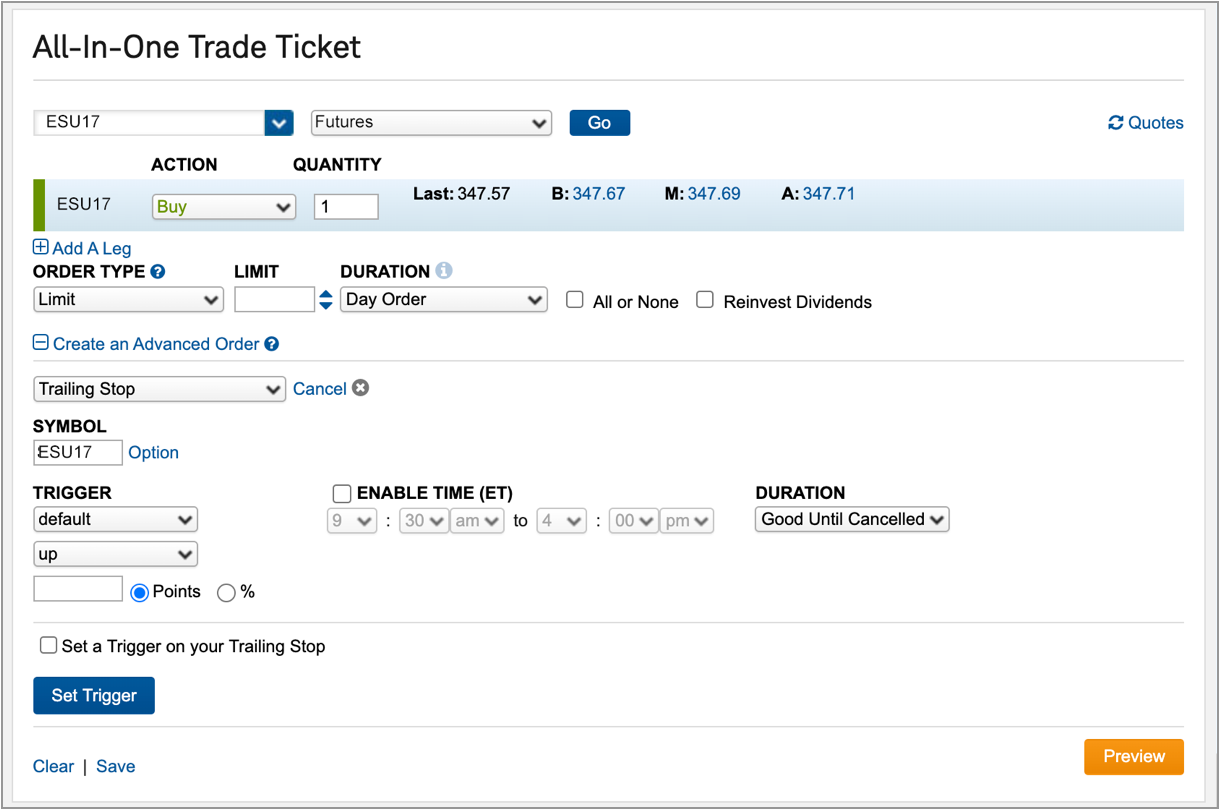

You can also set up conditional bracket orders and stop limits on the platform. These options allow for automated, one-click order entry. Tradovate's platform also allows for direct integrations to third-party market information solutions. To make it easy for users to take advantage of its features, the brokerage also offers a user-friendly interface. Charting is also made easier by multiple depth-of market screens.

As part of its ongoing effort to support the futures market, Tradovate will offer commission-free trades for participants on the new FairX exchange. Retail investors will be able to trade at a lower cost with this offering. Tradovate will become the first broker to offer trading on the platform when the exchange opens.

Tradovate is a broker that offers a wide range of tools and indicators to traders to help them reach their goals. Its proprietary system can be overwhelming for new traders. With its innovative platform, the broker is aiming to help experienced traders create and optimize their strategies, while reducing costs.

Traders who want to save money on their futures trades can sign up for a Tradovate trial account. Once they've completed the test run, they can decide whether to continue with the company. Unlike most brokers, there are no minimum funding requirements or inactivity fees.

You will have full access to the platform, regardless of what membership plan you select. Trades are executed in real time so that you will be notified of any price changes. To get alerts when a certain price changes, you can also personalize your watchlist. You can also choose from different order types such as trailing stops, stop-limit orders, and conditional bracket orders.

Although Tradovate has a learning curve for traders, the platform's innovative features and platform make Tradovate an appealing option. For those who wish to trade while on the move, the mobile app is available.

FAQ

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

How do forex traders make their money?

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Where can i invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not respond to unsolicited emails or phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

You should also use safe online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.