The Best Stocks in Blockchain to Buy Right Now

In a world where blockchain technology is becoming increasingly popular, there's no shortage of opportunities for investors. However, before you put your hard-earned cash into any new investment, it's important to understand exactly what you're purchasing.

Companies that can build strong businesses around blockchain technology and use it for growth are the best blockchain stocks. Some of these companies are already well-established and positioned to benefit from the long-term boom in the sector, while others are nascent and will need time to find success.

International Business Machines

IBM is a famous name in computing, and the company's blockchain business is a great place start if looking for a company with the potential to harness the benefits of this new technology. The company is currently working with clients to create a range blockchain applications. These include supply chain management as well as health records.

Mastercard Incorporated

Mastercard Incorporated is a leading company in the blockchain industry. It offers a platform that allows companies to streamline and secure their trade finance and business-to-business transactions. It also provides a robust Blockchain API that makes it easy to integrate your business processes in a blockchain-based system.

Taiwan Semiconductor Corporation

This semiconductor manufacturer is a global leader in high performance chips. They also have many applications in the Blockchain space. Its chips are designed to be efficient and highly scalable. The company's application-specific integrated circuits (ASICs) are especially popular among miners, who want chips that are more powerful and efficient than the competition.

Coinbase Global, Inc

Coinbase, a cryptocurrency trading and storage firm, is one the most preferred stocks today to invest. Although the stock suffered a bit recently as digital asset prices have plummeted in recent times, the firm should experience strong gains if there is a recovery in the blockchain market.

It is a major player in the cryptocurrency market, with a user base of nearly 90 million. Its Coinbase Exchange lets you trade more than 10,000 cryptocurrencies on the platform.

Robinhood Markets, Inc

Robinhood Markets is a well-known stock trading platform. They also offer trading services for cryptocurrencies, and other digital currencies. The company is growing rapidly in the crypto space and its user base has increased significantly over the last few months.

eToro, LLC

eToro is the biggest online broker that specializes exclusively in forex and crypto. It's a great way for you to make cryptocurrency investments without having to pay any commission fees. You can also store your cryptocurrency wealth in a safe and secure location.

Metacade

Metacade token can be used to reward players through a game-based platform. It's designed to provide big benefits unlike any other. The token has a recent launch, so it isn't yet subject to the law of diminishing return. This gives it huge upside potential.

Riot Blockchain

Riot Blockchain (Nasdaq.RIOT) might be a good investment if you are interested in Bitcoin mining. This company focuses on mining and wants to be the biggest and most affordable producer of cryptocurrency in America. It has a strong reputation within the industry and a well-respected management team.

FAQ

How can I invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

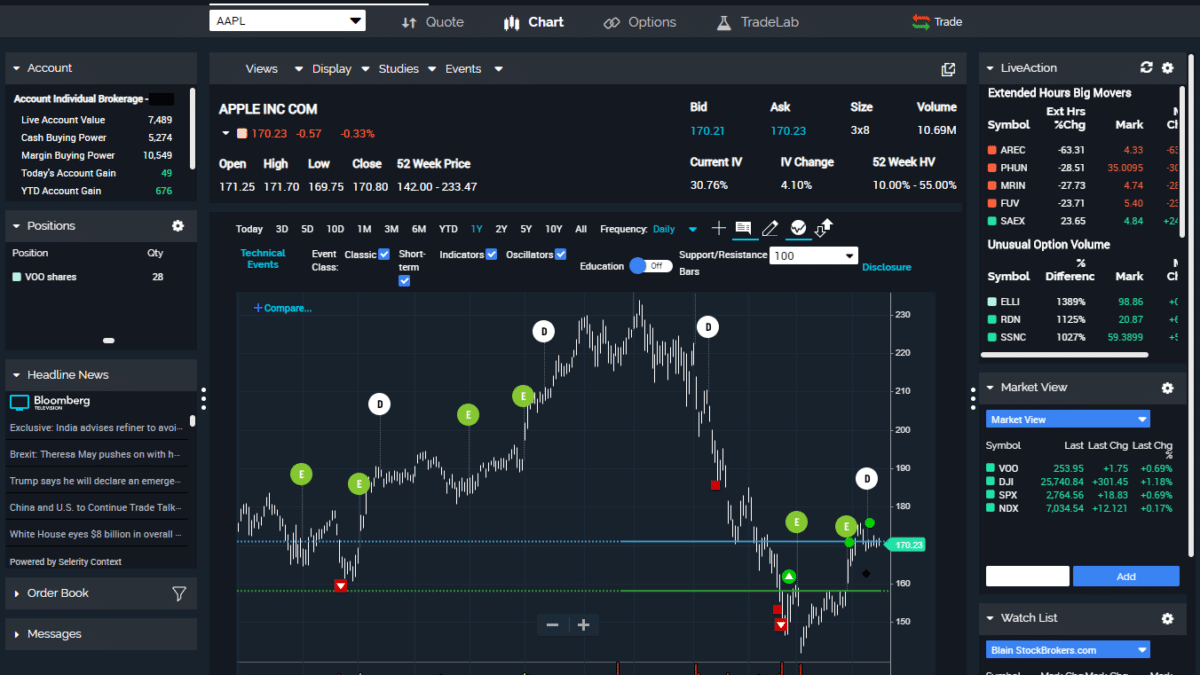

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Frequently Asked Questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts are a matter of safety. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, you want to make sure the platform you're using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. Review and rate the platform and see what other users think. Finally, be sure to know about any tax implications that investing online can have.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.