When deciding on which online brokerage to use, there are a number of factors to consider. The most important aspect is cost. There are many companies that charge fees for every transaction. The best brokers online offer low to zero commissions on stocks and bonds. Before you make your final decision, it is important to compare the fees charged by each company.

Consider customer service, investment instruments, and educational materials as other factors. A broker that offers educational materials and a fund and stock screener is a good choice if you are interested in investing in stocks. You should also feel comfortable asking questions.

Although there are many aspects to consider, it is worth reviewing your financial goals as well as your risk tolerance. This will help to find the best online broker for your needs. A brokerage should offer a variety of tools and features such as an education centre, research library, and trading app.

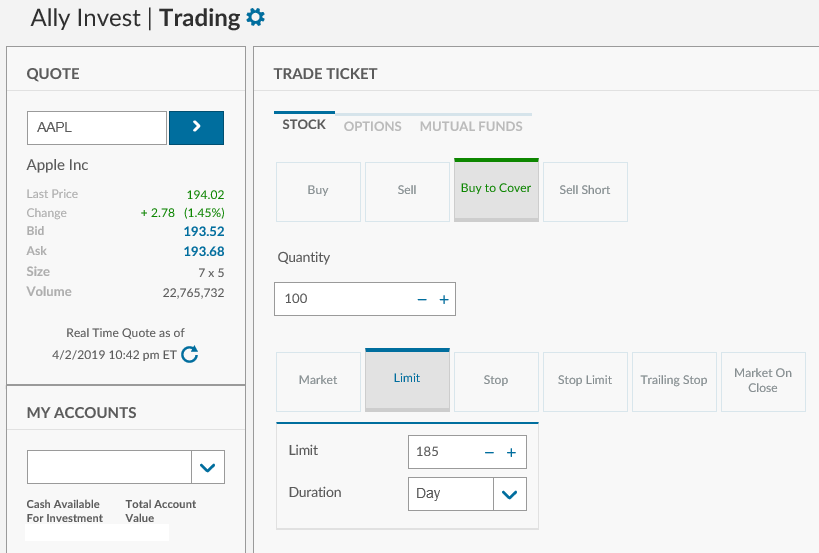

Online stock brokers can match your buy orders with sellers for you, or they can make the transaction for you at a discounted price. Some of the best online brokers have no minimum requirements for opening an account. Although they might require a deposit to open an account, it is not required.

Full-service brokerages often offer a variety of financial products including loans and checking accounts. They'll even provide you with advice about saving for your retirement, minimizing your capital gains tax, or maximizing your investments. These services can however be very expensive. For those with limited budgets, you can opt to open an online brokerage account with a discount broker. These firms often provide no-cost funds which can be a simple way to start investing.

Interactive Brokers provides a variety of services including commission-free online trades, a mobile application, and a service for robo-advising. Their platform is not as user-friendly as other brokers, however.

Charles Schwab is a well-rounded online brokerage. It features an intuitive interface, a large selection of mutual funds, no expense ratios, as well as extensive research tools. Investors who want to have a diverse portfolio are likely to love it. Google Assistant is also integrated into the research.

Another popular option is Robinhood. Robinhood is an online brokerage. There are many options available and ETF trades can be made for free. You also have access to the free weekly investment tool. What makes this brokerage unique is its ability offer free online trading for cryptocurrency.

Fidelity, TD Ameritrade and other online brokerages offer more than online trades. These brokerages offer many educational resources such webinars and seminars. Plus, TD Ameritrade has robust trading software, which is great for novice investors. Fidelity, on the other hand, has a solid platform.

Online brokerages should be evaluated on the following factors: commission fees, trading type, investment products, and type. Make sure you review your trade history before choosing an online broker.

FAQ

Forex and Cryptocurrencies are great investments.

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Where can you invest and make daily income?

Although investing can be a great investment, it's important that you know your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

What are the benefits and drawbacks of investing online?

Online investing has the main advantage of being convenient. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Any type of trading can be managed by diversifying your assets.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts are a matter of safety. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, make sure that your platform is secure. Secure platforms should include encryption technology, two factor authentication, and other security features that provide maximum protection against hackers and malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, make sure you understand your investment platform's terms and conditions. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourthly, research the company you are investing with and ensure they have a good track record of customer service and satisfaction. You can read user reviews and ratings about the platform to see how it works and what users have said about it. You should also be aware of the tax implications when investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.