Reddit is a popular online forum that offers an interactive platform to discuss a variety of topics. Discussions about cryptocurrency are among the most popular. You can reach out to the community, whether you're an investor with experience or a beginner to learn more about the market. You should remember that cryptoassets have the potential to be very volatile. It is important to keep a list of assets with high potential value. You will need coins with strong utility to make a profit in the market.

IMPT, a green currency that uses blockchain technology for reducing greenhouse gas emissions, is a great example. The project also has an integrated P2E (play to earn) element that will offer tokens for winning the game. IMPT is expected to increase in value by 50% in the near future. The project also has a green version available that can be played for free.

Meta Masters Guild is another investment opportunity. This play-and-earn platform allows players to earn a reward when they reach certain milestones. It also boasts a presale that raised over $50,000 in 24 hours. The native token $MEMAG currently has a price of $0.007. As the presale draws to a close, the token will experience an important increase in its value.

TAMA, another exciting project, is expected to be on the exchanges soon. This is a play to earn crypto that will soon become listed on major exchanges. The game will offer rewards to players for their efforts in collecting resources. TAMA is currently priced at $0.194. The coin has strong utility so it's possible to invest and reap the advantages of rising prices. In fact, the project has even launched a part of its NFT (non-fungible token) collection, allowing users to win a number of rewards for playing the game and collecting resources.

TAMA still generates hype, despite the bearish market. Investors can purchase tokens during the pre-sale for a mere $0.02. It is expected that the token will explode once it is listed on the main exchanges. Investors may also participate in a 100,000 token giveaway during the presale.

Cardano is a smart-contract blockchain that will likely compete with Ethereum and Solana. Cardano's PoS consensus protocol will make it possible to quickly process transactions. Vasil upgrades will increase its appeal to dApp developers. Cardano will eventually fork into two chains.

The Dash 2 Trade presale is another option. The Dash 2 Trade presale is now in its final stage. Only $1 million of tokens have been left. If you want to know more about the project, join its Telegram channel. There, you will receive updates on the latest developments.

These are only a few of the best cryptos to buy on Reddit. Although it can be tempting for some to rush to buy cryptos, it is best not to do so without a detailed watch list. It may surprise you to learn that many projects offer similar returns to Bitcoin.

FAQ

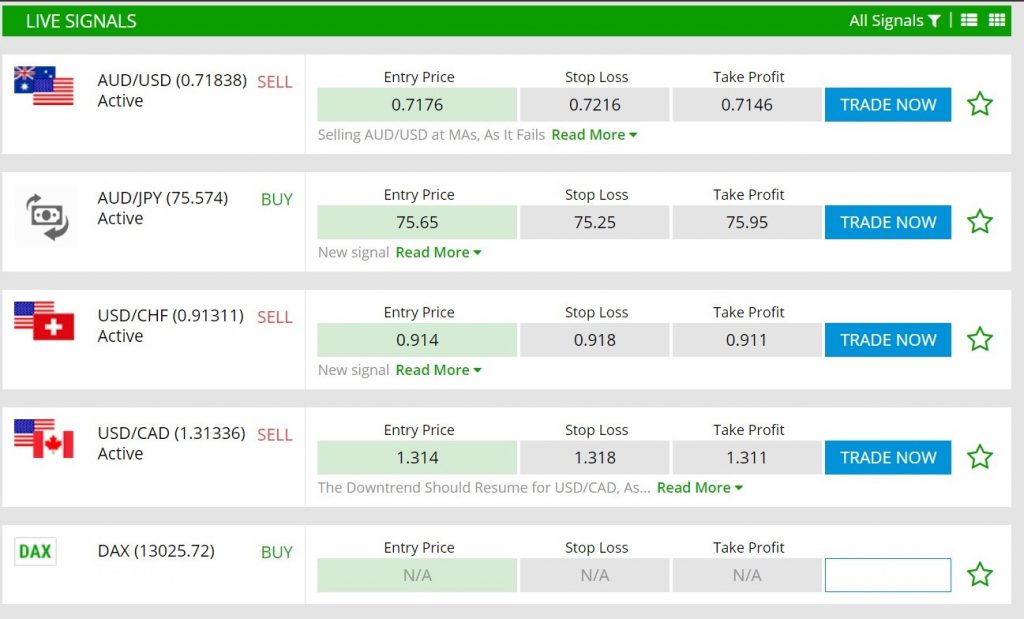

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Do forex traders make money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which trading platform is best?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which is harder forex or crypto?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Frequently Asked Fragen

Which are the 4 types that you should invest in?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. You have several options when it comes to protecting your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?