An online advisor is a qualified professional that helps you manage your money and achieve your financial goals. These advisors can offer advice on a variety of topics including tax preparation, investing, retirement planning, and tax preparation. A few can assist you in preparing a will, revocable living estate and other legal documents.

How to choose an Online Financial Advisor

There are many options for online financial advisors. It is crucial to choose the right one for you and your budget.

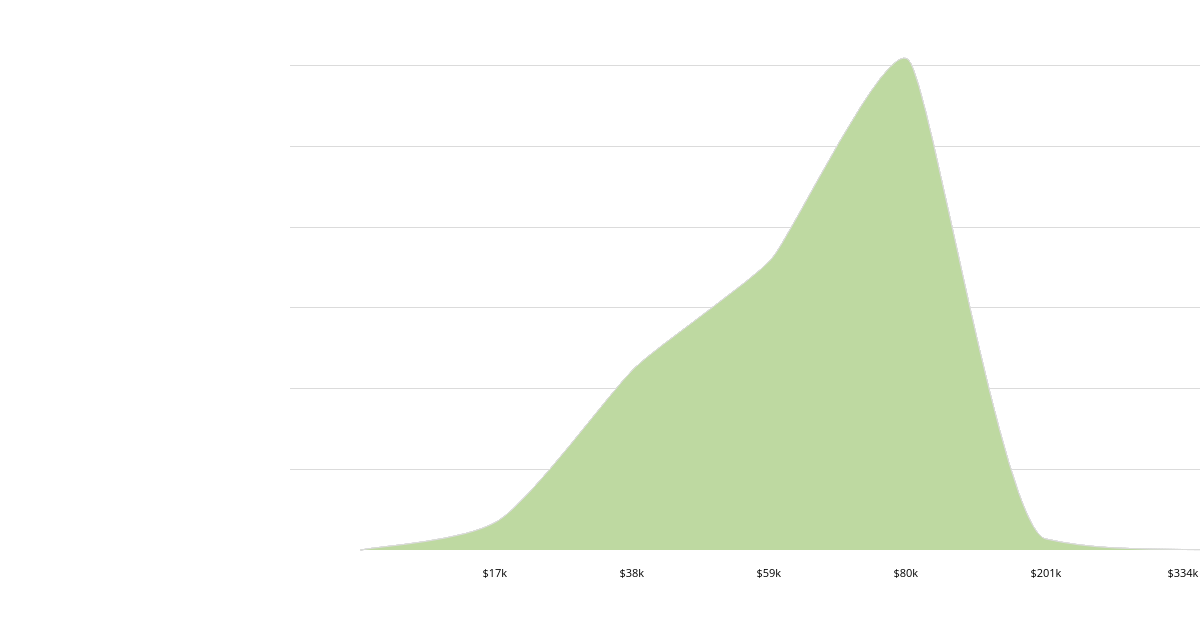

Robo advisers, also called "robo-finance", offer low-cost solutions for millennials with smaller investment portfolios that want to automate and reduce costs. These robo advisors use technology to automatically build investment portfolios that meet your risk tolerance and financial goals.

These portfolios are based upon passive strategies like indexing or ETFs. As such, they generally have lower risks than traditional investment plans. They can also be a good choice if you are just starting out and don't require complex guidance.

Online financial advisors with human coaches are a better option if you need a more personal and tailored set of insights and recommendations. These firms can offer a deeper analysis of your assets as well customized investment portfolios or strategies.

Although you'll have to pay a monthly fee, this service is much more affordable than traditional financial advisers. An interactive financial planning tool is available and you can create a customized roadmap to reach your goals.

Some robo-advisors also offer a personal finance coach for extra assistance. Online advisors are a great way for you to connect with a financial professional without leaving the comfort of your office or home.

How to choose the best online financial advisor

It doesn’t matter whether you’re searching for an investment advisor online or a financial planner online, it’s important that you take your time. Find out what they charge for fees, what their qualifications and whether there have been any complaints.

When selecting an online financial advisor, there are many factors to consider. From the type and quality of their services to their track record for providing excellent service. These tips can help you choose the best advisor for your specific needs and budget.

It can be difficult to find the right online financial advisor. However, it is possible if you are able to identify where to look. First, identify the reason you need a financial plan. Do you need a financial plan to pay for school, save for retirement, or navigate a divorce?

You can also ask your friends and family to recommend financial advisors that are best suited for your needs. You can also search the internet for local financial professionals.

It is essential that you only choose an accredited online financial advisor licensed in your jurisdiction. There are many kinds of financial advisers. These range from certified financial planners to registered investment advisors.

FAQ

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two kinds of stock: common stock and preferred stocks. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

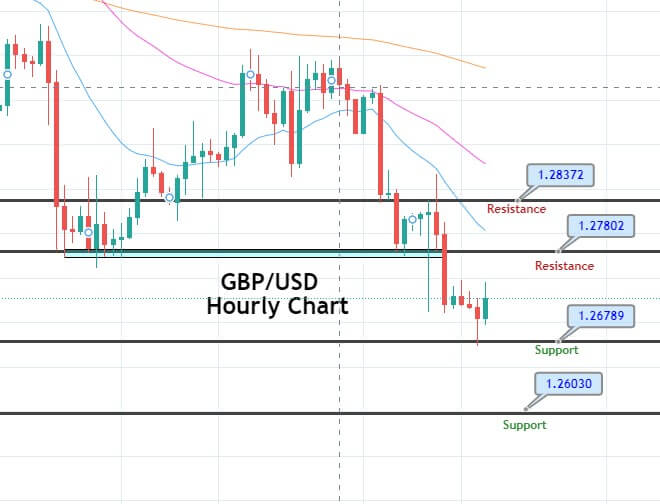

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Which trading site is best for beginners?

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Online investments require security. Protecting your financial and personal information online is essential.

Begin by paying attention to who you are dealing on investment platforms and apps. Reputable companies have good customer ratings and reviews. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!